Equity investors should expect to make half the returns they have become accustomed to over the past decade and a half, as markets will be challenged on several different fronts in the years to come, according to Pictet Asset Management senior multi-asset strategist Arun Sai.

“Both on earnings and on multiples, the primary drivers of growth tell us that returns are going to be much weaker for equities. It's going to be as much as half of the past five to 10 years,” he said.

“Returns over the next five years for global equities will be around 5% rather than the 10% we have got used to.”

This all comes down to Sai’s view that the key driver of equity returns over the past 20 years has been a “bizarre” structural uptrend in profit margins – a consequence of globalisation.

Although globalisation is “not going to reverse”, it will be “more nuanced”, he said, continuing for services, plateauing on goods and reversing on capital – all of which will lead to lower margins.

His way to tackle that is to “allocate deliberately to non-US champions, mid-cap stocks and European assets”.

Challenged US leaders

The US will be particularly affected. US tariffs, tax increases and weaker consumer demand will push global equities into a profit downturn, just as investors will grow more wary of inflation volatility and less inclined to pay a premium for stocks from a country that is losing momentum and soft power amid divisive policies.

There will be no US exceptionalism to come to the rescue, said Sai, not even its superiority in tech.

“There is no question that the US is the leader in tech across several dimensions, but are the moats around tech companies as deep as we thought they were a year ago? Perhaps not,” he said.

Sai used the example of Chinese artificial intelligence (AI) firm DeepSeek, which challenged Open AI’s ChatGPT at the start of the year. But this isn’t the only champion whose leadership is “not quite eroding, but at least being challenged”.

The US does not have a monopoly on innovation, Sai stressed.

“There are champions everywhere that benefit from the same kind of winner-takes-all trend, but trade on much lower multiples,” he said. “While retaining your investments in the winners, some amount of exposure to these other companies makes sense and diversifies you away from very crowded positions.”

