UK smaller companies, private equity and Indian strategies are compelling choices for investors with a high-risk budget, according to Hawksmoor chief investment officer Ben Conway.

Following US president Donald Trump’s announcement of reciprocal tariffs in April, many investors spent the early part of the year pivoting into more defensive assets such as gold and banks.

But investors are starting to put risk back on the table, with the recent Bank of America Global Fund Manager Survey finding that professional investor sentiment had rebounded sharply in June.

“When you’re trying to make money for people who have a lot of risk tolerance, you should probably be putting it in equities with either a strong thematic or a great value opportunity,” Conway said.

For a UK-based investor, domestic small-caps are an “astonishingly good value opportunity” trading at significant discounts to the already cheap UK market. “We’re spoilt for choice in terms of talented managers in the UK”, he said, with several managers having proved themselves in this illiquid part of the market over the long term.

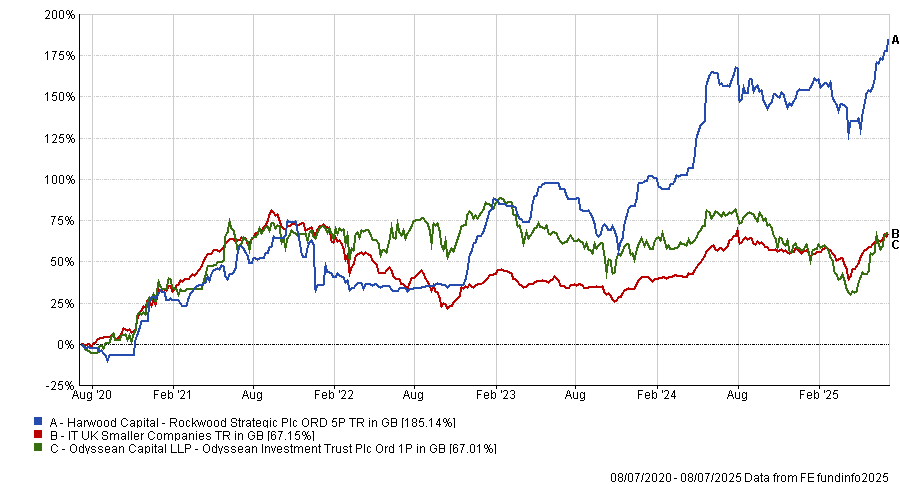

Two UK smaller company trusts that Conway likes are the Rockwood Strategic Trust and Odyssean Investment Trust.

These trusts benefit from capable and high-conviction managers who are willing to hold big allocations in stocks that align with their investment criteria, he explained. Odyssean managers Stuart Widdowson and Ed Wielechowski are former private equity specialists who are applying their previous experience to “run public equities through a private equity lens”, Conway noted.

However, this approach has led to volatile results in recent years. While the trust ranked in the top quartile in both 2021 and 2022, it fell into the bottom quartile in 2023 and 2024. As a result, the strategy is underperforming the IT UK Smaller Companies average over five years.

Meanwhile, Rockwood Strategic’s Richard Staveley is a “pure money maker”, according to Conway. Despite having a reputation as a value manager, his strategy is far more pragmatic and willing to buy good companies wherever he sees them, whether in growth or value buckets.

This has resulted in some “exceptional performance” with the trust up by 185.1% over the past five years, the second-best return in the IT UK Smaller Companies sector.

Performance of Rockwood Strategic and Odyssean Investment Trust over past 5 years

Source: FE Analytics

While he noted that a particularly high-risk investor may be happy to keep their holdings relatively concentrated in a single fund, “I think diversification is your friend, even if you have a very high-risk tolerance.”

