The growth-versus-value debate has never been as relevant as it has been since 2022, which was the year when value re-emerged from its slumber.

Growth has defended itself well in this financial tug-of-war, but not only do stocks that follow this style (such as US-based technology) come with a hefty price tag, investors are also getting more wary about the risks.

Being valuation-aware will provide another chance at outperforming, with investors “getting another bite at the value apple”, said Rob Perrone, investment specialist at Orbis Investments.

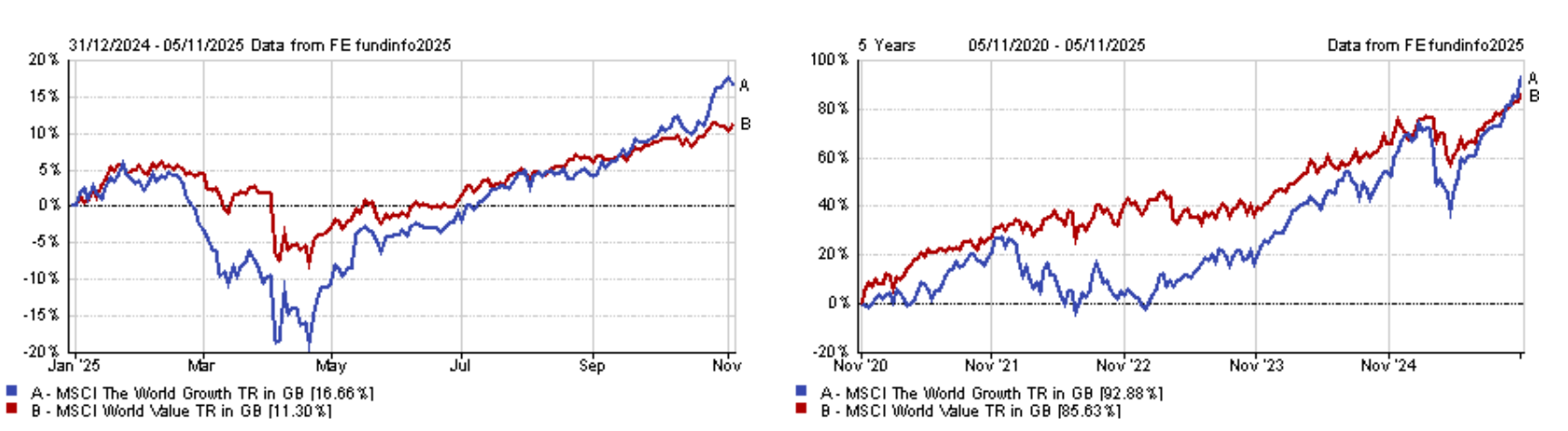

Performance of indices over multiple timeframes

Source: FE Analytics

The chief reason for all of Orbis’ asset allocation decisions is valuation, which is pushing the multi-asset team to be “substantially underweight the US, substantially underweight mega-caps in favour of mid-caps, and substantially underweight growth in favour of value”.

Aggregate valuations in North America look “punchy”, so all of Orbis’ funds are currently at the lowest exposure to the US in their history. This includes the Orbis Global Balanced portfolio, which has about 35% in the region – some 28 percentage points below its benchmark, a 60/40 split between the MSCI World index and the JP Morgan Global Government Bond index (hedged into sterling) – and the Orbis Global Equity fund.