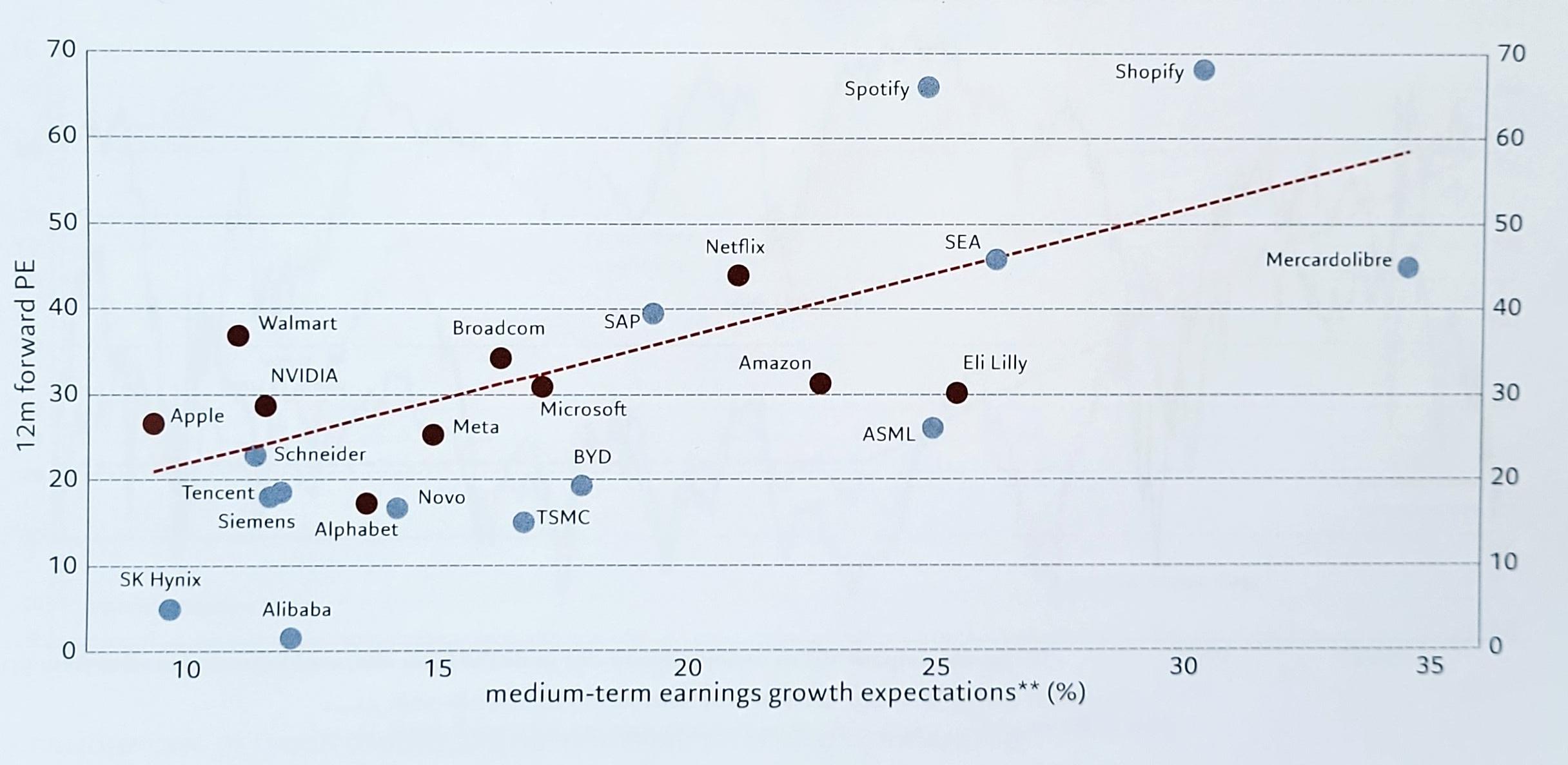

Below is a chart of such companies, showing the price-versus-growth expectations of US champions (in brown) and non-US champions (in blue).

US versus non-US leader by 12 months forward P/E ratio

Source: Refinitiv, Pictet Asset Management. As of 30 May 2025.

“The blue dots are either as critical to some of these secular growth stories, or as good as some of the US winners,” Sai said. For example, he argued that the growth potential of Brazilian e-commerce company MercadoLibre is comparable to that of Amazon.

“There are a number of these players that have been left behind in the whole US exceptionalism narrative.”

To illustrate the transformation driving this winner-takes-all dynamic, Sai pointed to John Deere – a 200-year-old US tractor manufacturer that has reinvented itself as a high-tech solutions provider.

“We’re not abandoning that dynamic,” he said, “but on the margin we’re shifting toward non-US champions that are tapping into similar forces but trade at more reasonable valuations.”

Mid-caps on the rise

Not only did Sai suggest moving away from US leaders, he also argued that the large-cap space overall is getting overcrowded.

“If you had the luxury of taking a 30-year investment horizon, then all you would do is bet on the median stock, not on the winners,” he said. “That is because, over time, the median stock catches up to the winners. You always sell the winners and buy the median stock.”

Unfortunately, no investors can think that far ahead, so Sai suggested to hedge your bets: staying with the winners and allocating deliberately to what he called the “feed” stock.

“We think of this as mid-cap stocks. Investors should take an equal-weighted exposure to markets, rather than just focus on the mega-caps,” he said. “This gives them exposure to some of the next generation of winners, which will begin to play out in the next five years or so.”

The European advantage

Pictet chief strategist Luca Paolini mentioned another trend: there will be a “very minimal difference” between US and European GDP growth in a scenario where growth will normalise across developed countries.

“The US will always be a much more dynamic place to do business than in Europe. We are not saying sell everything in the US and come to the European heaven,” he said.

“Europe is not going to move significantly, but it is going to improve from a period of stagnation that has lasted for the past decade.”

Investors, especially if they are based in Europe, should also “think twice” about having a permanent, structural overweight to the US and would be better off putting their money to work at home.

“What we tend to forget is that, for Britons and Europeans investing abroad in equities, roughly 30% or 40% of total returns come from currency movements,” he said.

“The currency risk is not that relevant normally, but if you have low returns and low dispersion, like we will, one of the critical factors in achieving your expected returns is to get the currency right.”