With UK inflation hovering at 3.6%, investors face the ongoing challenge of chasing returns that don’t only grow their wealth but outpace the rising cost of living.

Following the Bank of England’s decision to cut interest rates from 4.25% to 4%, money-market-funds and cash returns will be lower, so investing might appeal to more people.

As such, Trustnet asked experts which funds or investment trusts they would recommend for investors looking to beat inflation levels.

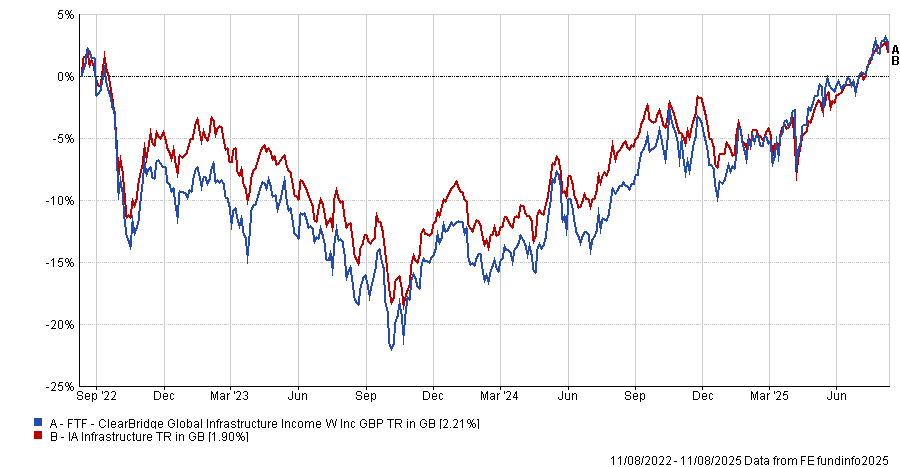

Alex Watts, senior investment analyst at interactive investor, pointed to FTF Clearbridge Global Infrastructure Income.

“Infrastructure securities possess certain characteristics that can counteract inflation in the long run,” he said.

The fund, which has a 12-month yield of 4%, aims to generate a reliable income from the dividends of underlying companies while targeting capital growth above inflation over a five-year period.

Performance of the fund vs the sector over 3yrs

Source: FE Analytics

It currently allocates 33% to the US, 18% to Canada and 11.5% to the UK.

Managers Charles Hamieh, Daniel Chu, Nick Langley and Shane Hurst “pay little mind” to any benchmark and focus on regulated and contracted utilities, such as water and electricity, as well as user-paying assets.

“The team looks for businesses with predictable cashflows, health yields and quality asset bases,” Watts said.

His other choice was City of London Investment Trust, noting that it taps into strong yields on offer across UK equities, also allowing a small overseas allocation.

The trust has a 58-year history of increasing dividends year-on-year, a feat it achieved by taking a bottom-up approach to assessing companies’ cash generation and dividend paying potential, while also building a substantial revenue reserve for future payouts, Watts explained.

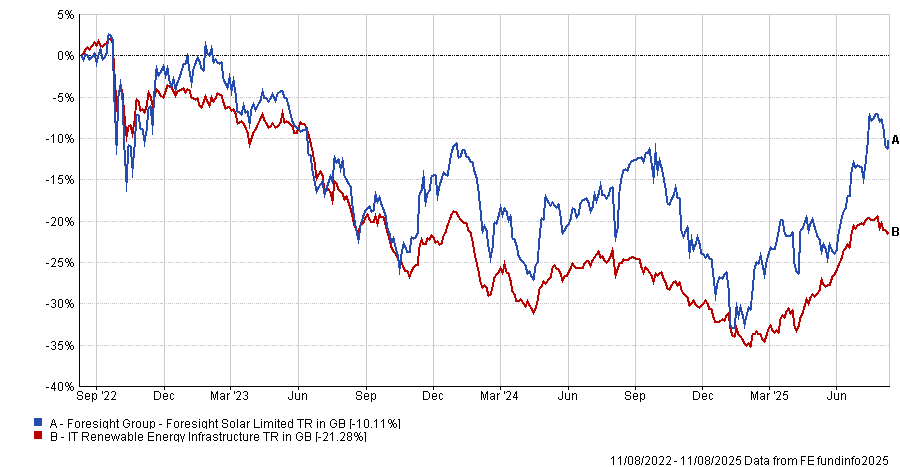

Meanwhile, Ben Yearsley, director at Fairview Investing, selected Foresight Solar. As the name suggests, it focuses energy generation – specifically solar farms.

Performance of the trust vs the sector of 3yrs

Source: FE Analytics

The £478.4m investment trust has logged a first- or second-quartile performance against its sector over 10 years, managing a 61.6% total return over the decade compared to a sector average of just shy of 40%.

The trust is mainly UK-based and currently trades on a 20% discount to net asset value (NAV).

“The clincher is that about half of their revenue stream has a direct inflation link,” Yearsley said.

Yearsley’s second pick was the £2.3bn International Public Partnership.

The objective of the investment trust is to provide investors with long-term, inflation-linked returns by growing its dividend and creating the potential for capital appreciation.

“The revenues are mostly government-backed or payments are based on the availability of assets and not actual usage,” Yearsley said.

“It’s dull but chucks out a nice dividend (about 5%), which has risen for the past 16 years and has been well covered.”

The trust is currently trading at a 16.3% discount to NAV.

