Just two trusts in the entire Association of Investment Companies (AIC) universe has paired an FE fundinfo Alpha Manager with the highest FE fundinfo Crown Rating of five, according to Trustnet research.

The Alpha Manager rating is given to the top 10% of UK managers for their entire career performance and are based on risk-adjusted alpha (using the Sortino ratio) with a track record length bias and consistent outperformance of a benchmark.

Meanwhile, the Crown Ratings are a three-year metric that takes into account three key measurements to derive a fund’s performance: alpha, volatility and consistently strong performance. The top 10% of funds are awarded five crowns and the next 15% get four crowns.

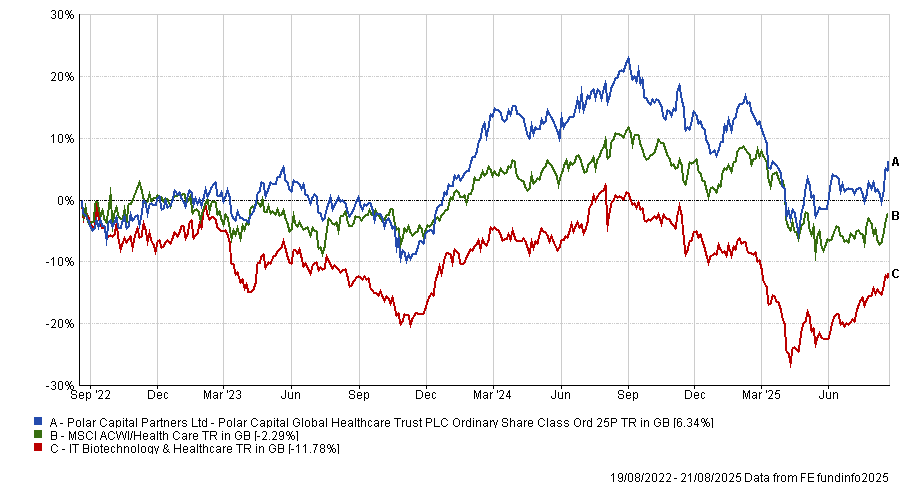

Polar Capital Global Healthcare Trust is one of just two strategies to pair an Alpha Manager with a five-crown rating. Led by Alpha Manager James Douglas and co-manager Gareth Powell, it invests in a portfolio of listed global healthcare equities, such as AstraZeneca, Eli Lilly and UnitedHealth Group.

Over the past three years, the trust posted a top-quartile return of 6.3% in the IT Biotechnology and Healthcare sector, compared to the average peer, which slid 11.8%.

Performance of Trust vs sector and benchmark over 3yrs

Source: FE Analytics

It also boasts a top-quartile total return over the past five years (49.1%) compared to the MSCI ACWI/Healthcare index, which rose 24.1%. However, recent performance has become more challenging with the trust down 11.9% in the past 12 months, the fourth-best performance in the seven-strong sector.

This is due to recent headwinds for healthcare stocks, with regulatory uncertainty and investors' rotation into higher growth sectors hitting the sector hard, experts said.

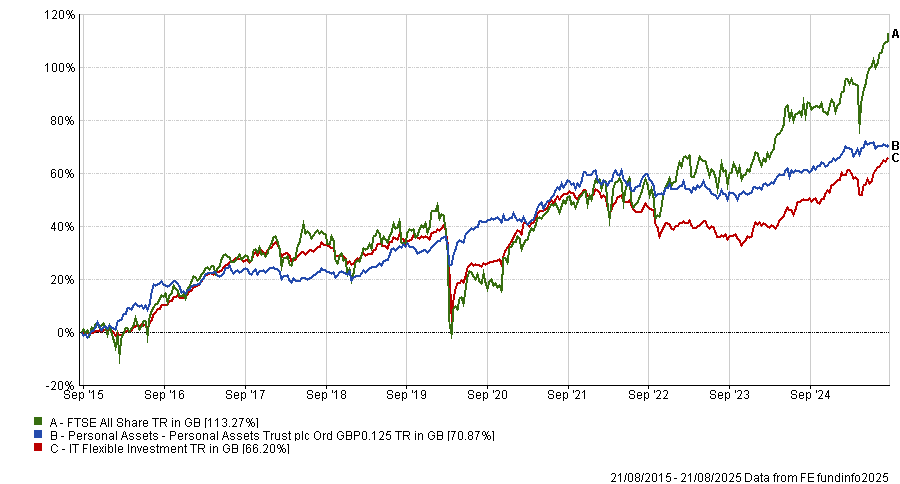

The other on the list with both a five-crown rating and an Alpha Manager at the helm is Sebastian Lyon’s Personal Assets Trust.

It is a capital preservation strategy that aims to protect and increase (in that order) the value of a shareholder's investment over the long term. Using a portfolio of four key pillars (equities, bonds, gold and liquidity), it aims to avoid taking on greater risk than the FTSE All Share.

Due to this focus on capital preservation, the trust has underperformed the IT Flexible Investment sector average over the past one, three and five years. Over the past 10 years, the fund has delivered a second-quartile total return of 70.9%.

