So far this year global stock markets have been shaken by concerns over trade and escalating geo-political tensions, leading some investors to consider diversifying away from the US and mega-cap tech.

While the formerly top-performing S&P 500 is down more than 5% year to date (YTD), Asian markets have remained in the black, with the MSCI Japan up 0.6% and the MSCI Asia ex Japan up 4.7%.

Daniele Antonucci, chief investment officer at Brown Shipley, Japanese and Asian equities currently offer “attractive valuations and strong diversification potential”, which will cause them to outperform if volatility persists.

However, it may be difficult for investors to know where to start, particularly if they have no experience investing in Asian markets. To this end, it might be helpful to know what types of investments have performed well in recent years.

This is part of an ongoing series where Trustnet examines different markets based on market capitalisation and investment style, as well as looking at the relative performance of active and passive funds to determine the best way to invest since 2020.

Japan

In terms of market capitalisation, large-caps dominated in Japan with the MSCI Japan Large Cap index up by 42.3% in this period. Small-caps trailed behind with a return of 20.1%, while mid-caps are up 13%.

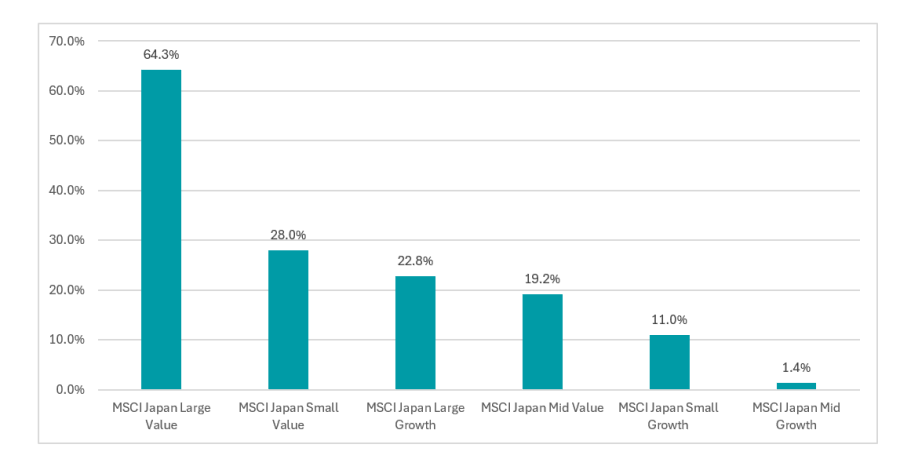

Digging deeper into investment styles, the MSCI Japan large-cap value index has trounced its competitors in this period, up 64.3%, outpacing all other investment styles by at least 30 percentage points, with the second-place large-cap growth index up 22.8% in comparison.

Performance of the indices since 2020

Source: FE Analytics

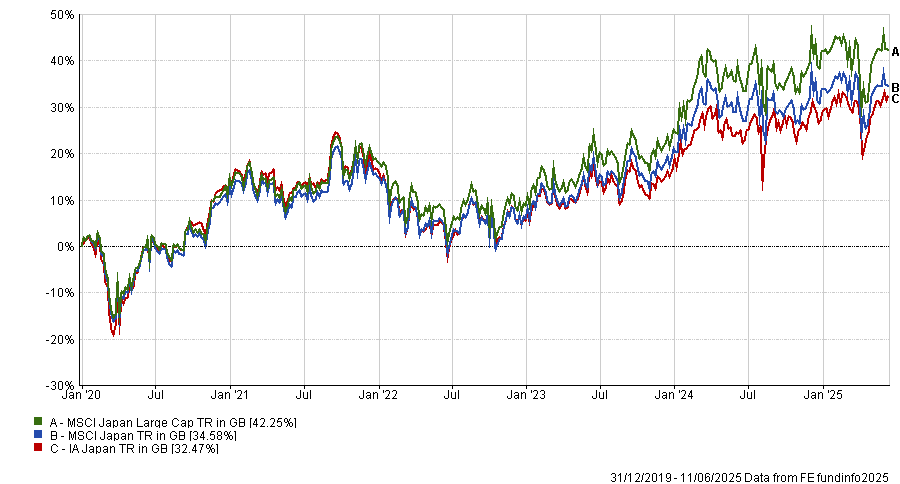

With large-caps dominating, the MSCI Japan, up 34.6%, performed better than the average fund in the IA Japan sector, which climbed 32.5%, suggesting a low-cost passive option may have been investors’ best bet.

