Spells of volatility are scary but can be the right time for investors to assess the behaviour of funds – which are struggling, treading along or even flourishing as markets move.

One area that has taken investors on a rollercoaster ride this year is US, alternating shocking dives and spectacular recoveries.

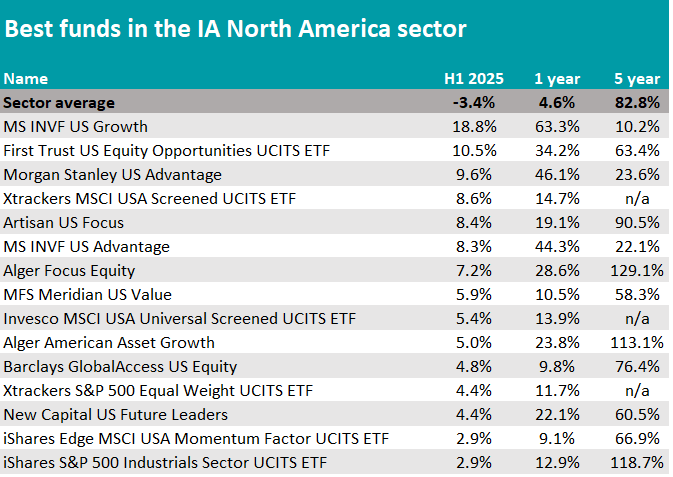

In this series, Trustnet is highlighting the funds that have been able to enjoy the scariest of rides. Today, we look at America, where only 12% of IA North America funds have managed to turn a profit for investors in the first half of 2025, data from FE Analytics has shown.

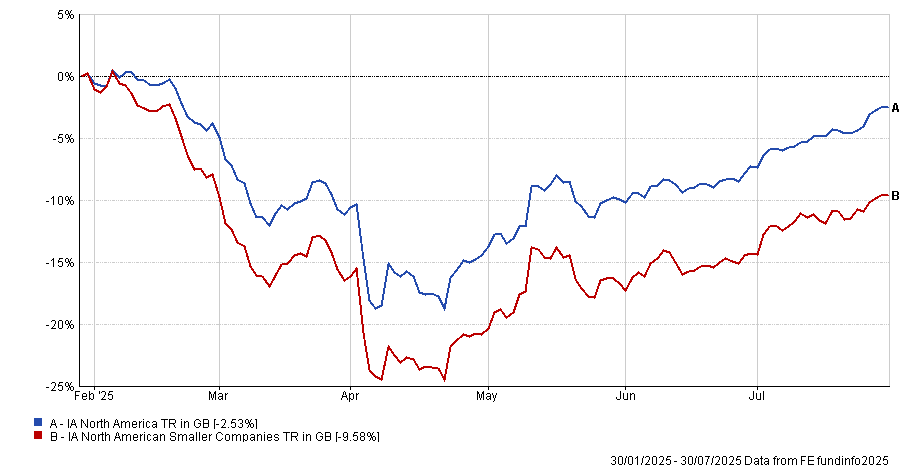

Performance of sectors over 6 months

Source: FE Analytics

Out of the 246-strong peer group, only 27 were in the black and just two made double-digit returns – MS INVF US Growth (18.8%) and First Trust US Equity Opportunities UCITS ETF (10.5%).

The former is a $3.5bn strategy led by Dennis Lynch and a team of deputy managers at Morgan Stanley, whose sector allocations give it a slight underweight to tech (46.5% against 51.2% of the Russell 1000 Growth Net 30% Withholding Tax benchmark) and overweights to consumer discretionary (21% versus13.5%) and financials (9.4% against 6.6%).

Top holdings include network services company Cloudflare (9.77%), Elon Musk’s Tesla (6.5%) and software and cloud services company Microstrategy (6.4%).

The First Trust US Equity Opportunities exchange-traded fund (ETF) came second-best by tracking the performance of the IPOX-100 US index, a modified value-weighted price index that measures the performance of the top 100 US-domiciled companies, ranked quarterly by market capitalisation.

Its top 10 holdings include names such as delivery company Doordash, video game developer Roblox and language-learning specialist Duolingo.

In third place, with a 9.6% return, is another Morgan Stanley vehicle led by the same team as for the fund above. The £76.6m Morgan Stanley US Advantage fund is benchmarked against the more popular S&P 500 index but has an active share of 96% (above 80% is traditionally considered high), indicating the managers are taking different positions than the index and are outperforming it.

Source: FE Analytics

With yet another Morgan Stanley fund led by Dennis Lynch, MS INVF US Advantage, a few positions below in the list, the team has proven to have an edge in navigating the recent uncertain markets.

