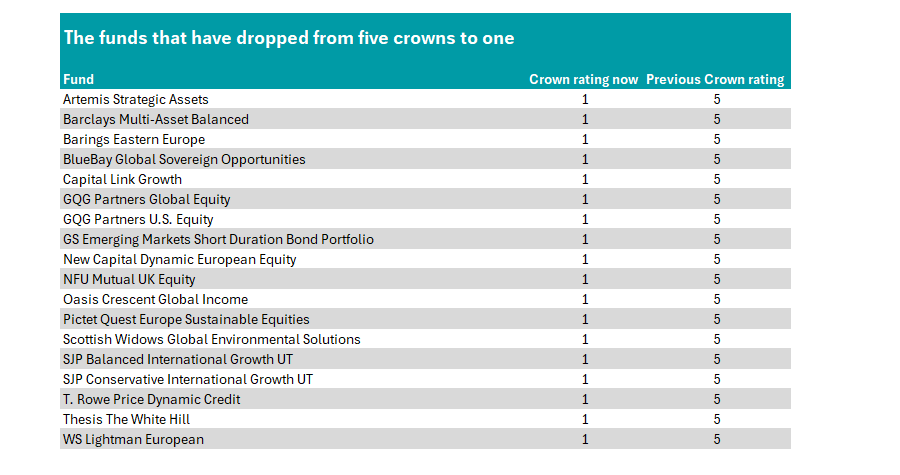

Funds run by GQG Partners, Artemis Fund Managers, St James’s Place (SJP) and Barings have all suffered a severe ratings decrease in the bi-annual FE fundinfo Crown Ratings rebalance.

The top 10% of funds based on three factors (alpha, relative volatility and consistent performance over the past three years) are awarded five FE fundinfo crowns. The next 15% receive four crowns and each of the remaining three quartiles are given three, two and one crowns respectively.

Having previously looked at the funds that have shot up the table in the past six months, here Trustnet focuses on those that have plummeted from the top of the heap to the bottom ranking.

Past performance is no guide for future returns, however, and investors should remember that all funds go through difficult patches. Whether these funds can retain their former glory will be a key consideration for those who own them.

Source: FE fundinfo

GQG Partners had two entrants on the table above: GQG Partners Global Equity, home to £2.9bn of investors’ capital, and GQG Partners US Equity, which has £1.4bn in assets under management (AUM).

The Global fund is recommended by analysts at interactive investor, having only been added to the platform's Super 60 recommendations list at the end of 2024

The portfolio is managed by FE fundinfo Alpha Manager Rajiv Jain, Brian Kersmanc and Sudarshan Murthy.

Analysts at interactive investor said: “The managers’ flexible investment approach and quality bias have typically led to strong performance through the market cycle with good downside protection during periods of market weakness. The fund benefits from an experienced manager, with a flexible, proven and well-executed investment process”.

However, GQG Partners Global Equity has made 21.8% over the past three years, a third-quartile return during this time, but has particularly struggled over the short term. It is down 7% over one year and has suffered a 15% drop over the past six months.

Managed by the same team, GQG Partners US Equity has been a bottom-quartile performer in the IA North America sector over three years, up 18.4%.

Recommended by analysts at FE Investments, they said it “combines a strong focus on quality companies with a flexibility to adapt to macroeconomic conditions, which provides multiple avenues for generating outperformance”.

“Jain, has a proven track record over a long career and has built GQG to focus on client outcomes and alignment," they added. “The diverse experience of the managers and the analyst bank, as well as the use of non-traditional methods of analysis to gain an insight advantage, is highly differentiated and provides a competitive edge against peers.”

Another fund on the list recommended by a best-buy list is WS Lightman European, which sat in the bottom quartile of its peer group over three years to the end of June (the period covered by the rating).

However, it is in the second quartile of the IA Europe Excluding UK sector over three years to the most recent price, with a 42.5% return. It performed strongly since the end of June, making 4.4% over the past month compared with 2.9% from its average peer.

Run by Rob Burnett and George Boyd-Bowman, analysts at AJ Bell rate the £1.1bn fund high enough to include it in the firm’s Favourite Funds list.

“We like this boutique asset manager, focused on investing in European equities. At the helm is an experienced fund manager with a tried and tested investment approach underpinned by a clear investment philosophy,” they said.

“The fund is typically invested in lower valued stocks and the performance profile is therefore likely to be volatile and different to that of the benchmark. The fund benefits from the manager’s consistent implementation of his investment process.”

Analysts at FE Investments also rate the fund, highlighting its “flexibility to play the value factor in a light or aggressive way, depending on the macro environment”.

Pictet Quest Europe Sustainable Equities is the only other fund on the list with more than £1bn in AUM. Managed by Laurent Nguyen, it uses a quantitative approach to select securities that it believes offer superior financial and sustainable characteristics.

The fund has been a third-quartile performer in the IA Europe Including UK sector over the past three years, up 34.2%. It is joined by peer New Capital Dynamic European Equity, which also appears on the list.