For those searching for passive exposure to the Japanese market, the Amundi MSCI Japan has returned 84.3% (the fourth-best performance in the peer group) by closely tracking a hedged version of the index.

Performance of sector vs the benchmark since 2020

Source: FE Analytics

However, while the average active fund did not outperform the market, 29 strategies in the sector did with 19 also outperforming the large-cap index.

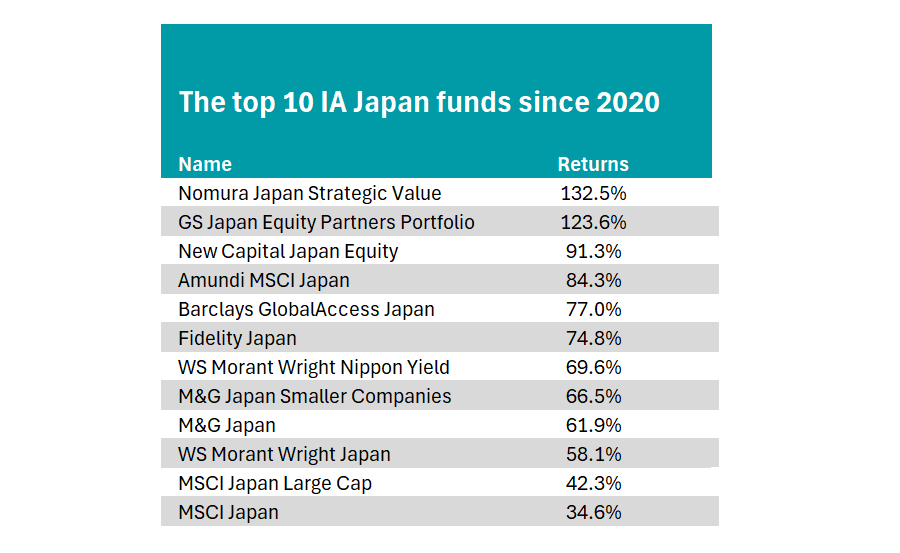

The Nomura Japan Strategic Value and GS Japan Equity Partners Portfolio stand out. Over this period, these actively managed strategies have posted returns of 132.5% and 123.6% respectively, outpacing the third-place fund by more than 30 percentage points. However, both are hedged, meaning they have benefited from a weakening yen.

Both also have high allocations towards some of the largest stocks in the Japanese index, including Mitsubishi, Hitachi and Tokyo Electron.

Source: FE Analytics

The rest of the top 10 funds in the chart above also posted index-beating returns during this period, including a mixture that did so with and without currency hedging.

Asia ex Japan

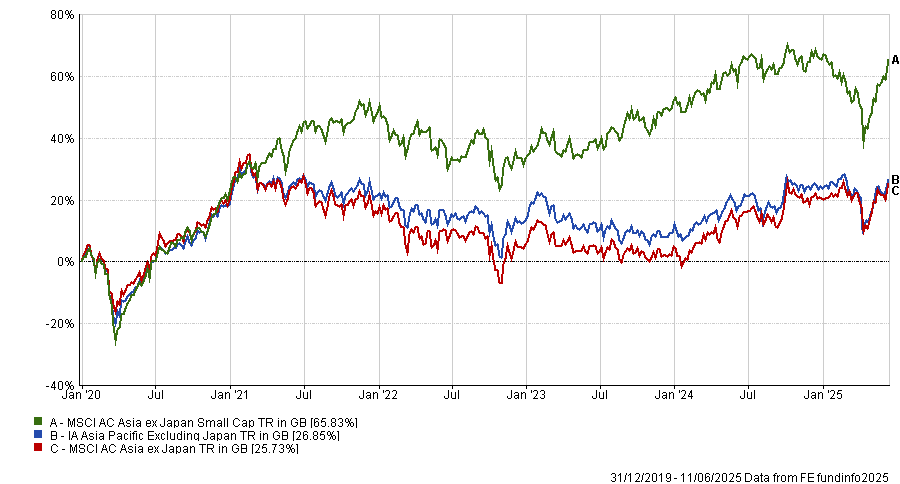

In contrast to Japan, Asia excluding Japan has been led by the performance of small-caps, with the MSCI AC Asia ex Japan small-cap index up 65.8%, more than double the performance of the large- and mid-cap indices.

