Investors in Baillie Gifford Managed have endured a tumultuous ride in recent years, with dizzying highs and disappointing lows.

In November 2021, the fund had £9.5bn in assets under management. Over the past 12 months, it reported £1.2bn in outflows (with the fund now sitting at £4.6bn) – which suggests investor sentiment is souring.

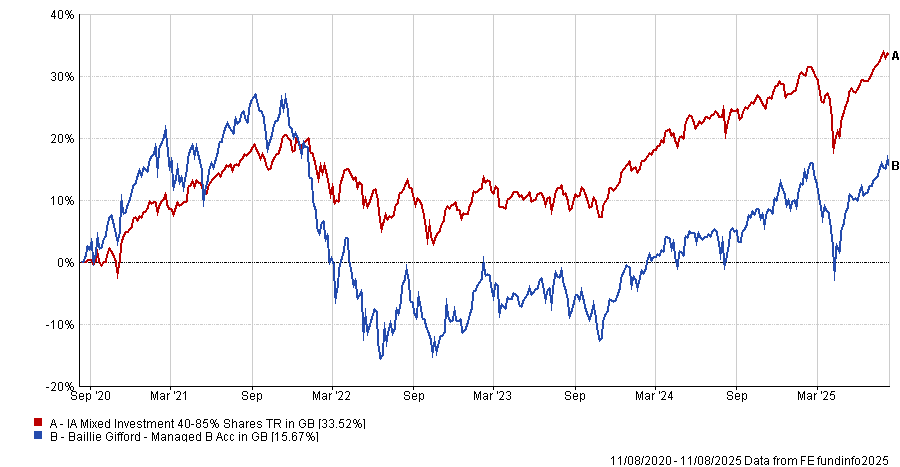

Baillie Gifford Managed was launched in 1987 and has been managed by Iain McCombie and Steven Hay since 2012. While it has been a top-10 performer in the IA Mixed Investment 40-85% Shares sector over a decade (managing a 117.9% total return), its three- and five-year performance fell to the third and fourth quartile of the peer group, bracketing back-to-back poor years in 2021 and 2022.

In 2022, Baillie Gifford Managed was the worst fund in the sector, down 24.3%. Hay previously explained this was due to having one of the highest allocations to equities in the peer group.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

Trustnet asked fund pickers for their thoughts on the strategy in 2025, finding the consensus that the fund is still worth holding, despite its struggles.

Rob Morgan, chief investment analyst at Charles Stanley, said: “If there is one thing that investors should be aware of when considering a Baillie Gifford fund, it’s that performance is going to be different to that of its peers – for better or worse – and sometimes dramatically so.”

He explained that Baillie Gifford has a “particular style of investing”, as it is very growth-focused and will carry plenty of stock-specific risk in portfolios.

“At the moment, the fund seems to be coming out of a trough of poor performance, which is to be entirely expected given the differentiation with the strategy, but that’s not yet been enough to turn around the three- and five-year numbers that seem to be most important to people,” he said.

Hal Cook, senior investment analyst at Hargreaves Lansdown, said it would be easy to attribute the losses during 2021 and 2022 to poor stock selection by the managers. However, he said this was largely caused by market rotation from growth to value.

Although Cook acknowledged there is an argument to be made that the managers should have sold many of their investments after the sharp rises in 2020, but “this simply isn’t the Baillie Gifford way”.

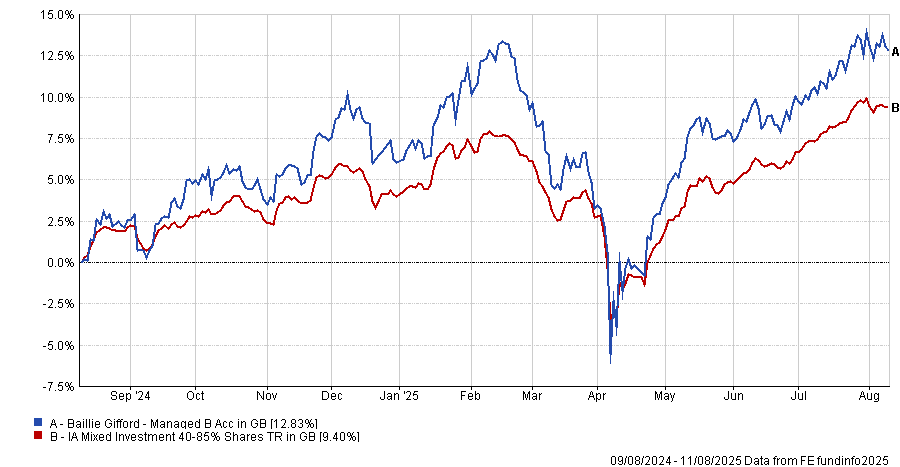

Recent performance has been stronger through a balanced exposure to growth, defensive assets and income generated holdings.

