Active funds dominated the lists of best-selling fixed income funds in the first half of 2025, according to data from FE Analytics, with short duration funds and responsible strategies particularly garnering investors' money.

It has been a year of ups and downs for fixed income funds, with investors adding roughly £1bn to fixed income sectors in May 2025, but pulling almost £3bn over the previous two months, based on data from the Investment Association.

But there are some funds that have been more in vogue than others during this time. Below, Trustnet looks at the best-selling fixed income funds sector by sector. This data is based on the UT & OEICS universe, which puts funds in different categories than their IA counterparts.

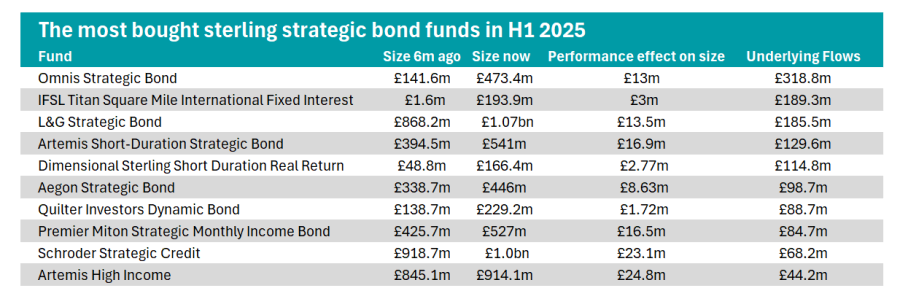

Starting with sterling strategic bond funds, £318.8m was added to the Omnis Strategic Bond Fund in the first half of the year, the largest net inflows across the main fixed income sectors.

Source: FE Analytics

The fund aims to achieve a return of income and some capital growth that will beat the total return of the ICE BofA Global Broad Market TR Index (GBP Hedged), over five years. Its top holdings are primarily in UK and US-listed government bonds.

It started to attract inflows in February, adding almost £90m in assets under management (AUM) in just a few days, according to FE Analytics data.

Investors should note, however, that responsibility for the mandate was transferred to T.Rowe Price from Fidelity at the end of the second quarter.

Also on the list, L&G Strategic Bond, led by FE Fundinfo Alpha Managers Colin Reedie and Matthews Rees, broke £1bn in AUM during the past six months with a net inflow of £185.5m between January and June. In the past year, the fund has posted a top-quartile performance among sterling strategic bond funds.

Two short-duration bond funds also captured investors' interest, with the Artemis Short-Duration Strategic Bond Fund and Dimensional Sterling Short Duration Real Return Fund up by £129.6m and £114.8m respectively.

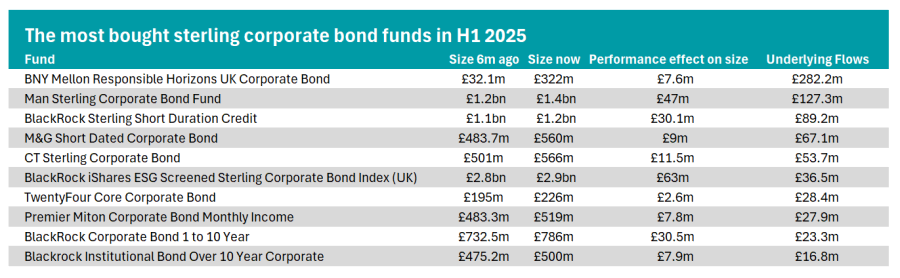

Turning to sterling corporate bonds, BNY Mellon Responsible Horizons UK Corporate Bond topped the chart, with investors pouring £282.2m of new money into the fund.

Source: FE Analytics

Managed by Damien Hill, it aims to beat the S&P iBoxx GBP Collateralised & Corporate Index after fees. It uses environmental, social and Governance (ESG) principles by screening issuers who are involved in “industries and sectors with weak ESG scores”.

However, it allows up to 30% of the net asset value in securities that do not meet its sustainability criteria.

Meanwhile, already popular funds continued to attract attention. The Man Sterling Corporate Bond Fund, managed by FE Fundinfo Alpha Manager of the year Jonathan Golan, attracted a further £127m, taking its total AUM to £1.4bn.

The fund has delivered the best total return among sterling corporate bond funds over the past one and three years.

