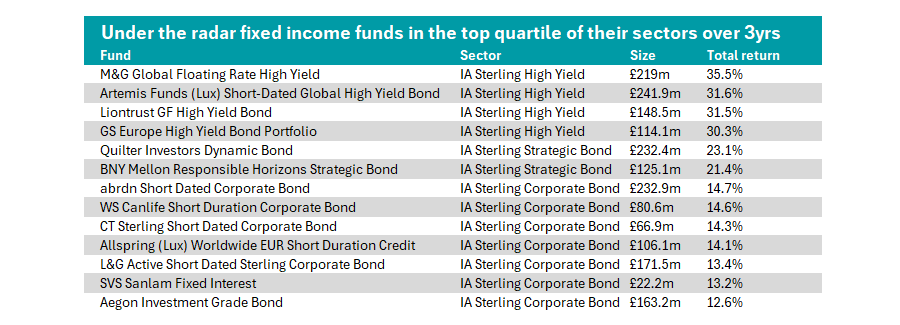

There are a litany of bond funds making strong gains that investors may not yet be aware of, according to Trustnet research, which highlights portfolios topping their sectors over the past three years with assets under management of less than £250m.

As part of our ongoing series, here we looked at the IA Sterling Strategic Bond, IA Sterling Corporate Bond and IA Sterling High Yield sectors.

Source: FE Analytics. Data as of 31 July.

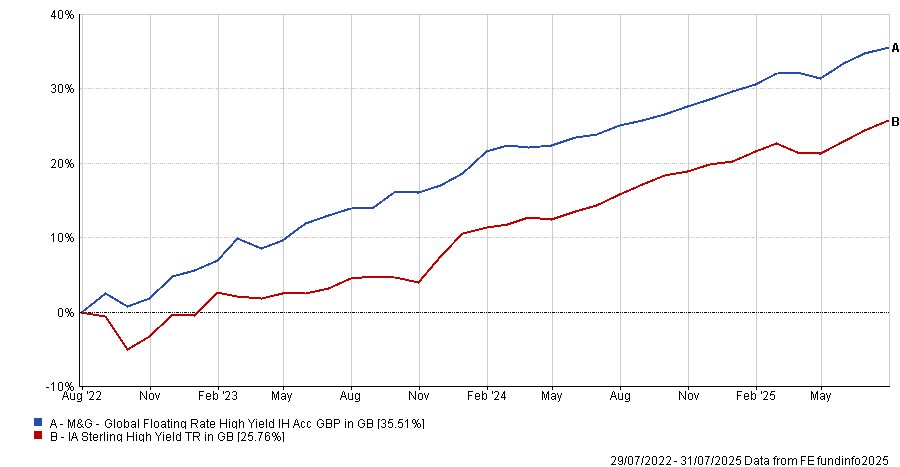

Leading the chart is a set of IA Sterling High Yield funds, which are expected to deliver higher returns in exchange for taking on greater risks. The top-performing high-yield hidden gem is the M&G Global Floating Rate High Yield fund led by Lu Yu and Stefan Isaacs.

It invests at least 70% of its assets in high-yielding floating-rate notes, or bonds that pay a variable coupon adjusted in line with interest rates. Over three years, it has beaten the average IA Sterling High Yield fund by nearly 8 percentage points.

However, investors should note that James Tomlins, who has led the strategy since its inception, stepped down earlier this year.

Performance of fund vs sector over 3yrs

Source: FE Analytics. Data as of 31 July.

While the fund is under the radar, with just £219m in AUM, it is not unheralded by experts.

Analysts at Rayner Spencer Mills Research (RSMR) praised the fund as an “interesting alternative to conventional high yield vehicles” that combines higher levels of income with capital protection.

They added that its emphasis on high-yield floating-rate notes provides more liquidity than other floating-rate alternatives and through “disciplined credit selection”, the fund has been able to avoid default losses and “perform well when set against peers”.

Other funds in the IA Sterling High Yield sector that met our criteria include the Artemis Short-Dated Global High Yield Bond fund, Liontrust GF High Yield Bond and GS Europe High Yield Bond.