Performance of Trust vs sector and benchmark over 10yrs

Source: FE Analytics.

Expanding our criteria to trusts run by Alpha Managers with a still very creditable four-crown rating adds two more strategies to our radar.

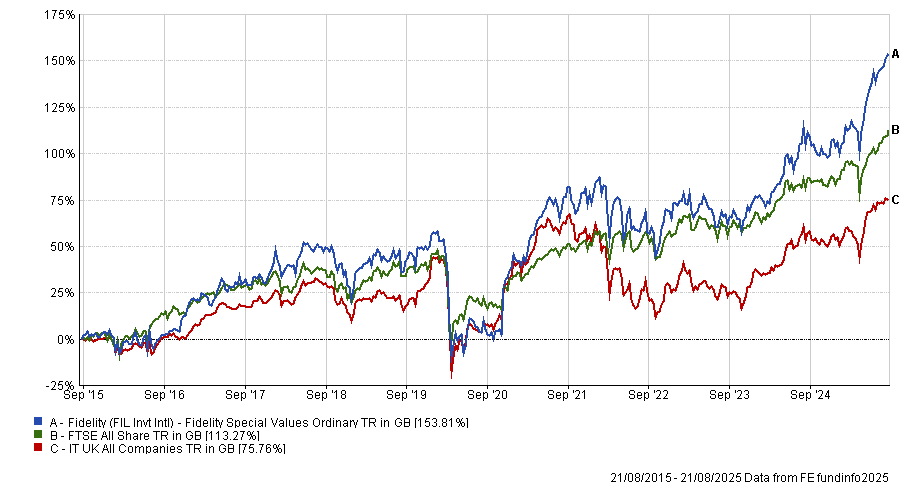

In the UK, Alex Wright’s Fidelity Special Values trust qualifies. This is one of Fidelity’s flagship UK strategies with nearly £1.2bn in assets under management and is the closed-ended counterpart to the manager’s Fidelity Special Situations fund.

It is a value strategy, focused on companies that Wright and his co-manager feel are not fully recognised by the market, particularly in the small- and mid-cap space.

This approach has broadly paid off for the team, with the trust ranking as the best-performing strategy in the IT UK All Companies peer group over the past one, three, five and 10 years.

Performance of Trust vs sector and benchmark over 10yrs

Source: FE Analytics.

Analysts at Square Mile said it is “a compelling proposition run by a highly motivated and passionate investor”.

The contrarian approach and emphasis on the lower end of the market-cap spectrum are “undoubtedly important drivers of returns”. However, this can also lead to higher levels of volatility and so it is most suited for investors with a long-term time horizon, they continued.

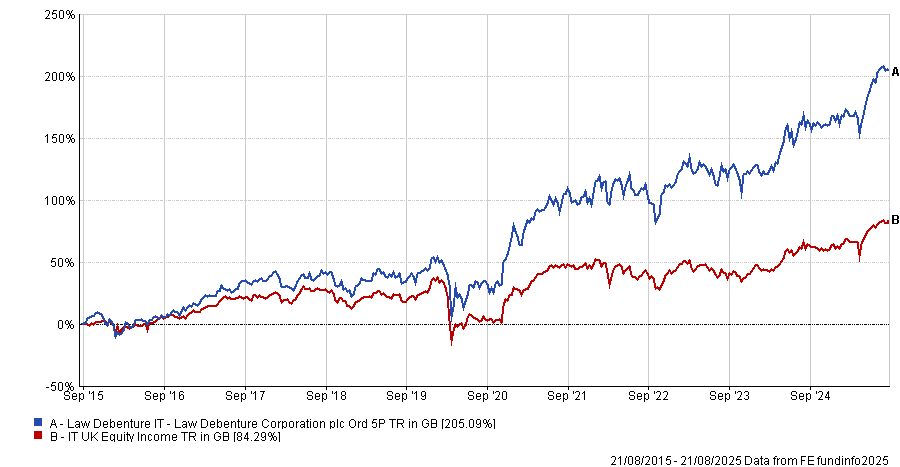

Finally, Law Debenture Corporation Trust rounds out the short list. Led by Alpha Manager James Henderson and co-manager Laura Foll, the trust is one of the oldest investment trusts in the UK market, with more than 130 years of history.

The managers aim to outperform the FTSE Actuaries All Share while also providing a steadily increasing income. Indeed, the trust has raised its dividend for the past 15 consecutive years, making it one of the AIC’s next-generation dividend heroes.

It has posted a top-quartile return in the IT UK Equity Income sector over the past three, five and 10 years, as demonstrated by the chart below.

Performance of trust vs sector over 10yrs

Source: FE Analytics.

Some of this performance will have come from the trust’s independent professional services business, which makes up around a fifth of the trust’s overall assets. This allows greater flexibility in portfolio construction, according to the managers.

For example, earlier this year, Foll explained how the team has opted to downsize some of their defence holdings to move into new positions in stocks such as Rathbones and Aberdeen.