Open-ended passive funds are better for investors with a longer time horizon, while exchange-traded funds (ETFs) may be more suitable for those who want to move their money around more frequently, according to Danielle Farley, passive investment analyst at Hargreaves Lansdown.

These tracker funds offer a cheap and effective way for investors to replicate the performance of a specific index or market and have surged in popularity in recent years.

Farley said: “There’s been a huge shift towards passive investing in recent years. In 2024, European domiciled passive funds saw net inflows of €307.6bn, a new record high, versus €150.5bn inflows for active funds.”

Despite tumultuous performance from global stock markets, the most bought equity funds in the first half of 2025 were still mostly passive vehicles.

Meanwhile, many active funds have struggled to outperform, with it paying to go passive in areas such as China, Europe and the UK last year, based on Trustnet research.

However, investors may struggle to decide if an index fund or an ETF is right for their passive exposure. The two are slightly different in terms of approach: index funds trade once per day at market close while ETFs are funds can be bought and sold throughout the day in the same way as a share on the stock market.

More active traders may prefer ETFs, she explained, because intraday trading makes them more flexible and allows investors to react quicker to market news and developments.

ETFs also have an advantage in terms of transparency because they disclose their holdings daily. This can also be more appealing to short-term traders or engaged investors keen to know exactly what they are holding.

They also generally have lower management fees compared to their index counterparts, which they achieve by using “in-kind transfers” to exchange securities for trades in the ETF rather than cash, which keeps tax costs down.

In theory, ETFs should outperform equivalent index funds due to tax efficiency and lower costs, but it is often not that simple, Farley explained. A variety of factors can impact performance, such as the different techniques managers might use to keep costs down and performance as close to the index as possible.

Additionally, making shorter-term investment decisions can come with additional risk, with professional investors often cautioning clients against trying to ‘time the market’.

Index funds operate slightly differently. They have a single valuation point throughout the day, which can bring down costs, as dealing charges are lower and bid spreads are less of a factor, said Farley. They are also not required to disclose their holdings daily,

This may make them less suitable for investors hoping to trade frequently and more suitable for those with a long-term time horizon, making them a solid core option in long-term portfolios, she explained.

Fund picks

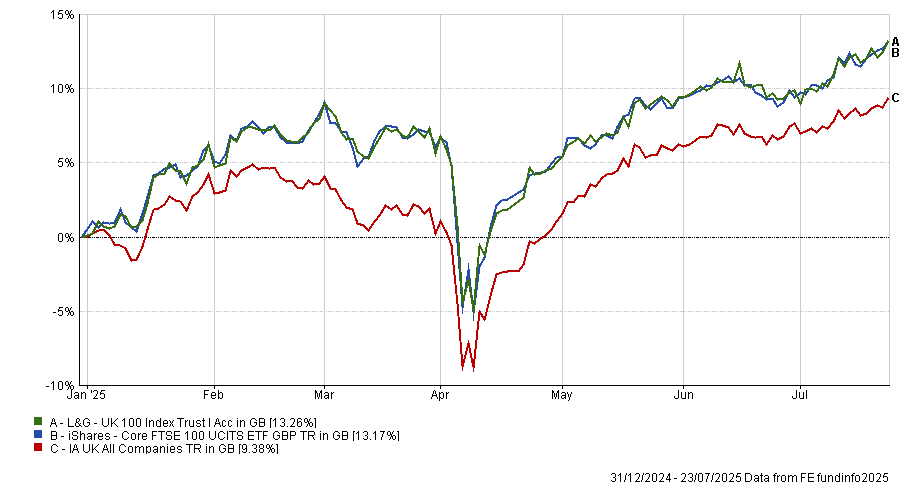

In the UK, Farley likes the Legal and General (L&G) UK 100 Index and the iShares FTSE 100 ETF, both of which offer a “simple and low-cost way” to gain exposure to the UK’s biggest 100 companies.

Both L&G and BlackRock are among the “UK’s leading providers of passive funds” and have “plenty of experience in passive investing”, she said. Because they have the scale to keep costs down, they can provide some of the “cheapest passive funds on the market”.

So far this year, both funds have outperformed the average fund in the IA UK All Companies sector by closely tracking the FTSE 100, as demonstrated by the chart below.

Performance of funds vs sector YTD

Source: FE Analytics.

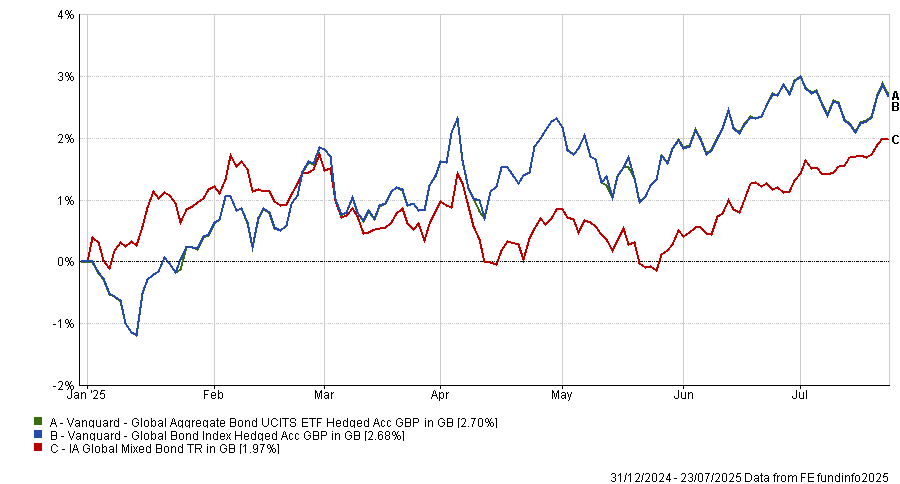

For fixed income exposure, she likes two strategies from Vanguard – the Vanguard Global Bond Index and Vanguard Global Aggregate Bond ETF.

“Vanguard is a pioneer when it comes to passive investing and its index funds and ETFs are run by a large global investment team that we rate highly”, Farley noted.

The funds provide exposure to the fixed income securities in the Bloomberg Global Aggregate Index, including global and corporate bonds, at a “low cost”.

So far this year, both funds have outperformed the IA Global Mixed Bond sector, with the ETF slightly beating its index fund counterpart, as seen in the chart below.

Performance of funds vs sector YTD

Source: FE Analytics.