Four of BlackRock’s strategies attracted net inflows in this period, including another ESG-focused strategy, the BlackRock iShares ESG Screen Sterling Corporate Bond index, which reached £2.9bn in AUM.

Some of these strategies are very popular, with the BlackRock Sterling Short Duration Credit and iShares ESG Screen Sterling Corporate Bond Index holding £1.2bn and £2.9bn in assets under management.

Short-duration funds were also popular here, with two (BlackRock Sterling Short Duration Credit and M&G Short-Dated Corporate Bond) attracting more than £60m of net inflows.

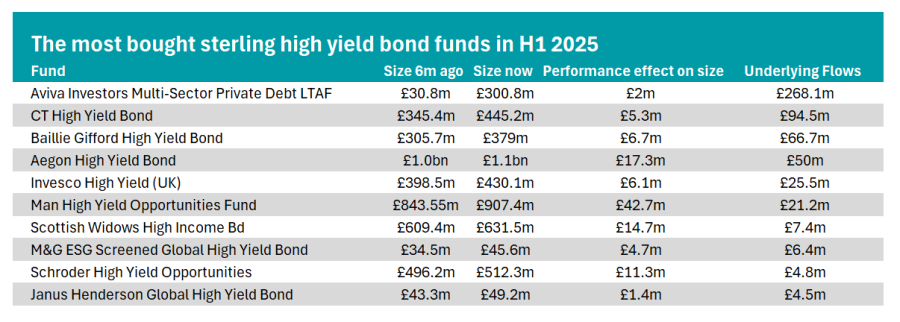

Pivoting towards high-yield bonds, the Aviva Investors Multi-Sector Private Debt LTAF led the charge, with £268.1m added to the fund in the first half of 2025.

Source: FE Analytics

First launched in November last year, the fund has benefited from the rising investor interest in private assets. When launched, the Aviva team expected that the LTAF would be “particularly appealing to defined contribution (DC) pension funds looking to diversify returns from traditional asset classes, such as private equity and fixed income”.

Ranking second is the CT High Yield Bond fund, with AUM up by £100m in the first half, largely thanks to £94.5m in net inflows.

Managed by David Backhouse and Roman Gaiser, the fund aims to outperform the ICE BofA European Currency High Yield Excluding Subordinated Financials Constrained (Hedged to Sterling) Index.

Analysts at Square Mile praised the fund for its sensible focus on avoiding capital loss “in a market that naturally carries more risk”.

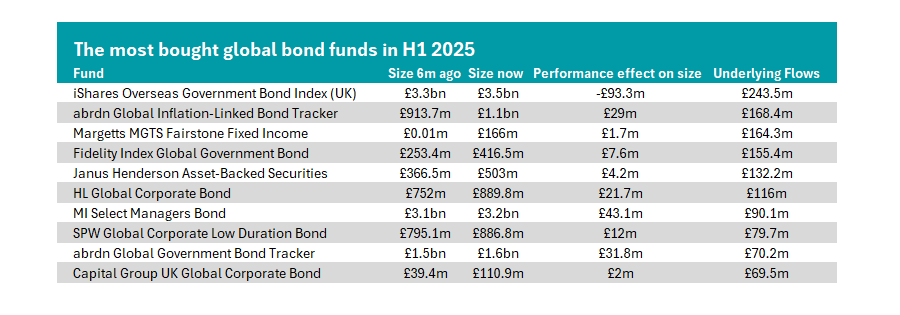

Finally, we turn to global bonds. Topping the chart is the passive iShares Overseas Government Bond Index (UK). A further £243m was added to the already £3.3bn portfolio despite it losing money in performance terms over the first six months of the year.

It was far from the only passive fund to catch investors' eyes in this period, with net inflows added to the abrdn Global Inflation-Linked Bond Tracker, Fidelity Index Global Government Bond and abrdn Global Government Bond Tracker.

Source: FE Analytics

This increased interest in passive funds contrasts with bond investors who recently argued that passive investing forces exposure to the most indebted companies.

Another low-duration strategy proved popular, with £79.7m of net inflows added to the SPW Global Corporate Low Duration Bond fund.

Actively managed by the team at Schroders, it currently has a 60% allocation towards US-denominated bonds. This approach has paid off, with the fund posting a top-quartile return among global bond funds over the past year.