Other recognisable active managers made an appearance further down the ranking, including Janus Henderson US Sustainable Equity (1.4%), BlackRock US Dynamic (2%) and Baillie Gifford American (1.4%).

FE Investment analysts flagged the Janus Henderson strategy for its managers’ passion for responsible investing, meaning that “the team will only invest in names it truly believes are companies of the future that will provide sustainable returns”.

The fund provides “a good option for sustainability-minded investors with a long-term time horizon”, they added.

FE analysts also ranked the Baillie Gifford American fund for its “clear focus on bottom-up stock selection” and “clear and consistent ability to leverage its expertise in growth investing”.

They said: “The fund exhibits above-average volatility due to it being heavily concentrated in high conviction positions. The benchmark-agnostic approach suggests that the fund may behave nothing like the S&P 500 – rather, it will be a case of the underlying stocks being heavily skewed towards those that use disruptive technologies.”

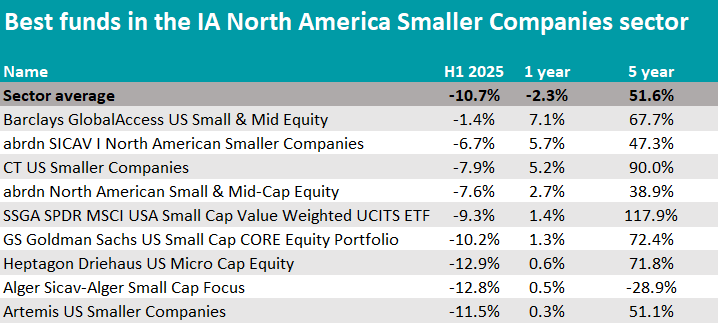

Source: FE Analytics

Smaller companies have been even more challenged than their larger counterparts, with no IA North America Smaller Companies fund turning a profit in the first half of the year.

Nine strategies had better luck in the longer time horizon of 12 months. Top of the pile is Barclays GlobalAccess US Small & Mid Equity, which returned 7.1% in the past year versus the sector average, which was a 2.3% loss.

Three different managers contribute to the allocation decisions in this fund: Wellington Management runs 45% of the allocation the ‘industry’ sleeve; Kennedy Capital Management is responsible for 35% of the asset allocation, focusing on ‘long-term, value-style stocks; while the remaining 20% is taken care of by Stephen Goddard at The London Company, who employs a bottom-up, benchmark-agnostic stock selection.

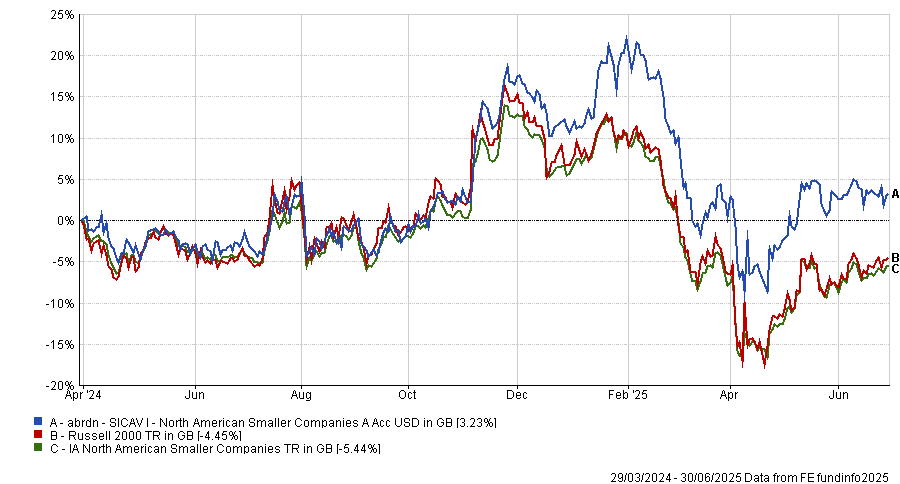

Two strategies by Aberdeen took up the second and fourth position in the list: the $300m abrdn SICAV I North American Smaller Companies and the institutional £48m abrdn North American Small & Mid-Cap Equity, both managed by Christopher Colarik.

Colarik took up the management of the former fund in March 2023 from Jason Kotik, Ralph Bassett and Timothy Skiendzielewski. Since then, the fund distanced itself from both its peer group and benchmark, as the chart below shows.

Performance of fund against index and sector since March 2023

Source: FE Analytics

CT US Smaller Companies also stood out, achieving third place in the ranking. Artemis US Smaller Companies concluded the list.

This article is part of an ongoing series analysing the best funds in the worst-performing sectors. Previously, we covered China, India and the UK.