The past five years have been tough for Lindsell Train’s flagship funds and experts are mixed on whether patient investors should stick with FE fundinfo Alpha Manager Nick Train.

Last week, Train told Trustnet that the past few years have been “among the most disappointing of my career”, after we revealed his £2.1bn WS Lindsell Train UK Equity fund dropped to the second quartile of the IA UK All Companies sector over 10 years in July for the first time in its almost two-decade history.

Performance is even worse, however, on the £3.5bn Lindsell Train Global Equity fund. Although it has a shorter track record, its 48-month streak of top-quartile returns over 10 years ended in March.

In July, the fund dropped to the third quartile of the IA Global peer group, meaning long-term investors could have picked more than half of the sector a decade ago and made a better return.

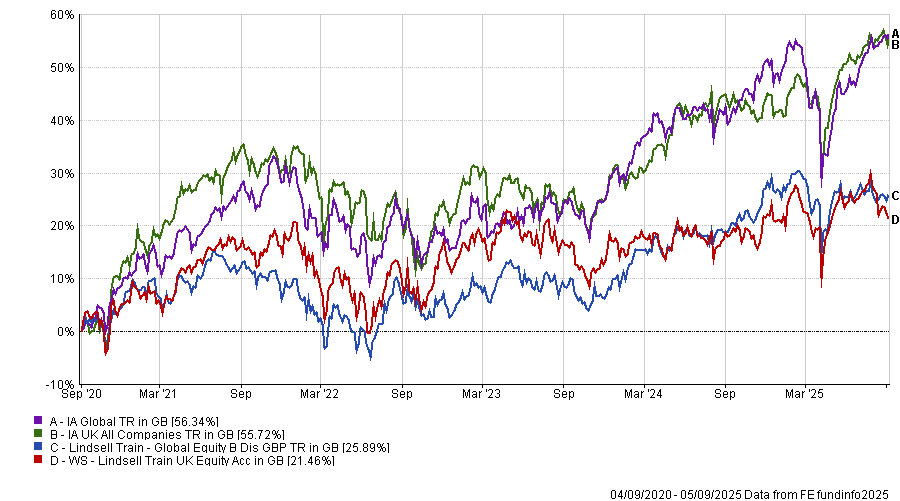

Performance of funds vs sectors over 5yrs

Source: FE Analytics

Gary Moglione, portfolio manager at Momentum Global Investment Management, said the underperformance of the Lindsell Train strategy over the past five years is “primarily a result of style headwinds with stock selection being secondary”.

“Lindsell Train’s strategy is highly focused on quality and built around a concentrated, stock-specific portfolio. In such a framework, prolonged periods of underperformance are inevitable when the market favours different styles, particularly asset-heavy, cyclical sectors that the strategy structurally avoids,” he said.

“Quality-focused strategies have lagged significantly, with the quality factor underperforming value by around 8 percentage points per annum. This mirrors other quality-focused strategies, where asset-light, high-return businesses were derated while asset-heavy sectors like banks, commodities and defence surged,” he said.

Peter Toogood, chief investment officer at The Adviser Centre, agreed. While he noted there have been “some stock errors (or at least the timing of buys and sells)”, overall Train’s large-cap defensive growth funds have been hampered by a return to form for value strategies.

“Nick has staunchly, and correctly, refused to change his agenda with regard to his investment process. His style is simply out of favour,” he said.

“If you consider the dominance of the value investment style for the past four-plus years, his performance is not out of kilter with our expectations.”

Not all were as convinced, however. Richard Philbin, chief investment officer (investment solutions) at Hawksmoor Investment Management, said his style has not helped, but noted that stock picking has been a significant factor.

In particular, he highlighted Train’s concentrated approach, with very few names in his portfolios, which means the manager’s decisions are “magnified”.

“If you’ve got a concentrated portfolio, you only need one or two to turn south and it massively affects the portfolio. In the same way, you only need one or two to do well and suddenly it looks great again. The problem he has had over the past five years is that he has not had one or two winners that have made him look admirable,” said Philbin.

While there have been some successes, such as the privatisation of Hargreaves Lansdown, “he has had a lot of holdings that have not hit and have disappointed”.

Moglione also noted there have been mistakes, despite referring to these as the “secondary” reason for Train’s funds’ underperformance.

“Stock selection has played a role, particularly the prolonged overweight to consumer staples and the delayed pivot to digital platforms. Train himself acknowledged missing the early signals of digital business quality, such as Rightmove’s 70% margins and 100%+ ROE [return on equity], compared to traditional staples like Diageo,” he said.

The recent shift toward digital franchises is encouraging, but some legacy positions were held too long.”

Should investors keep faith?

Moglione said Train’s poor performance in recent years is a “classic case of style cyclicality”, noting that the “underlying fundamentals of the portfolio remain strong”.

“If you believe in mean reversion and the long-term merits of quality investing, this could be a compelling entry point,” he added, noting that he took an initial position in the Finsbury Growth & Income Trust earlier this year to take advantage of the trust discount.

“That said, investors must be realistic. Recovery may take time, and flows could remain negative in the short term. For long-term holders, this is a time to stay the course, especially given the manager’s track record and the strategic pivot underway. For new investors, this is not a ‘bang the table’ moment, but it is a strategically attractive entry point for those with patience.”

However, Philbin was less sure. While he said Train was a “good manager” who “talks a fantastic fight”, he has not had exposure to any Lindsell Train funds for many years.

While Train has “delivered” over the very long run and it is “quite probable” that the funds will enjoy another day in the sun, he noted that “we don’t really know” if or when his style will come back into favour.

“I think he’s a very good manager who has a lot of history and experience, but I do not have any exposure to him and have not had for a long time because I’ve felt there are better alternatives,” he said.

When asked whether it would be safer for investors to sell out of the fund and move back when there are signs that his style is back in vogue, Philbin responded: “Possibly.”