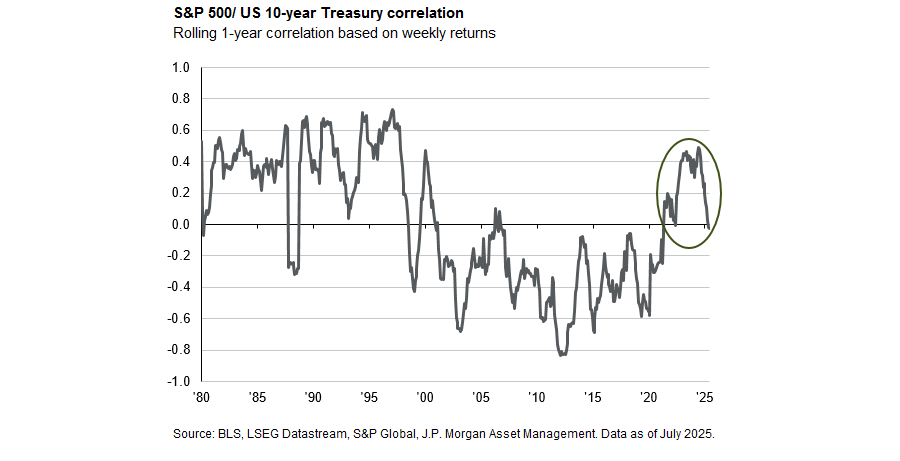

For much of 2010s, investors were rewarded for going long. Subdued inflation, near-zero interest rates and massive central bank balance sheet expansion meant equities and bonds often rallied in tandem. Diversification came easily, drawdowns were shallow, and the 60/40 portfolio looked unassailable.

But the world is changing. The return of inflation, positive real interest rates and more unpredictable policy paths have revived market volatility and reminded investors that relationships between asset classes can break down.

In 2022, a classic US 60/40 portfolio lost around 18%, its worst calendar-year performance since 2008, and one of only three times since 1970 that both stocks and bonds declined significantly in the same year.

With volatility set to remain elevated, it makes sense to revisit strategies designed to navigate dislocations – not just benefit from rising markets.

Global macro investing is one of the oldest forms of active management, analysing the macroeconomic environment and then translating those views into positions across currencies, rates, commodities and equity indices.

Crucially, macro strategies aren’t constrained to a single view or asset class: they can go long or short; make directional or relative value calls; and can shift capital quickly to where opportunities emerge.

Why is this view controversial?

To answer that question, you have to acknowledge why scepticism about macro funds exists in the first place. From 2010 to 2019, macro funds endured what many dubbed an ‘alpha winter’.

The same factors that buoyed traditional assets made life difficult for macro funds. Policy rates were stuck at zero. Central banks moved in lockstep, compressing policy divergence. Volatility fell to multi-decade lows and correlations increased across regions and sectors.

Macro managers – who rely on dislocations, dispersion and differences between markets – simply had little to work with.

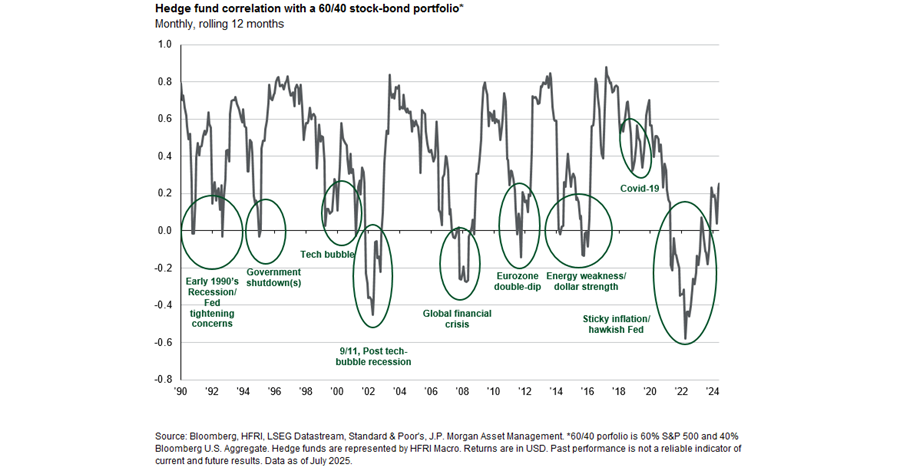

Against that backdrop, long-only portfolios quietly compounded at strong rates. Macro funds still played an important role as diversifiers in the portfolio but lacklustre returns made them feel like an expensive form of insurance.

