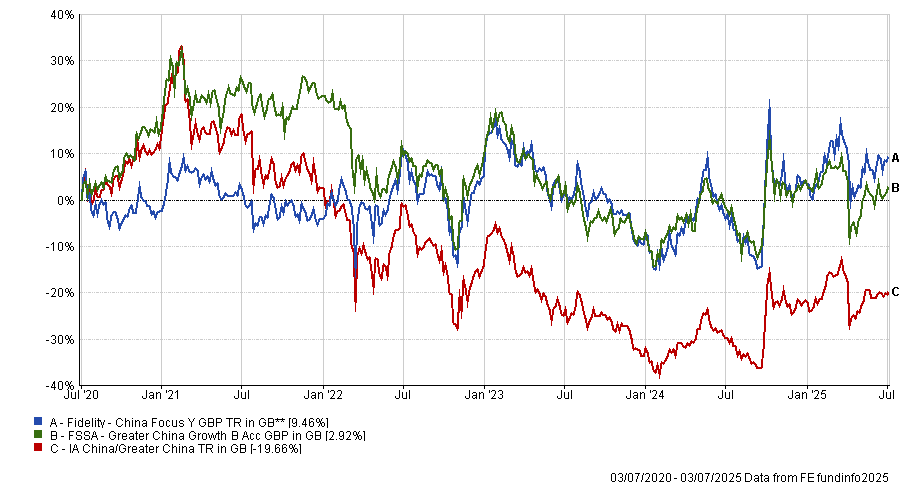

China has long been a market of extremes, capable of dazzling highs but equally steep setbacks. The past five years have tilted firmly toward the latter, as Covid lockdowns, geopolitical tensions and an ongoing tariff war with the US sapped investor confidence.

The IA China/Greater China sector spent much of that period among the worst performers in the Investment Association universe and those who invested five years ago are now sitting on 19.7% losses on average.

But the past 12 months have brought signs of recovery, with the peer group gaining 14.9% amid renewed investor interest. Because this volatility can be hard to stomach for many investors, it is important to choose funds that offer a smoother ride or even defy the wider market’s direction.

Data from FE Analytics shows that only two China funds have managed to stay afloat with positive returns during the market’s most turbulent years, from July 2020 to today: Fidelity China Focus and FSSA Greater China Growth.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Fidelity China Focus is a $2.3bn strategy managed by Jing Ning and Nitin Bajaj, who invest at least 70% of its portfolio in China- and Hong-Kong-listed companies, as well as non-Chinese companies which do most of their business in China.

It picks stocks with a bottom-up approach and a value bias.

What sets it apart – and enables it to perform independently of its sector – is its quality-value approach in a sector that RSMR analysts said is “dominated by growth”, as well as its “non-mainstream, benchmark-unaware exposure” and the “under-researched companies” it holds.

Its top-10 positions include well-known names such as technology and entertainment conglomerate Tencent (8.7%) and e-commerce retailer Alibaba (8.2%), but the rest of the portfolio is skewed towards mid-caps, including a number of plays in the consumer discretionary and financials sectors.

Fidelity China Focus suffered in the 2020 calendar year, when it ranked at the very bottom of its sector with a -3.9% return, but the losses were much more contained in 2021 and 2023 and performance was positive in 2022, adding 10% while its average peer was down 15.7%.

“The value bias of the fund can lead the fund to lag in markets where growth companies outperform,” RSMR analysts explained. “In addition, the focus on high-quality companies can mean the fund underperforms when low-quality companies are rewarded by the market.”

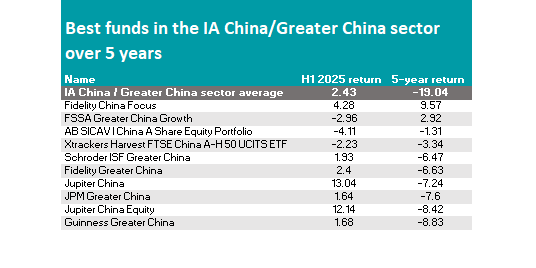

This isn’t the only Fidelity strategy in the list of the IA China/Greater China sector’s best performers, with Fidelity Greater China also making an appearance a few positions behind, as shown in the table below.

Source: FE Analytics

The only other fund in the black was the £407.5m FSSA Greater China Growth fund, co-managed by FE fundinfo Alpha Manager Martin Lau and Helen Chen, who invest primarily in large- and medium-sized companies based in or with significant operations in China, Hong Kong or Taiwan.

“The fund is a lower-risk option for investors seeking exposure to Chinese equities,” RSMR analysts said. “The managers’ contrarian nature makes this fund somewhat differentiated to a passive option as it tends to be underweight some of the largest stocks and sectors in the [MSCI Golden Dragon] index and often focuses on contrarian growth opportunities outside of the mega-caps.”

Tencent is the largest holding (9.6%), followed by Taiwan Semiconductors (8.1%); further down the list, Chinese consumer companies make up a quarter of the portfolio.

“The domestic China consumption story will be important to the fund over the longer term and whilst this will be cyclical at times it should grow over the medium term as China continues to catch up with more developed economies,” RSMR said.

To the analysts, this is a satellite investment option with a key differentiator in its “strong emphasis on downside protection, limiting volatility versus other China mandates”.

FSSA Greater China Growth has remained in the first quartile of performance against the peer group in all calendar years between 2021 and 2023, but slipped more recently, with 10.7% return in 2024 versus a sector average of 14.5%.

Another standout name was JPM Greater China, which in the past five calendar years, never fell to the bottom quartile of performance; a feat also achieved by three smaller strategies: Jupiter China Equity, GAM Multistock - China Evolution Equity and Polar China Stars.