Best buy lists can be incredibly useful tools for investors, showing which strategies the experts believe are a cut above their competition and are compelling choices for a portfolio.

They can be a great starting point for investors who want to add a trusted strategy to their portfolio, although it is important to note that they are not designed to hold entirely outperforming funds and some picks will move in and out of favour. Nor are they designed to be an entire portfolio.

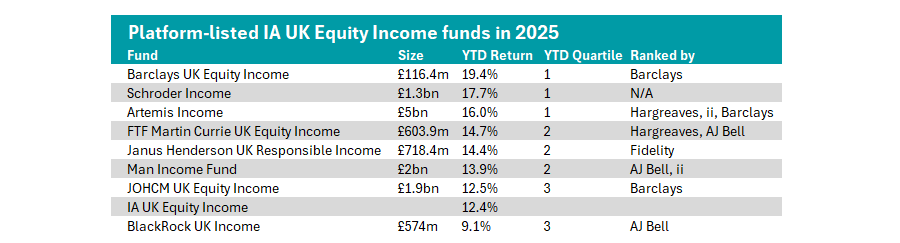

The chart below shows the UK equity income funds backed by some of the major UK platforms and their year-to-date (YTD) performance.

Source: Trustnet.

Barclays

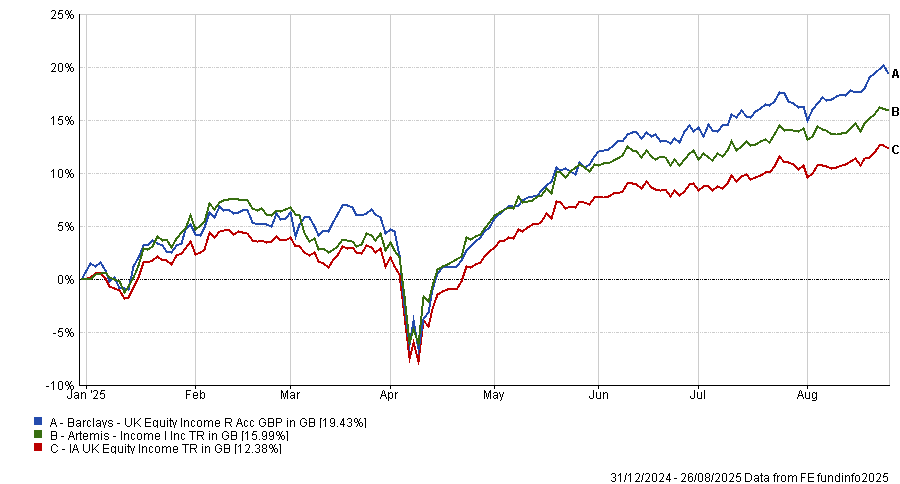

Some best-buy lists featured more top-performing portfolios than others. For example, with two top-quartile recommendations, Barclays housed the most top performers of 2025 so far.

Firstly, it ranked the Barclays UK Equity Income fund, led by the team at Aberdeen and Jupiter Asset Management.

Analysts at Barclays explained that the two managers have very different approaches, with Aberdeen targeting companies with good dividends that are growing and increasing their earnings, while Jupiter focuses on undervalued shares with strong income.

“By investing in two very different managers together, the aim is to deliver more consistent performance, as when one underperforms, we hope that the other has the potential to deliver”, analysts said.

This approach is paying off this year, with the fund delivering the second-best performance in the IA UK Equity Income peer group.

Barclays also ranked the top-quartile Artemis Income fund, “one of the stalwarts of the UK equity income market”.

The team focuses on a “simple, but successful investment philosophy” of providing a steady and growing income and capital over five years.

Analysts continued: “The fund’s three managers – Adrian Frost, Nick Shenton and Andy Marsh – plough all their resources into looking for attractive companies to invest in, rather than trying to predict what will happen to the economy.”

This has led to strong recent performance, with the Artemis Income fund surging 17.7% so far this year.

Performance of funds vs sector YTD

Source: FE Analytics

Barclays also rated the JOHCM UK Equity Income fund, which is up 12.5%, narrowly beating the 12.4% peer group average.

Hargreaves Lansdown

The Hargreaves Lansdown team favoured just one top-quartile strategy so far in 2025 – the Artemis Income fund, which it shared with Barclays’ list.

It would have tied with Barclays for the number of top performers, but it chose to drop Schroder Income earlier this year after the departure of Nick Kirrage.

