Fresnillo is a shining example of one of the UK market’s most underappreciated gems, according to stock analysts, who have given the surging stock a ‘buy’ rating despite impressive gains over the past 12 months.

The precious metals miner has bucked the trend of flat performance by FTSE 100-listed mining companies in recent months, making a 237.6% total return over 12 months, largely powered by investors seeking safety in gold.

Although expensive (the shares are on a price-to-earnings (P/E) ratio of 37x), Krishan Agarwal, an analyst at Citi, gave Fresnillo a ‘buy’ rating (as of July), setting a price target of 1,300p to 1,700p.

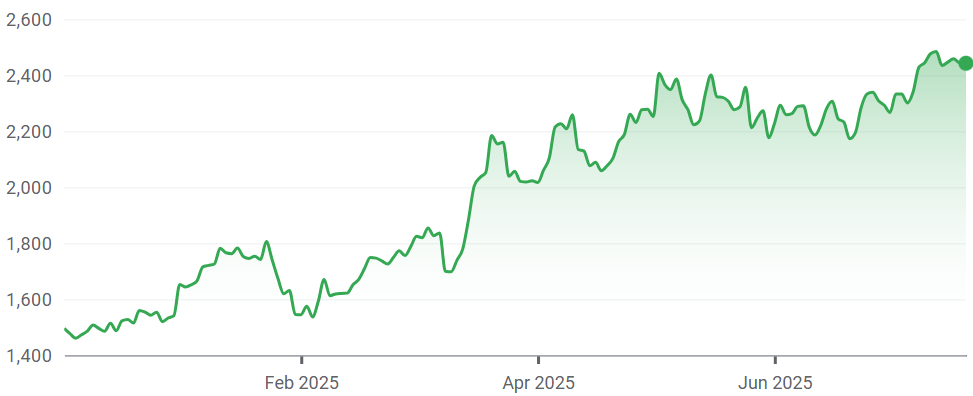

Stock price performance of Fresnillo YTD

Source: Google Finance

“We have been forecasting a strong pricing environment for silver and gold, which has turned out to be the case with a 30% year-to-date increase for both commodities,” he said.

The company’s gold production climbed 15.9% in the 12 months ending in June 2025 – helped along by a strong performance at its Herradura mine – while silver output fell 11.7% due to lower grades and mine closures.

According to Fresnillo’s latest interim results, it expects to produce between 550,000-590,000 ounces of gold, compared to its previous range of 525,000-580,000. Meanwhile, its silver guidance was lowered from 49-56 million ounces to 47.5-54.5 million ounces.

Earnings for mining companies are largely influenced by the underlying commodity prices. However, Fresnillo has also made structure-positive changes to strengthen its business model, such as ensuring stable operations and improved cost discipline, according to Agarwal, who noted this increases confidence that Fresnillo’s outperformance is more sustainable.

As an example, the company reported a $400m net debt position at the end of 2023, which, following strong earnings in 2024 and the first half of 2025, has grown into a net cash position of over $1bn for the six months ending June 2025.

“This is the strongest turnaround by far for any mining company in the FTSE 100,” he said.

Revenue rose more than 30% year-over-year to $1.9bn between the first half of 2024 and the first half of 2025, while earnings before interest, taxation, depreciation and amortisation (EBITDA) more than doubled to $1.1bn – up 103%.

Meanwhile, the average realised silver price increased 21.9% from $27.6 per ounce to $33.7 per ounce, while the average realised gold price increased by 45.8% from $2,171.9 to $3,167.6.

Adjusted production costs were also down 20.2% (or $673.5m) compared to the first half of 2024, primarily due to the devaluation of the Mexican peso versus the US dollar and cost reduction initiatives.

Due to the surge in profits, Fresnillo’s board of directors declared an interim dividend of 20.8 cents per share – up from 6.4 cents last year.

“We expect the total dividend for 2025 to be higher than 2024, thanks to the large net cash position,” Agarwal said.