Performance of the fund vs sector over 1yr

Source: FE Analytics

Chris Salih, head of multi-asset and investment trust research at FundCalibre, said Baillie Gifford Managed offers strong, diversified exposure to both stocks and bonds globally.

“Ultimately, the focus on the long-term – as highlighted by a low active share of around 15% – has proven successful,” he said.

“The fund may be a bit more volatile but could easily be blended with a more defensive vehicle if investors have concerns. For those already invested, we’d see it as a hold.”

The fund also remains on Hargreaves Lansdown’s Wealth Shortlist, with Cook explaining that the platform thinks it’s a great option for investors who want a multi-asset fund at the higher end of the volatility spectrum.

Cook said: “On a forward-looking basis, with three-year sector relative performance having improved, we would not be surprised to see the fund move back to seeing inflows in the not-too-distant future.”

Meanwhile, Morgan’s personal preference for a mixed fund at the heart of a portfolio is a more stable holding – reserving the risk budget for more specialist satellite holdings.

“With a beta a third higher than that of the sector, holding this fund in quantity introduces extra volatility in the core of the portfolio and likely means dialling back elsewhere,” he said.

However, for investors that want a diversified fund that offers the Baillie-Gifford philosophy in a single ‘one-stop shop’, Morgan said Baillie Gifford Managed is “worth considering”, adding that the costs are “highly competitive”.

“Overall, I would suggest ‘hold’, on the basis that it does meet the objectives of a particular type of investor well,” he said. However, if an investor has lots of growth-led investments elsewhere, having Baillie Gifford Managed make up the core “could be a step too far and lead to a lopsided situation”.

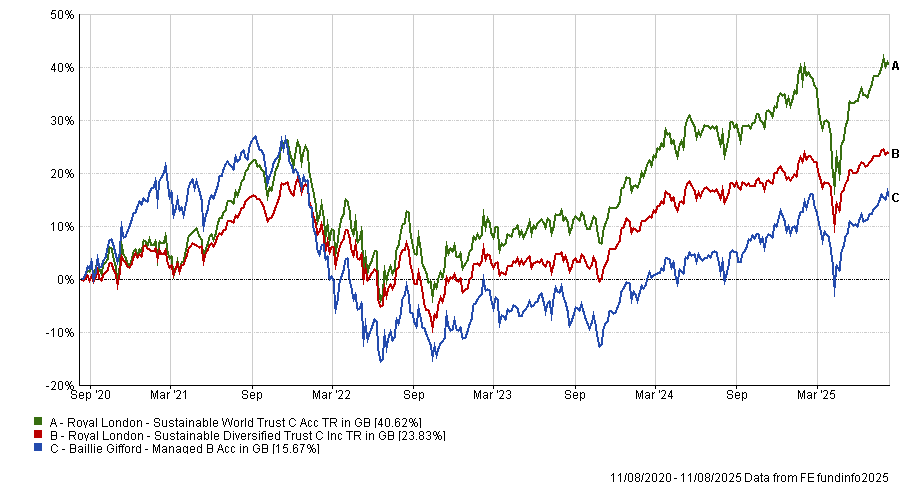

For investors with less of a risk appetite, Alex Watts, senior investment analyst at interactive investor, suggested investing in Royal London Sustainable World and Royal London Sustainable Diversified instead.

Performance of Royal London Sustainable World, Royal London Sustainable Diversified and Baillie Gifford Managed over 5yrs

Source: FE Analytics

The sustainable multi-asset range is led by head of equities Mike Fox, alongside co-managers George Crowdy and Sebastien Beguelin, with fixed income allocations overseen by Shalin Shah and Matt Franklin.

He noted that, across equities, the focus of the sustainable suite is on long-term sustainable growth, with a stylistic bias to growth companies. The funds favour large-cap, as these firms are typically “most able to facilitate sustainable objectives”, Watts said.

Royal London Sustainable World and Royal London Sustainable Diversified outperformed Baillie Gifford Managed over five years, delivering a 40.6% and 23.8% total return respectively – compared to Baillie Gifford Managed delivering 15.7%.

Royal London Sustainable World beat Baillie Gifford Managed over three and 10 years, while Royal London Sustainable Diversified languished in the fourth quartile.