The number of investment trusts trading at a premium has risen since 2024, with 24 vehicles now above net asset value compared with 19 last year, according to data from AJ Bell and the Association of Investment Companies (AIC) published last week.

However, experts warned that premiums and discounts should be assessed individually, rather than seen as evidence of a broader sentiment shift or market-wide repricing. In fact, the numbers are still too small to be talking about any broad-based shift, with most premiums confined to a small list of outliers.

The outliers

The most expensive trusts right now are JPMorgan Emerging Europe, Middle East & Africa and British & American, trading at 310.8% and 72.3% premium to net asset value (NAV), respectively.

The price of the former, previously known as JP Morgan Russian Securities, is based on its NAV with the once-significant Russian exposure rebalanced to zero. According to analysts, the market is counting on those assets being written up quite heavily if or when the war in Ukraine and subsequent sanctions on Russia end.

“Whether that deserves a 300% premium is another thing,” said Daniel Lockyer, senior fund manager at Hawksmoor.

British & American is another exception: with just under £4m of assets under management, a high level of internal ownership and a 30% allocation in one underlying asset (healthcare company Geron), it remains well off the radars of most investors.

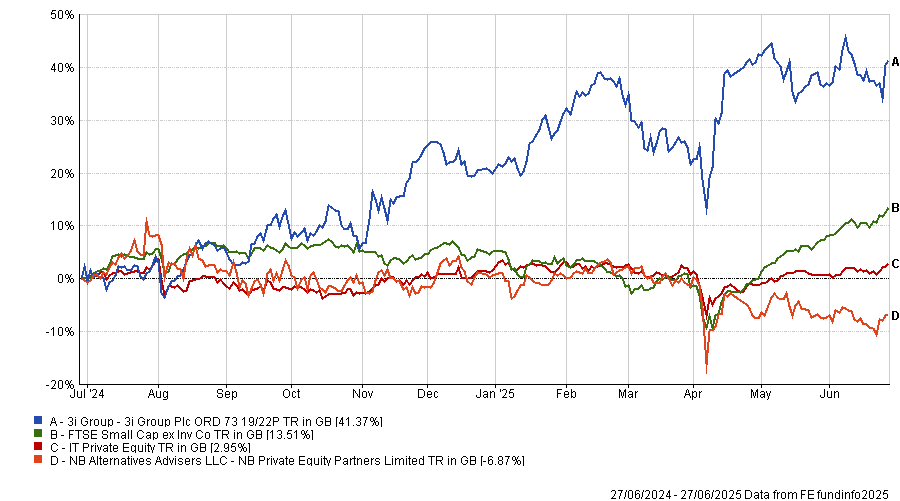

Only two other trusts have a double-digit premium. One is 3i Group (61% premium to NAV), whose premium is driven by the high demand for Action, a European supermarket chain that makes up 60% of its portfolio.

“3i is pretty much the only way to get access to Action and a lot of managers are interested in the stock right now,” Lockyer said.

However, he would prefer “a less binary exposure” through another trust, NB Private Equity.

“It has a 5% stake in Action and lots of other things as well, plus and it's trading on a 31% discount.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

Finally, Doric Nimrod Air Three (19.2% premium), an aircraft leasing special-situation portfolio, is another peculiar case, linked to the opportunity of selling airplanes to the leasing company at an appraised valuation.

But Lockyer said “it's not really worth dwelling too much on this first group” as they are all extreme cases.

Darius McDermott, managing director at Chelsea Financial Services, also preferred trusts trading on discounts.

“The risk with buying at a premium is that underperformance can hit twice – through weak NAV and a reversion to discount – which can be painful. We're generally more comfortable backing quality names trading below NAV, where the margin of safety is greater,” he said.

Jim Harrison, investment director at Chancery Lane, was even blunter, saying that he “would not go anywhere near any of them”, as premiums above 5% are “almost never worth it”.

With the exception of the four above, all the remaining trusts have a premium of 4% or below.

Trusts worth paying for

There are certainly occasions where it makes sense to pay a premium, according to McDermott.