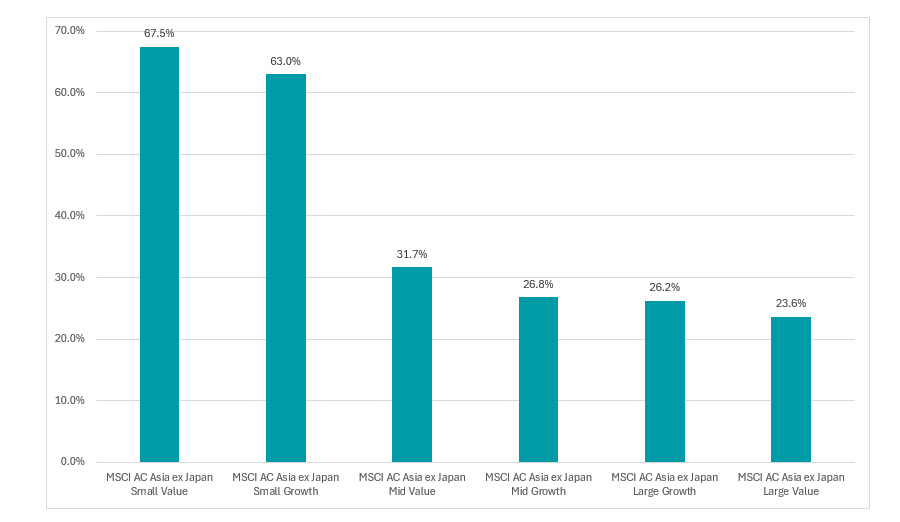

The small value and small growth indices surged by 67.5% and 63% during this period, with mid-cap value trailing by more than 30 percentage points.

Performance of the indices since 2020

Source: FE Analytics

The supranormal performance of both small-cap indices demonstrates that Asia is a market in which market capitalisation triumphed over investment style. Indeed, the two mid-cap and large-cap indices also had very similarly performances.

As can be expected when smaller companies outperform, active strategies had a much better time of it in Asia than in Japan.

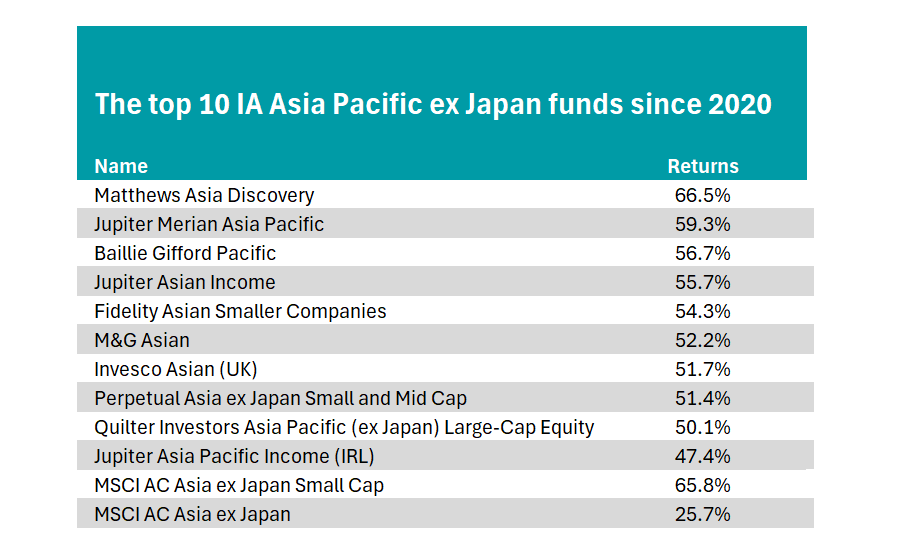

The average IA Asia Pacific ex Japan fund is up 26.9% in this period, beating the wider index by 1.3 percentage points. In the entire peer group, 53 out of 105 funds posted a return above the MSCI AC Asia ex Japan index.

Performance of sector vs the benchmark since 2020

Source: FE Analytics

Below is a list of the top 10 funds in the sector over this period, all of which beat the market. Topping the table is the Matthews Asia Discovery fund, which is up 66.5% since 2020.

Source: FE Analytics

Managed by FE fundinfo Alpha Manager Vivek Tanneeru, the fund had a very strong 2021 and 2023 when it delivered top-quartile results, which has contributed to its performance over the past five years. Notably, it is the only fund on the list which also beat the supranormal returns of the small-cap index.