While tensions driven by US policy shifts have rattled global markets, Europe has emerged as a relative safe haven, offering stability, attractive valuations and strong corporate fundamentals.

Against this backdrop, one investment trust is positioning itself to become a bigger force in the region. Fidelity European Trust, managed by Marcel Stötzel and Sam Morse, is set to merge with Henderson European Trust, creating a £2.1bn vehicle – subject to a shareholder vote scheduled later this month.

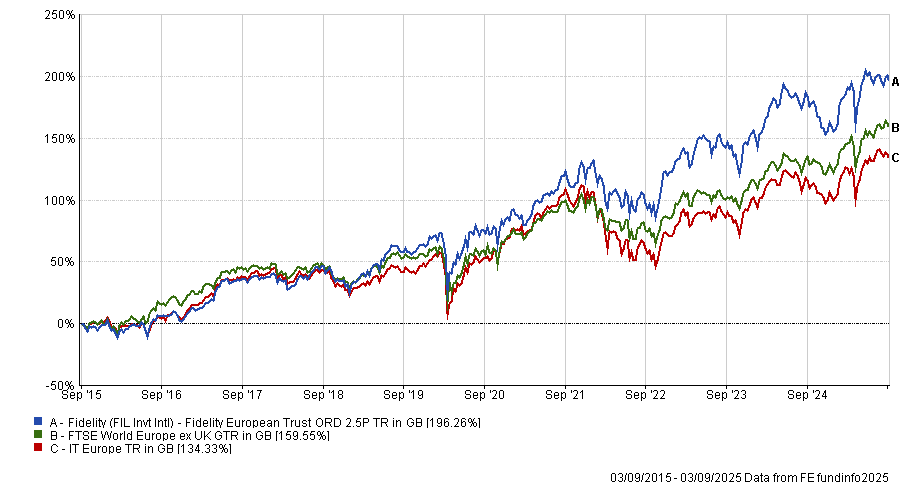

It is easy to see why shareholders would approve the move, with the trust flourishing over the past decade. Over 10 years, Fidelity European Trust has delivered a top-quartile total return of 196.3%, beating both its sector and benchmark.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

More recently, in the trust’s latest interim results released this week, it reported a 9.6% net asset value increase and a 16.7% share price return for the six months to 30 June 2025 – beating the FTSE World Europe (ex UK) Index, which returned 14.3%.

Below, Stötzel reflects on a year of change for Europe and what lies ahead for the enlarged trust post-merger.

What is your philosophy?

We are trying to buy companies that consistently grow their dividends, as research suggests companies that consistently grow their dividends outperform those that do not.

We look at the past as an indicator but this is not going to be a perfect guide, so we also look at things like structural growth, cash conversion and use of capital.

Will anything change following the merger with Henderson European Trust?

Nothing will change in terms of our process and philosophy but shareholders will benefit from lower fees and the general upsides of scale, such as more liquidity.

We will now kick the tyres of the Henderson portfolio to see if there is anything we like in there but, ultimately, we do not want to change the formula that we have developed over 15 to 20 years. Upon initial review, there is around 25% commonality between the two portfolios.

How has the European investment landscape evolved over the past 12 months?

A kick in the backside still moves you forward. And the kick in the backside that Europe has gotten in terms of tariffs and questions around NATO spending has – intentionally or not – moved Europe forward.

There is a renewed sense of urgency for structural reforms. After all, it is currently much easier to do business in California or Texas than it is to do business in Germany or France.

And Europe has been making changes, such as Germany’s fiscal debt brake being lifted and the bloc-wide increase in defence spending. Longer-term, we may also see red tape and bureaucracy cut and savings rates being mobilised.

However, when looking at specific European countries, a lot of the international European companies have been sold off because of postcode risk.

One of our biggest overweights is France, which has been a painful position over the past year. The reason we have kept it and even added to it selectively is that we own very little purely domestic France.

If the French macro gets better, others will obviously want to own French stocks, but if the French macro gets worse, then international players like TotalEnergies generally will not be that impacted.

What has been your best call over the past year?

One of our biggest winners has been Ryanair. We purchased shares in March 2024, initially via the ADR as this was the only instrument easily accessible to non-EU investors, and we added to the position in September 2024.

Following the removal of the EU’s restriction on non-EU ownership of airlines, we switched our holding into the cheaper ordinary shares in March 2025.

Over the holding period, the shares are up almost 30% and Ryanair is one of the top 10 contributors to the fund in 2025.

It is the only company that I know of that has convinced customers to expect the bare minimum from their experience and yet they still come back.

It is the lowest cost provider in a commoditised industry – if we call short haul flights a commodity – and that cost gap between Ryanair and its competitors is widening, which is why we like it long-term.

We also like it cyclically. Many airlines have struggled with production post-Covid, yet the amount of people wanting to travel is increasing. In a situation where there is, say, a 4% growth in demand versus the actual number of seats remaining almost flat because airlines cannot meet that demand, it pushes fares higher.

For Ryanair, this is extremely beneficial because it flows through to the bottom line.

Which position has hurt the most?

One of the biggest detractors in our portfolio has been Novo Nordisk. We have had exposure to Novo Nordisk for at least 10 years, during which time the shares have gone up by over 150%, even after the recent share price weakness, so there has been a long-term benefit to holding it.

It has been a fantastic performer off the back of obesity medications. However, the trial data in recent months for Novo Nordisk’s next generation obesity drug was lower than expected, prompting the stock to be sold off hard. The company has since largely recovered from that.

What is one big theme you will be keeping an eye on?

There is this idea that Europe is being left behind in the AI [artificial intelligence] race, with the space dominated by big American companies. But there are several very nice European opportunities.

For example, we own Legrand, which sells plug points, switches and transformers – all of which are needed to power data centres.

On the other side of it, there is AI roadkill to worry about. There is a view that software companies are going to be very vulnerable to AI in terms of the strong results AI has seen in terms of coding.

This is going to lower the barrier to entry, as individuals will be able to use natural language to do the same job, as AI will effectively write the code for you. This means, in theory, a lot more competitors banging on the door of the big software players. We may or may not agree with that thesis – time will tell.

Banks have also been an exciting area. They have been great stocks for two or three years for us and nice contributors to the portfolio. We still think there is room to grow.

What do you do in your spare time?

I love going to live events of every possible form – rugby, football, music or comedy.