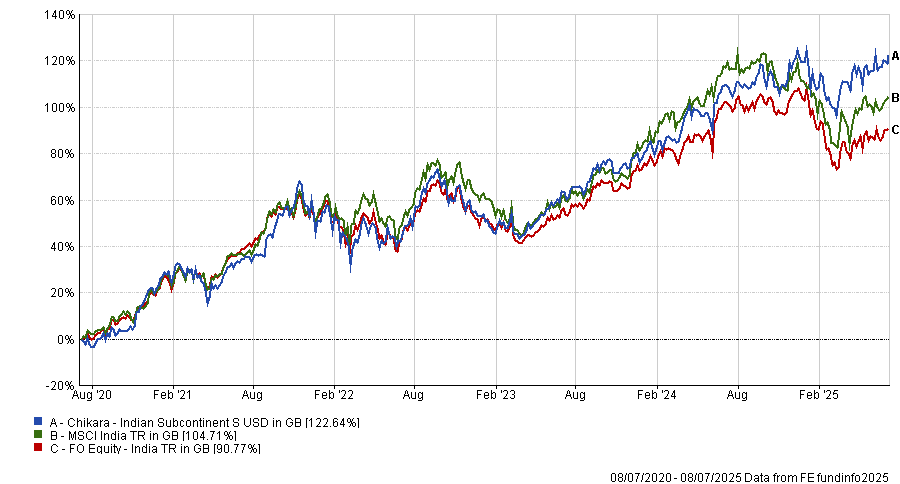

Hawksmoor’s chief investment officer identified the Chikara Indian Subcontinent fund as an option to add some regional diversification and play on a compelling growth theme.

The fund seeks to invest in large-cap Indian companies that are domestically facing, to benefit from the wave of corporate reform in the region. At $125m in assets under management, the fund is “nicely sized” and run by a highly motivated duo of Abhinav Mehra and Andrew Draycott.

“It ticks all of our boxes in terms of the themes and management”, Conway explained.

The two managers have led the fund successfully in recent years, delivering a return of 122.6% over the past five years. This is a top-quartile result in the FO Equity India sector and beats the MSCI India by 18 percentage points, as demonstrated in the chart below.

Performance of Chikara India Subcontinent vs sector and benchmark over 5yrs

Source: FE Analytics

However, Conway noted that while India is a strong theme with exciting long-term growth potential, it “certainly does not qualify as cheap”. As such, pairing it with another strategy that is more attractively valued but still had an interesting growth theme makes sense.

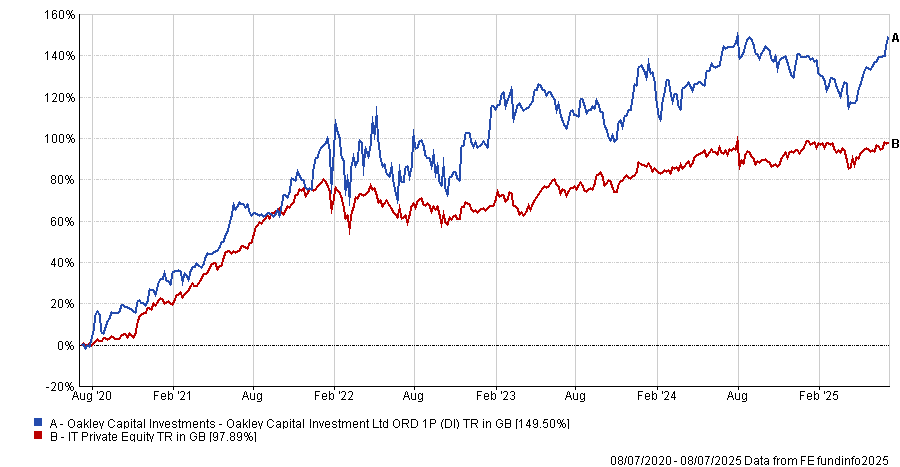

He pointed to the European private equity trust Oakley Capital as a good example of this.

It primarily targets the European mid-market, using a network of entrepreneurs to establish deals with fast-growing businesses in areas such as education and media, which they expect to have long-term potential.

Many competitors cannot access these deals as readily in the European market, giving it an edge over its peers in the IT Private equity sector, he explained. This has contributed to a top-quartile return of 149.5% over the past half a decade.

Performance of Oakley Capital vs sector over past 5yrs

Source: FE Analytics

While the recent performance has been more challenging, with the trust in the third quartile over the past 12 months, this means it’s on a “very healthy discount” of 28.2% to net asset value.

Its emphasis on private assets at a compelling valuation gives it a distinct role when paired with the expensive but high-growth India fund and the illiquid but well-performing UK smaller companies’ strategies.

These four funds cover three very different markets and so are exposed to separate risk factors, Conway explained. For example, Chikara India is tied primarily to the success of the Indian growth story, whereas UK smaller company strategies may be impacted by domestic policy.

While the strategies may rise together, he argued it is unlikely that they will fall together, offering meaningful protection even for investors with a higher risk budget.