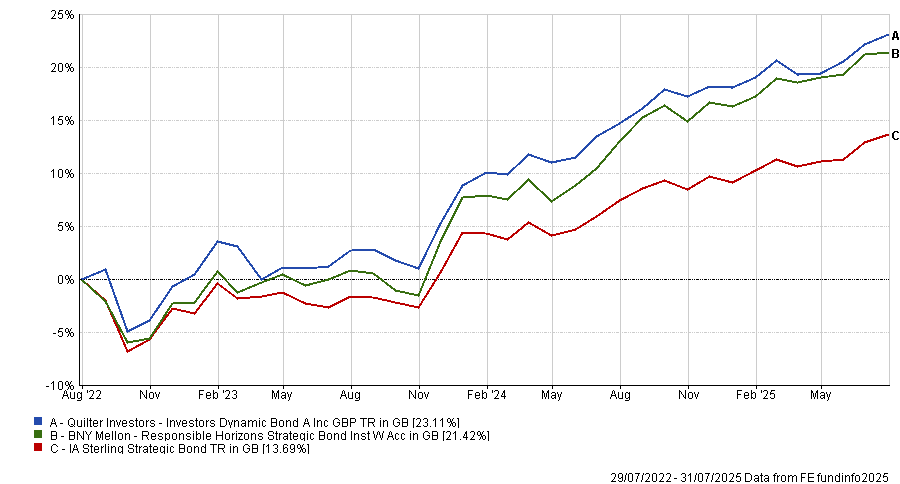

Moving on to the IA Sterling Strategic Bond sector, two funds matched our criteria – Quilter Investors Dynamic Bond and the BNY Mellon Responsible Horizons Strategic Bond.

The Quilter strategy aims to deliver both income and capital growth by investing at least 70% of its assets in investment-grade or sub-investment-grade bonds.

It has delivered a 23.2% return over our period, a top-quartile result in the IA Sterling Strategic Bond sector, due to a supranormal performance in 2024.

In the recent annual report, managers attributed strong performances to successful asset allocation decisions, such as reducing high-yield corporates early in the year.

Moving into 2025, managers expected strength in the asset class to continue and argued the government bond buffer and emphasis on liquidity would allow them to benefit. Indeed, so far in 2025, the fund is narrowly beating the sector average.

Meanwhile, the BNY Mellon Responsible Horizons Strategic Bond fund aims to generate a return through income and capital growth, while implementing environmental, social and governance (ESG) factors into security selection.

It has delivered top-quartile results across multiple timeframes since inception, despite anti-ESG backlash causing responsible funds to shed money since 2023, according to Investment Association data.

Performance of funds vs sector over 3yrs

Source: FE Analytics. Data as of 31 July.

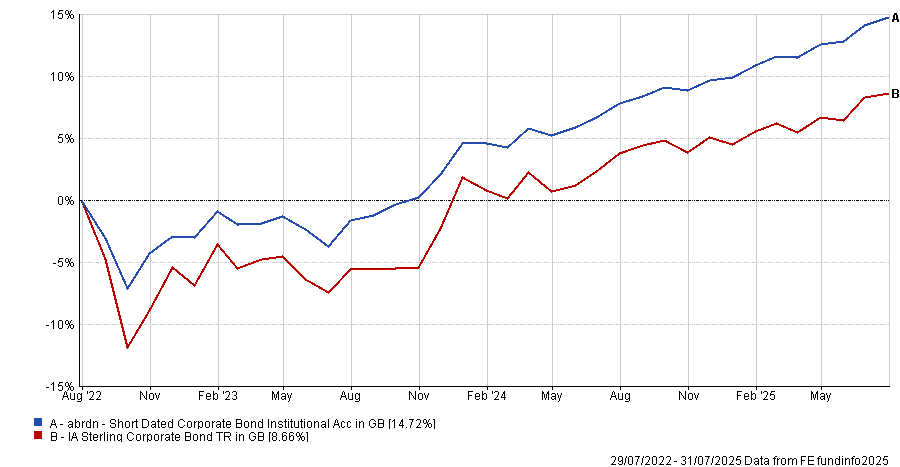

Finally, seven funds matched our criteria for under-the-radar gems in the IA Sterling Corporate Bond sector.

Narrowly beating its peers to the top spot is Mark Munro and Jamie Irvine’s Abrdn Short Dated Corporate Bond fund, which has made 0.1 percentage points more than its next-closest rival.

It is another short-duration mandate that aims to generate income and some growth over the medium and long term by investing in sterling investment-grade corporate bonds with a five-year maturity.

While this represents 89% of the total assets, the team also invests in some longer-dated bonds, with around 10% of the portfolio in five to 10-year bonds.

It has the sixth-best return in the IA Sterling Corporate bond sector over three years, due to a top-quartile return in 2024, despite a bottom-quartile result in 2023.

Performance of fund vs sector over 3yrs

Source: FE Analytics. Data as of 31 July.

Other strategies that qualified as ‘hidden gems’ in the sector during this period included the CT Sterling Short Dated Corporate Bond fund and the Allspring (Lux) Worldwide EUR Short Duration Credit fund, which had rallied from long-term laggards to leaders, according to Trustnet research last year.

Previously in this series we have looked at hidden gem Global, UK, European, US and emerging market funds.