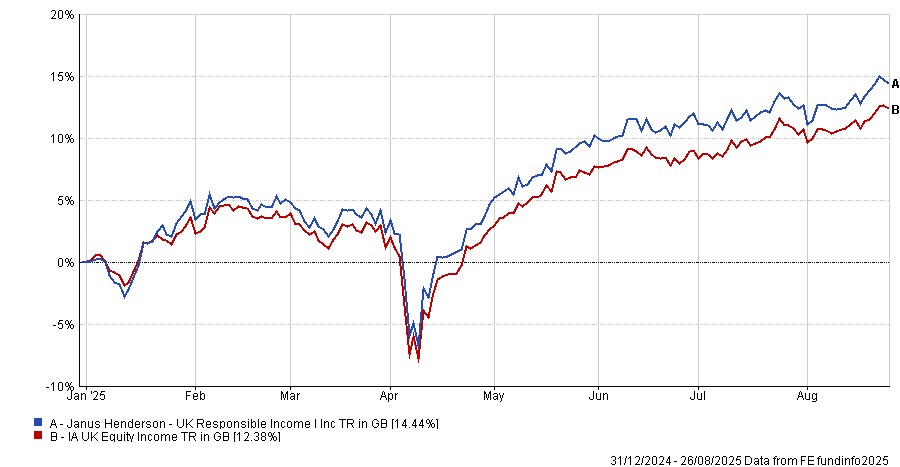

Hargreaves’ other pick, the Janus Henderson UK Responsible Income fund, also produced strong results. Managed by Andrew Jones, who has over two decades of experience in UK equities, it is up 14.4% so far this year, a second-quartile return.

Performance of funds vs sector YTD

Source: FE Analytics

Analysts at Hargreaves Lansdown highlighted its environmental characteristics and commitment to avoiding companies with “significant negative impact” such as tobacco companies.

These companies are usually large dividend payers and so are prominent in UK equity income funds, meaning Janus Henderson’s strategy could offer “some diversification to a traditional equity income portfolio”.

Interactive Investor:

Next is interactive investor’s (ii) Super 60 list. Analysts at ii also favoured Artemis Income, due to its “highly experienced management team” applying a “tried and tested approach”.

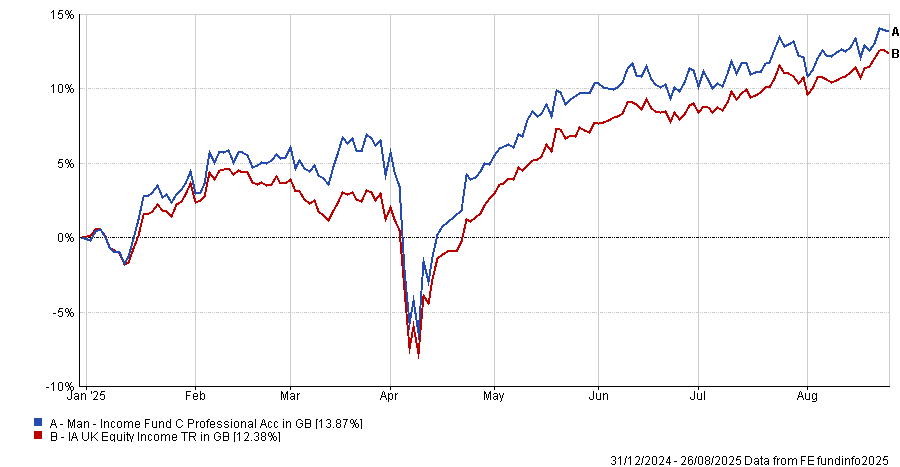

Henry Dixon and Jack Barrat’s Man Income Fund also featured on the Super 60. Analysts at ii noted the fund targets three types of stock: those that are cash generative and undervalued; those with positive earnings momentum; and companies with strong balance sheets and cashflows, which can lead to “positive dividend surprises”.

This leads to an emphasis on stocks lower down the market-cap spectrum, resulting in “returns varying materially from the index”.

So far this year, it has posted a second-quartile return of 13.9%.

Performance of funds vs sector YTD

Source: FE Analytics

Other buy lists

The rest of the popular UK buy lists do not rate a top-quartile UK equity income fund in 2025 but still rated names with good performance.

For example, AJ Bell’s list included the previously mentioned Janus Henderson UK Responsible Income and Man Income strategies.

It also favoured BlackRock UK Income, despite recent bottom-quartile performance, pointing to its “pragmatic investment approach” and willingness to hold a range of stocks with differentiated income profiles.

Meanwhile, the FTF Martin Currie UK Equity Income fund was the only strategy from the sector to appear on the Fidelity Select 50.

Led by FE fundinfo Alpha Manager Ben Russon, the portfolio aims to generate an income above the FTSE All Share’s yield while increasing capital over five years.

Fidelity analysts explained the team is full of “seasoned UK managers” with experience finding companies that can pay “sustainable and growing dividends”.

This year, it is up 14.7%, compared to a sector average of 12.4%.

This article is part of an ongoing series, looking at the year-to-date performance of funds in each major sector currently backed by the main UK Investment platforms. Previously, we have looked at global equity and UK All Companies funds.