Why now is different

That backdrop has flipped. The environment that made macro strategies look redundant has given way to one that plays to their strengths.

First, volatility has returned. More frequent and larger price swings create dislocations that long-only investors must ride out but macro managers can actively trade.

History shows the value of that flexibility: in 2008, when US equities were down 37%, the HFRI Macro Index gained nearly 5%. In 2022, macro once again stood out, rising 9% on aggregate as both global equities and bonds posted double-digit losses.

Second, interest rates are higher. Positive rates now boost returns on cash and margin collateral but, more importantly, they’ve brought back policy divergence.

Today, there is more than a 400 basis point gap between policy rates across major developed economies – levels of divergence unseen for over a decade. This opens up opportunities for trades in rate differentials, curve steepening or flattening, and foreign exchange carry.

Last but not least, dispersion is back. When all markets move in the same direction, long/short strategies struggle. But with greater variation across sectors, geographies and asset classes, there is now a richer opportunity set for skilled managers to generate alpha.

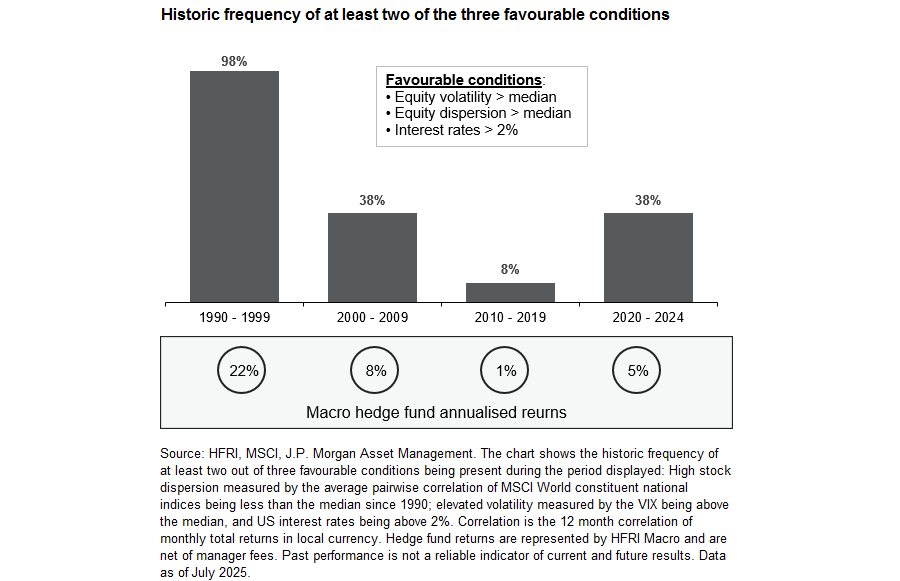

The chart below helps to bring this point to life. It looks at the historic frequency of those favourable market conditions and the corresponding hedge fund returns during different periods.

A couple of things stand out. First, there’s a close relationship between the favourable conditions and macro hedge fund returns. During the 1990s, a period of exceptionally strong macro hedge fund performance, at least two of the three favourable conditions were present over 90% of the time.

Second, during the alpha winter, favourable conditions were present less than 10% of the time. And finally, looking over the past 35 years, the 2010-2019 period looks like the exception, not the rule. Since 2020, the environment that’s prevailed looks much more like the 2000s than it does the 2010s.

Conclusion

For the better part of a decade, markets were calm, policy was predictable and long-only portfolios delivered. Macro funds looked expensive, and many investors concluded they weren’t worth the cost.

But that period was the exception, not the norm. Inflation has returned, rates are positive, volatility has risen, and the relationships investors have come to rely on – like stocks and bonds reliably offsetting one another – have become less certain.

If we are indeed returning to an ‘old normal’, it’s worth asking what belongs in a portfolio built for that world. Macro funds aren’t designed to beat the market in every regime.

They’re designed to behave differently – to diversify when correlations break down and to capture opportunities that emerge from dislocation. Those are precisely the qualities that look set to matter more in the decade ahead.

Aaron Hussein is a global market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.