Premier Miton has recently rebalanced its multi-asset portfolios, trimming positions in the UK and Japan while adding to new areas, most notably US small-caps.

The move reflects the firm’s focus on areas likely to benefit from recent US corporate tax changes as a result of the so-called ‘big, beautiful bill’ signed by US president Donal Trump, as explained by Ian Rees, Premier Miton head of multi asset.

“The bill introduces stimulus to companies by allowing them to expense R&D [research and development] expenditure, effectively getting tax cuts and incentivising more spend,” he said.

“That’s positive for growth, not just for large-cap companies but particularly small-caps, since they can backdate R&D expenses for four years. That’s a good support for corporates, alongside deregulation and red-tape cutting.”

The firm’s balanced model portfolios now include a 7.5% exposure to an equally-weighted index, which reduces concentration in US large-cap and broadens the valuation reach beyond the top names. This complements a wider allocation to US large-caps, which stands at 16% within the firm’s neutral 60% overall equity weighting.

An area that might benefit from the big-and-beautiful model is biotech, particularly nascent companies spending heavily, Rees noted.

He has been a fan of biotech for a long time, he confessed, despite the sector going through a long period of underperformance. In July, however, it showed signs of recovery, as Trustnet reported, offering “a clear example of timing allocations to structural opportunities,” the manager said.

“This is where a good active manager helps, using weak valuations as an entry point. Innovation is still happening and encouragingly, the FDA [Food and Drug Administration] has become more pro-growth on biotech, stimulating innovation. That’s a real positive.”

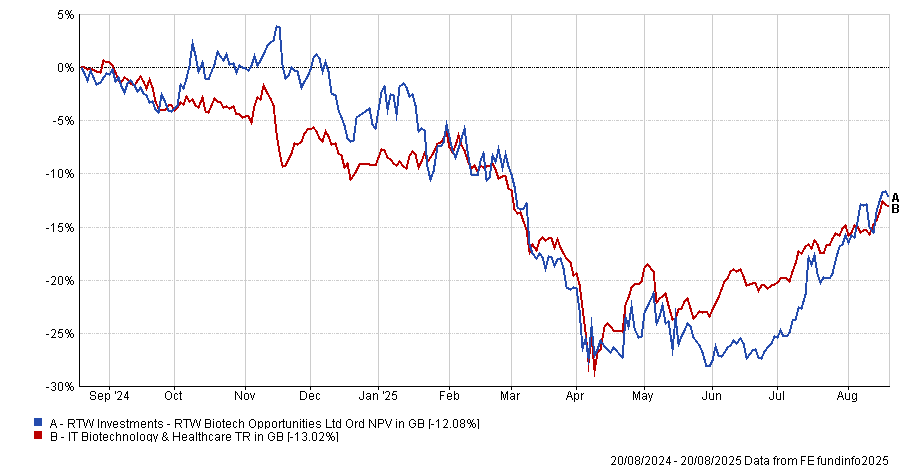

Biotech was one of the weakest positions in 2024 within the Premier Miton Multi-asset Global Growth fund, so the manager now decided to add more to the RTW Biotech Opportunities trust.

“RTW is trading over a 20% discount, so we’re accessing high-quality managers when biotech is out of favour, which is unlikely to persist beyond six-to-12 months,” he said.

Performance of fund against sector over 1yr

Source: FE Analytics

But the opportunity in smaller companies wasn’t limited to North America.

Large-cap names were reduced in the UK and Japan as well – now respectively at an 8% and 2% allocation for Asia Pacific in the balanced portfolios.

The UK retains appeal, said the manager, especially thanks to low valuations and to the de-equitisation trend from buybacks and takeovers. Also, the UK consumer is “in a relatively comfortable place with elevated savings”.

Concerns around the growth outlook prompted him to “ease back a little” on the large-cap allocation, but small- and mid-caps remained attractive.

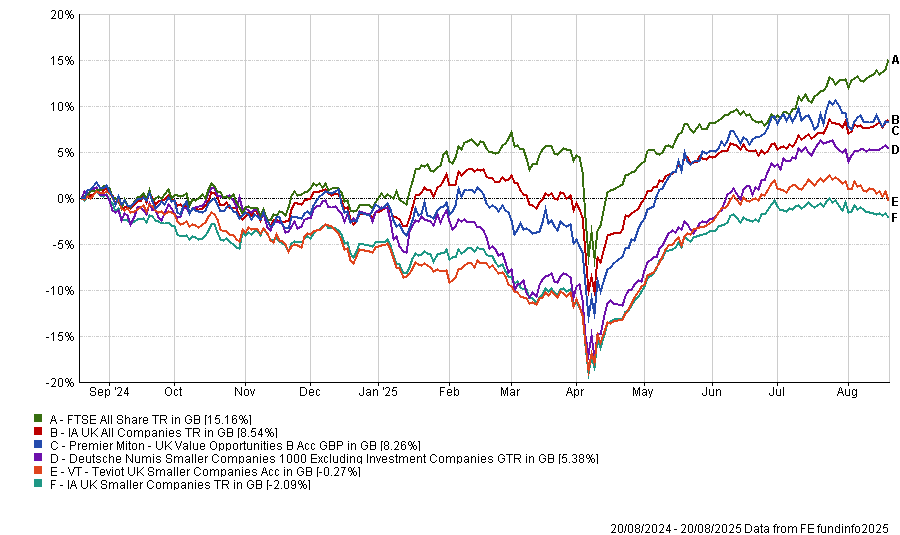

Rees added 6% to the FTSE 250, lifting UK mid- and large-cap exposure to 14% of the portfolio; on the active side, he favoured the firm’s internal Premier Miton UK Value Opportunities fund alongside external pick VT Teviot UK Smaller Companies.

Performance of funds against indices and sectors over 1yr

Source: FE Analytics

In Japan, interest rate increases are “inevitable” and “may strengthen the economy”, but may also have a negative effect on equity market performance. This prompted the manager to tame the “large” allocation he maintained before.

Here too, companies with lower capitalisation were the most interesting to Rees.

“Japanese small-cap managers benefited from shifting market attention. The segment lagged while large-caps did well last year, so we stuck with one of our favourite small-cap managers – Eastspring,” he explained.

In Europe, Rees has become “increasingly convinced on the growth outlook”, closing an underweight position “gradually”. European large-caps make up 9% of the overall balanced asset allocation.

Finally, emerging market debt stood out to him as a good opportunity right now, reflecting the stronger fiscal positions in Latin America relative to the West. One way to play this is through government-bond markets, he explained. Today, emerging markets make up 3% of Premier Miton’s balanced portfolio.