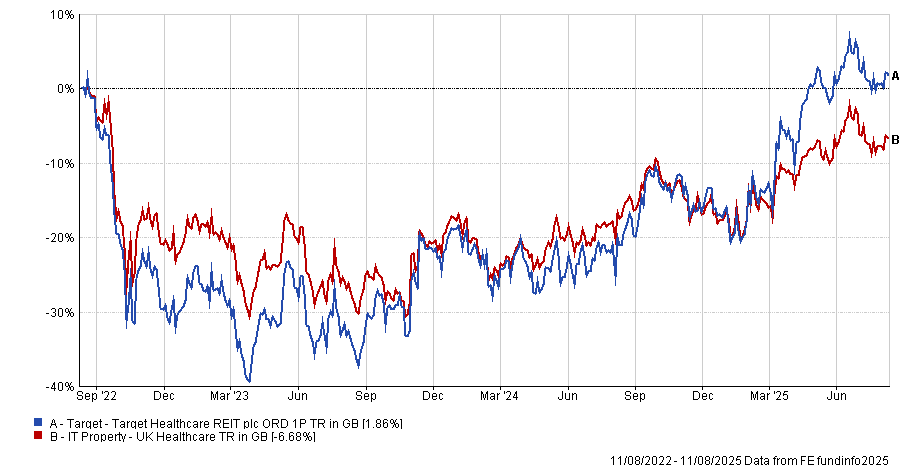

James Carthew, head of investment company research at QuotedData, picked Target Healthcare REIT.

It is a portfolio of 93 purpose-built care homes that specialise in dementia care. “There is a shortage of good dementia care places and growing demand,” Carthew said.

The £625m trust has inflation-linked rents that rise in line with the Retail Price index (RPI).

These uplifts tend to be capped at 4%, Carthew added. “Nevertheless, this real estate investment trust has income and a portfolio valuation that is linked reasonably closely to inflation.”

He said Target takes care to ensure that care home operators are generating sufficient income to cover the rents. The average rental cover ratio on the portfolio was 1.8x at the end of June.

Performance of the trust vs the sector over 3yrs

Source: FE Analytics

Increases in national insurance and other costs have put pressure on the profitability of some care home operators, yet Carthew said Target has demonstrated that it can re-let homes to other tenants if necessary.

The trust is funded in part by debt, which has a weighted average maturity of 4.2 years – 95% of which is at an average fixed cost of 3.84%, which “helps cushion the trust if interest rates need to rise again to choke off inflation”, Carthew explained.

It trades at a 16% discount to NAV and offers a dividend yield of 5.8%.

Carthew also picked GCP Infrastructure Investments – in which he is a shareholder.

“Many infrastructure trusts have assets with revenues explicitly linked to inflation,” he explained.

Recently updated NAV-sensitivity data noted that a 1% uplift in inflation above current forecasts would add 4.5% (or 4.6p) to GCP Infrastructure’s NAV, and a 2% uplift would add 9.8p, according to Carthew.

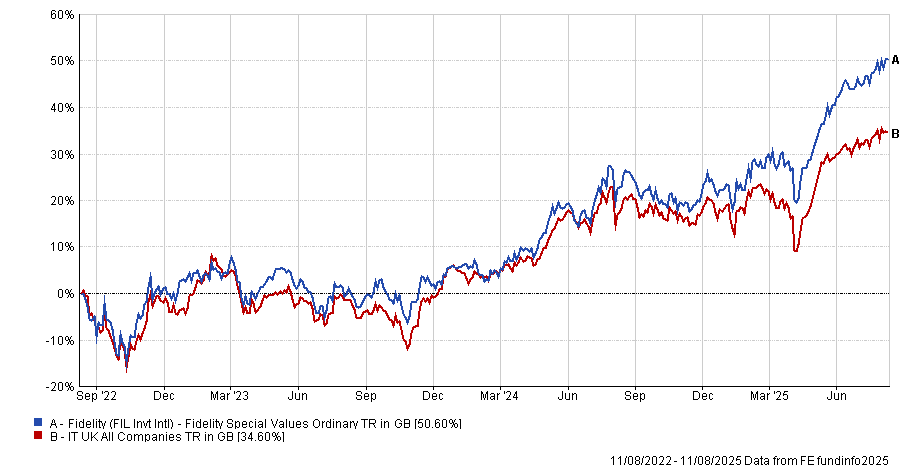

Finally, Laith Khalaf, head of investment analysis at AJ Bell, suggested Fidelity Special Values, noting that the trust has a long track record of investing across the cap scale in UK shares.

Manager Alex Wright’s value approach ensures the portfolio is “better protected” from more persistent inflation pushing up the discount rates applied to future cashflows, Khalaf said.

The trust also has exposure to banks which stand to benefit from rates staying higher for longer in an inflationary scenario.

Performance of the trust vs the sector over 3yrs

Source: FE Analytics

Alternatively, Khalaf suggested pursuing cheap exposures to equity markets through tracker funds like Amundi UK Equity All Cap or iShares Core FTSE 100.

“A global tracker might be an investor’s first port of call. However, because many of the biggest companies in such a fund will be big US tech stocks trading on lofty valuations, any inflation shock would likely take a big toll on share prices (assuming inflationary problems occur on both sides of the pond – a reasonable hypothesis given higher tariffs on US imports),” he explained.

“Investors may therefore look to the UK in search of a portfolio with less valuation risk and with more cyclical exposure.”