Inflation is proving stickier than once expected, with the Bank of England suggesting price rises could increase to 4% in September before settling back down again.

In July the consumer prices index (CPI) hit 3.8%, yet the Bank decided to cut rates by 25 basis points to 4% in August in an attempt to bolster the sluggish UK economy.

This combination is crippling savings, with the average savings rate now at around 3.5%, and the average easy access account paying 2.6%, according to MoneyfactsCompare.

Savers are therefore losing money in real terms as the interest paid is not keeping pace with the rising cost of living.

One way to combat this could be to invest, according to Joe Hill, senior investment analyst at Hargreaves Lansdown, who suggested three funds that should be able to beat inflation.

First on his list was Artemis High Income. FE fundinfo Alpha Manager Ed Legget, David Ennett and Jack Holmes look for cash-generative companies with pricing power.

This includes analysing the dynamics of both the industry in which the company operates in and the company itself.

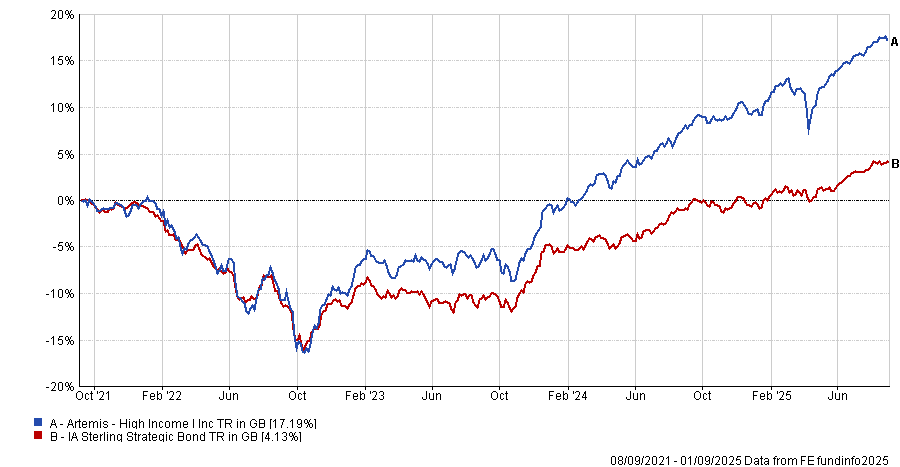

The trio took charge of the £928m strategic bond fund in 2021, since when it has been the fourth best performer in the IA Sterling Strategic Bond sector, up 17.2%.

Performance of fund vs sector under managers

Source: FE Analytics

“If funds were hairstyles, Artemis High Income would be the mullet of the strategic bond sector,” said Hill.

“Rather than having the traditional equal split of assets three ways between government bonds, investment grade bonds and high yield bonds, this fund invests differently. To generate a high income for investors, the fund invests predominantly in high yield bonds, which are higher risk.”

Artemis High Income also invest some of its capital in company shares to boost the fund’s income and growth potential, he noted.

“Ennett and Holmes are talented high yield bond fund managers with plenty of relevant experience and benefit from the support and challenge provided by a strong fixed income team at Artemis, led by Stephen Snowden,” said Hill, who noted the fund yields an “inflation-busting” 5.93%.

Staying with bonds, Royal London Corporate Bond could also be a solution to the current inflation and savings rate problem.

Run by Alpha Manager Shalin Shah and co-manager Matthew Franklin, it focuses on investment grade bonds and aims to provide an income alongside some capital growth.

“Shah and his team are prepared to invest in parts of the bond market that a lot of other investors ignore. Looking for opportunities in under-researched areas such as unrated bonds can throw up chances to boost returns,” said Hill.

“That said, this is a higher risk approach and means there’s potential for investments in the fund to be more volatile.”

