Vanguard has launched its Global Core Bond and Global Strategic Bond funds, expanding its active fixed income line-up accessible to UK investors.

Both funds offer broad exposure to global bond markets, with the ability to invest in high yield and emerging market bonds. Vanguard Global Core Bond primarily focuses on investment-grade debt from developed markets while Vanguard Global Strategic Bond has a broader remit across sectors, regions and credit qualities.

Both funds are managed by Ales Koutny, head of international rates, and Sarang Kulkarni, lead portfolio manager for global credit and pan-European strategies. The duo also run Vanguard Global Credit Bond (a top performer in its sector over three and five years) and Vanguard Emerging Markets Bond.

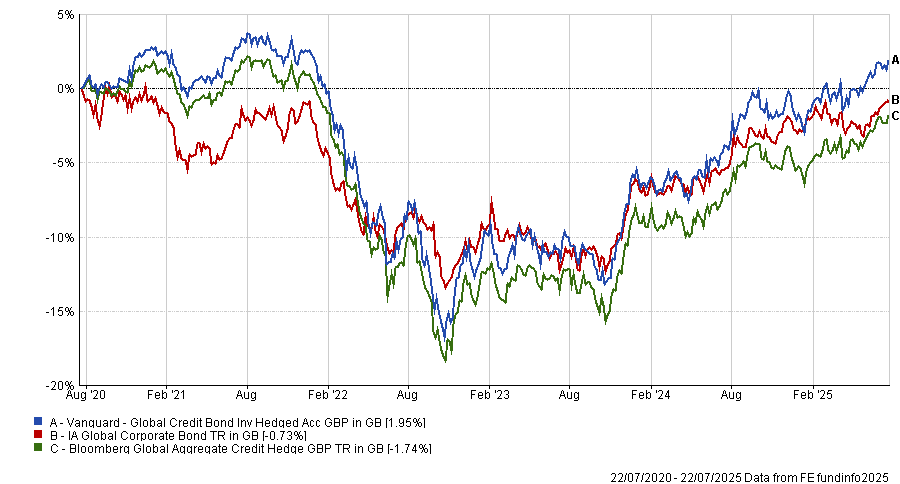

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Vanguard Global Core Bond carries an ongoing charges figure (OCF) of 0.35% while Vanguard Global Strategic Bond will charge a 0.40% OCF.

“Investors don’t want surprises from their fixed income funds,” said Koutny. “Our approach is to steer clear of concentrated macroeconomic positions and focus instead on consistently finding pockets of value through fundamental, bottom-up security selection and being smart about risk.”

Kulkarni added: “With the track record and capabilities we’ve built up for the Global Credit and Emerging Market Bond strategies, the size and experience of our investment team allows us to look for diversified opportunities across markets, rather than being reliant on one or two big positions.”