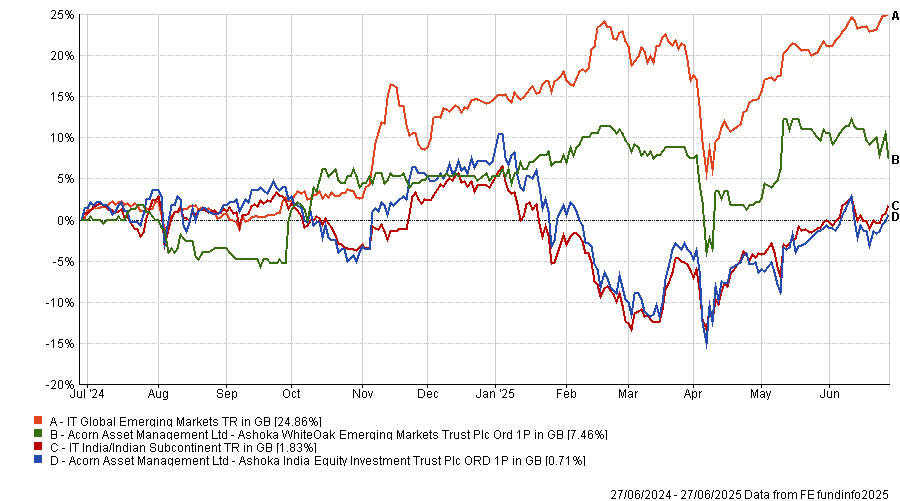

A good example are the Ashoka trusts India Equity (2% premium) and WhiteOak Emerging Markets (0.4% premium), both of which have delivered “standout performance” to justify the small premiums.

He particularly liked Ashoka India as it has “comfortably led its sector since launch” and the performance fee is tied to alpha generation, which “helps align the manager’s incentives with investors”.

Lockyer noted both vehicles have a “very good, shareholder-friendly structure” in the form of an annual redemption facility, which allows investors to exit at NAV every year and keeps their price from oscillating too much.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Rockwood Strategic (3.1% premium) has “defied the gloom around UK smaller companies to deliver outstanding performance” through a high-conviction, hands-on approach making “smart” use of the investment trust structure, McDermott said.

Lockyer agreed and added Law Debenture to the trusts he would currently own: “It has been around forever and everyone loves it”.

It has a “unique nature”, with a professional services company that “enhances the yield pays a lot of expenses as well”. “That's definitely one reason why that one's trading on premium, and it's very good,” he said.

Lockyer finished his list with the Achilles Investment Company (0.7% premium) and Onward Opportunities (0.4% premium).

Premiums not worth paying

The 24 trusts currently on a premium include many income strategies, but investors often overpay for income, according to McDermott, who noted “there are plenty of high-yielding trusts available at a discount”.

“That said, it’s easy to see why income investors gravitate toward trusts with a long history of dividend consistency,” he added.

The City of London Investment Trust (which trades at 1.3% premium to NAV) is a prime example of that, he said, having increased its dividend every year since 1966 and consistently outperformed the FTSE All Share and its sector over one, three, five and 10 years while charging just 0.37%.

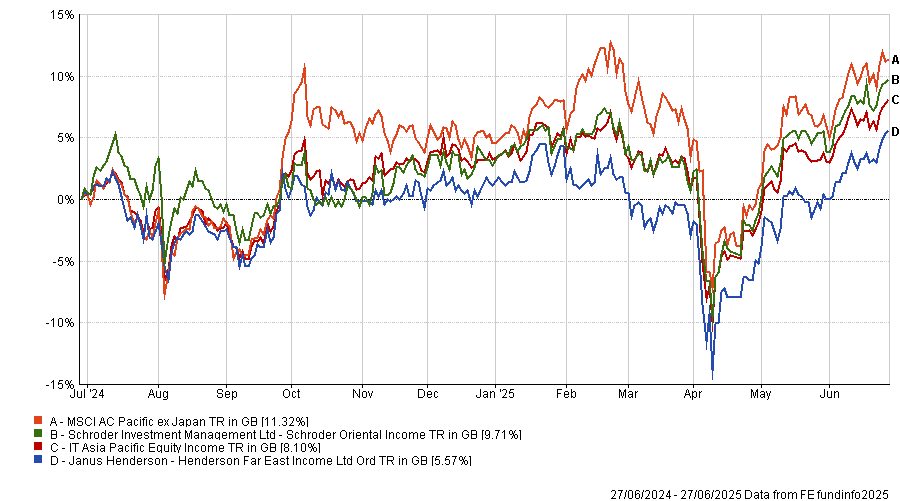

Lockyer also mentioned Henderson Far East Income, which people love because of the high yield (currently 11%), “but the total return has been lower than other Asian income investment trusts that pay a lower, more sensible yield”, such as Schroder Oriental Income, he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“You must think on a total return basis, whether you're an income manager or growth manager,” he said. “You can't sacrifice the capital at the expense of pushing for yield.”

Harrison, who uses the Henderson fund, disagreed and argued it is “very useful for people who need instant high income thanks to the sustained double-digit yield”.

However, he recognised that dividend growth is going to be “negligible” and suggested people might want to pair it with another trusts with better dividend growth potential, such as JPMorgan Claverhouse, Murray International or Law Debenture.