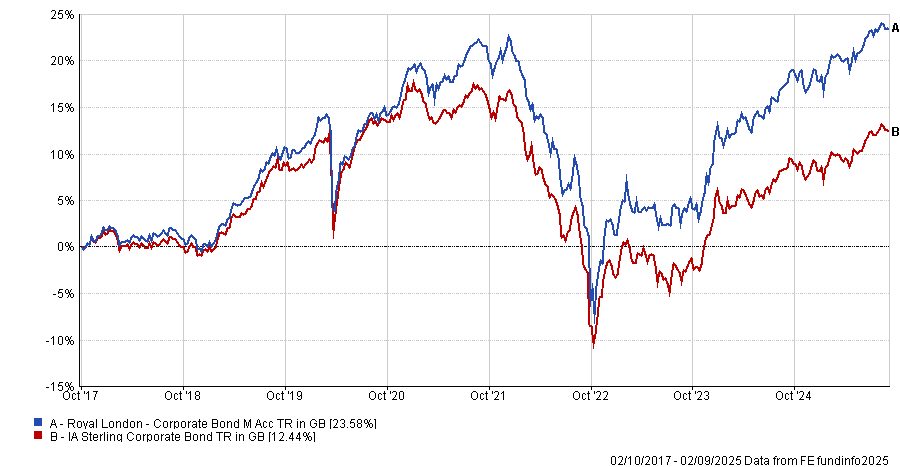

Since Shah took charge in 2017, the £1.5bn fund has been the fifth-best performer in the IA Sterling Corporate Bond sector, up 23.6%. It currently yields 5.81%.

Performance of fund vs sector since manager start

Source: FE Analytics

“The team's edge comes from their detailed research into 'low-profile' parts of the market,” said Hill, who noted the managers aim to diversify through exposure to a range of different sectors.

“They continue to believe that the yield on offer from investment grade corporate bonds compensates investors for default risk,” he concluded.

Turning to equities, Jason Pidcock’s Jupiter Asian Income fund was given the nod, with Hill noting that the “highly experienced fund manager” invests in “financially robust, income-paying companies that have the potential to grow dividends over time to provide an income at least 20% higher than the fund's benchmark”.

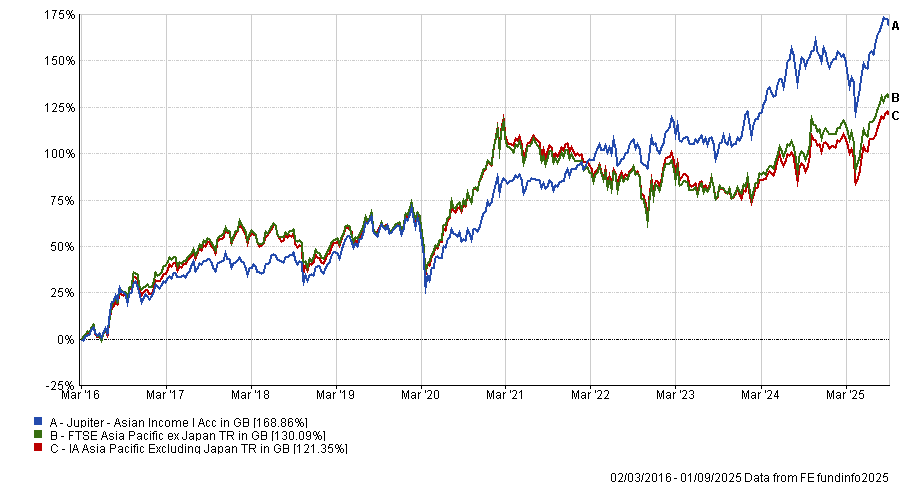

Pidcock has run the £1.9bn fund since its launch in 2016, when he moved from Newton to Jupiter. Since then, it has delivered a total return of 168.9%, around 60 percentage points more than its benchmark and average peer, as the below chart shows. It has been the seventh-best performer in the 90-strong sector during this time.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

“The stock-picking process seeks companies that make plenty of cash, have low levels of debt and are in good financial health. These businesses are typically industry leaders with advantages that are hard to replicate,” said Hill, although Pidcock also pays close attention to wider economic factors when making investment decisions.

“His focus on quality, dividend-paying companies means we expect the fund to hold up relatively well when markets fall. The fund yields a healthy 3.6% and, when blended with other income-generating funds, helps to diversify your dividend stream.”