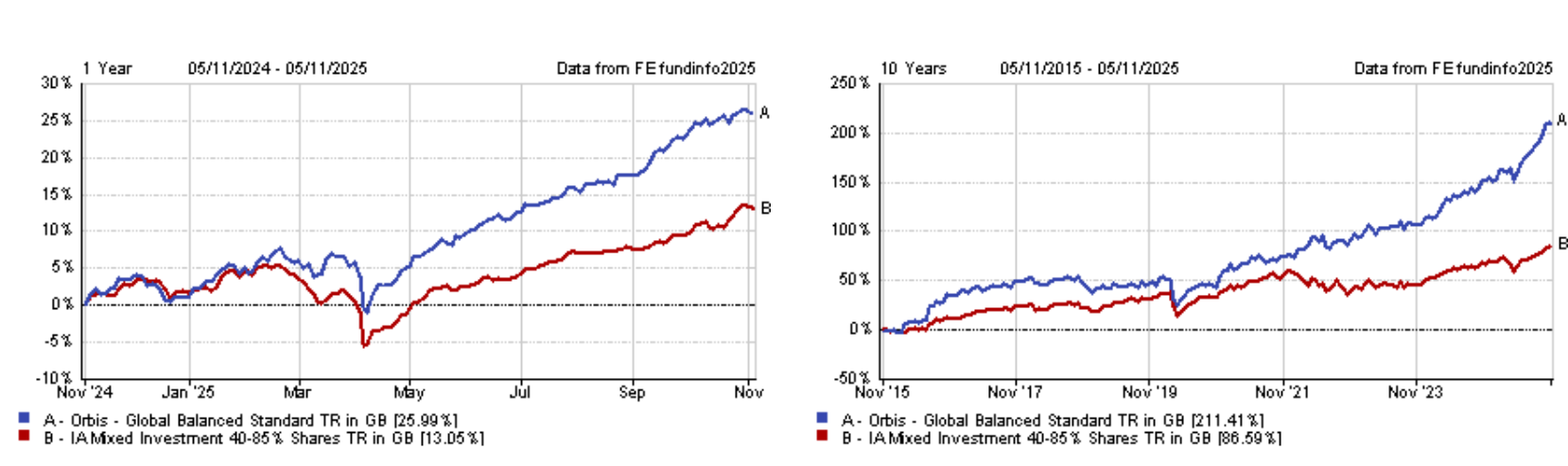

Both strategies have a maximum FE fundinfo Crown rating of five, with the balanced fund led by FE fundinfo Alpha Manager Alec Cutler sitting atop the IA Mixed Investment 40-85% Shares sector over the past one, three, five and 10 years.

Performance of fund over multiple timeframes

Source: FE Analytics

The caution towards the US doesn’t mean that the fund isn’t excited by the potential of the market, however, with the team using hedged equity to enhance returns.

“We go out, we buy the stocks we like, sell short index futures and hedge out the market exposure. That leaves us with the difference between the return of our stock and the return of its local index, plus cash,” Perrone explained.

“That's intriguing, because the market where we are most concerned about aggregate valuations, the US, is also the one with the highest short rates, and so we can find US stocks that we like that can really beat the S&P 500 and, on top of that, we'll get about 4%. That’s pretty good.”

Additionally, some of the trades made back in 2022 are still rewarding.

“When 2022 came along, we were excited to enter the first value cycle for years. And lo and behold, MSCI World Growth Versus Value reached a new all-time high, and so we are in the very unusual but very happy position.”

“Some of the companies we've owned traded on less of a discount to intrinsic value, but we are able to rotate into opportunities where the expected returns are still really quite good. You don't always get that, and it's a very nice position. It's a strange environment.”

Simon Skinner, Orbis’ head of the global investment team, gave European defence as an example of a sector that had been in the doldrums and written off as low-growth and volatile in the short term. The rise of environmental, sustainability and governance (ESG) principles also meant everybody had divested.

More recently, the industry is seen as one of the highest quality industrial plays.

“What's happened to the multiples for those businesses has been extraordinary. They've gone from being discarded almost as the lowest-quality end of the industrial complex to now being regarded as some of the highest-quality industrial stocks, because they have this huge runway of growth ahead of them,” Skinner said.

“Those are the kind of opportunities we get really excited about, because you have a complete transformation of the way that people perceive these businesses, as well as very solid underlying fundamentals.”

This, however, does cause “some angst” to the team because, at some point, these stocks will become consensually popular.

“And as contrarian investors, that means you get a two-day window where you feel good about your stocks, because they're going up and they're still contrarian. But that's the price we pay for hopefully delivering good returns.”

On the fixed income side, Orbis Balanced has no nominal G4 bonds, but does hold some in Norway and some in Iceland, Perrone explained, while its exposure to treasuries is exclusively inflation-linked, because “we're worried about inflation, and inflation is the bond assassin”.

More than 4% of the £1.3bn portfolio is held in the iShares Physical Gold ETC (exchange-traded commodity) and the team also own gold mining stocks, which “can hold their own if the cycle rolls over, but can also hold their own against inflation”.