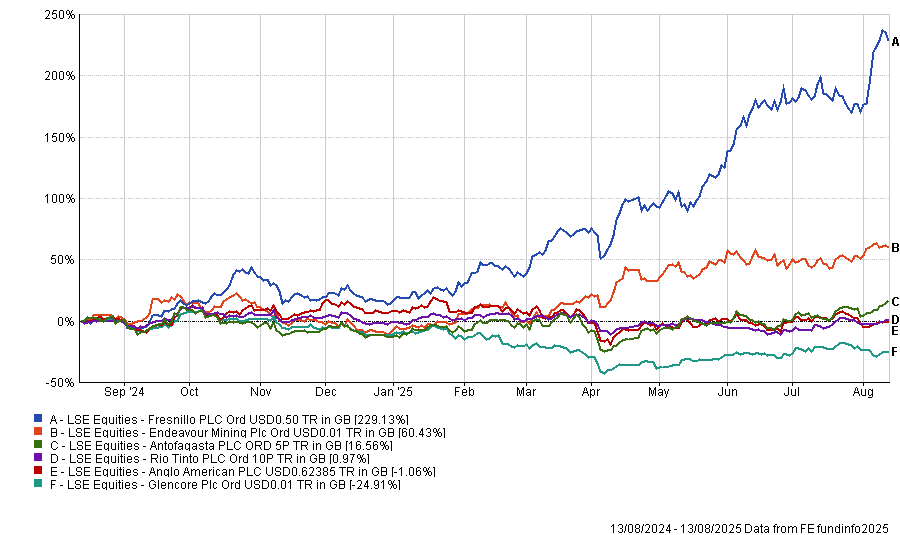

Combined, these factors all tell a story when comparing Fresnillo’s performance to its peers.

Over one year, Fresnillo massively outperformed FTSE 100-listed mining companies, with Fresnillo enjoying a total return of 237.6%. The next highest was Antofagasta at 12.2%.

Performance of Fresnillo vs other FTSE 100 mining companies over 1yr

Source: FE Analytics

More broadly, Fresnillo beat the FTSE All Share Basic Materials over one year, delivering 237.6% versus a loss of 5.4%.

It is a similar story at three, five and 10 years, with Fresnillo delivering a total return of 227.1% over the decade, while the sector index managed 179.2%.

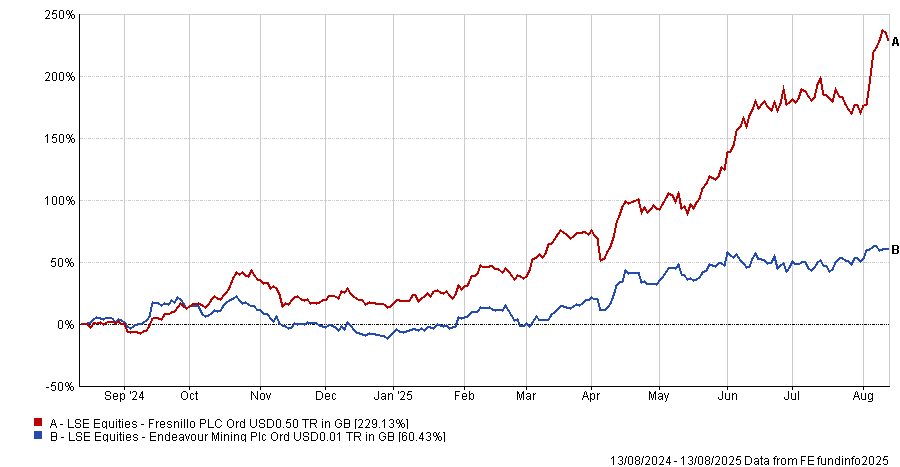

However, Fresnillo is just one of the two FTSE 100 precious metals miners, the other being Endeavour Mining, where shares have increased by 65% or more year-to-date.

Richard Hatch, equity research analyst at Berenberg, said Fresnillo has the steadier volume profile of the two at around 114 million ounces of silver equivalent (AgEq) versus Endeavour’s projected increase in gold from 1.2 million ounces to 1.4 million ounces by 2027.

However, Fresnillo is expected to generate a lower free cashflow yield over the next three years – 7% compared to Endeavour Mining’s projected 17%, Hatch noted.

“Endeavour also has scope to deliver slightly better shareholder returns, we think.”

According to Hatch, Fresnillo is valued at 6.7x its EBITDA for 2026, while Endeavour Mining’s valuation is only 2.6x its projected 2026 EBITDA.

Performance of Fresnillo vs Endeavour Mining over 1yr

Source: FE Analytics

Hatch has nonetheless given Fresnillo a ‘buy’ rating this month, setting a price target of 1,620p to 1,700p.

“We think the stock has had a good run,” he said. “For a stable name with yield upside, we think it is still attractive and offers upside, but on balance, we see more upside in Endeavour shares at this point.”

For investors seeking exposure to precious metals, Fresnillo may offer a blend of defensive strength and growth potential, according to the analysts.

Agarwal expects Fresnillo’s good run to continue, noting that the company has a good pipeline of growth projects in Mexico, which should enable the company to grow its production base over the next five years.

“We also continue to expect a supportive environment for silver and gold prices over the next 12 months,” he said. “This should be a favourable environment to gain exposure to the Fresnillo share price.”