Choosing the right manager to entrust your money to is no easy feat, especially when the choice is vast and marketing campaigns are loud and persuasive.

The challenge has become even harder in the past few years as uncertainty and unprecedented situations have upended historical norms.

Since Covid, for example, investors have rediscovered how equities and bonds aren’t always uncorrelated, growth investing doesn’t always outperform other styles and that inflation isn’t a thing of the past but very much alive. This year, they had to come to terms with fresh blows to globalisation due to president Donald Trump’s nationalist agenda.

Once upon a time, it would have been advised to turn to managers with long track records. Yet, this also faces pressure. Top managers such as Nick Train are struggling at present, while investors may be put off investing in star managers altogether after the Woodford debacle in 2019, when those who backed the previously beloved stock picker were left nursing heavy losses as his eponymous fund group was wound down.

Speaking with Trustnet recently, iBoss managing director and chief investment officer Chris Metcalfe said that “the value of data before November last year is much lower”, because “everything has changed,” suggesting that many veterans’ track records were forged in conditions that no longer apply.

The decade from 2010 to 2020 was relatively calm, with lower interest rates and negligible inflation providing a golden age for investors to make money. As such, managers may look like they have long track records, but in reality these ‘veterans’ are now dealing with their first crisis.

In other words, they were caught up in what Ian Rees, Premier Miton head of multi asset, called a “wave of momentum that has persisted for longer than has been comfortable” – from the end of the financial crisis up to last year.

“Investors ended up selecting ‘veterans’ on the basis of how they've performed or operated over that one cycle,” he said. “This is the thing that's being challenged at the moment – and quite rightly so – because good investment management isn't just about delivering investment returns, it's also about sensible risk management of portfolios.”

For Simon Evan Cook, fund-of-funds manager at Downing, portfolios that consist only of top performers between 2010 and 2024 “run the risk of being reliant on too many funds that only ‘worked’ in that deflation-heavy environment”.

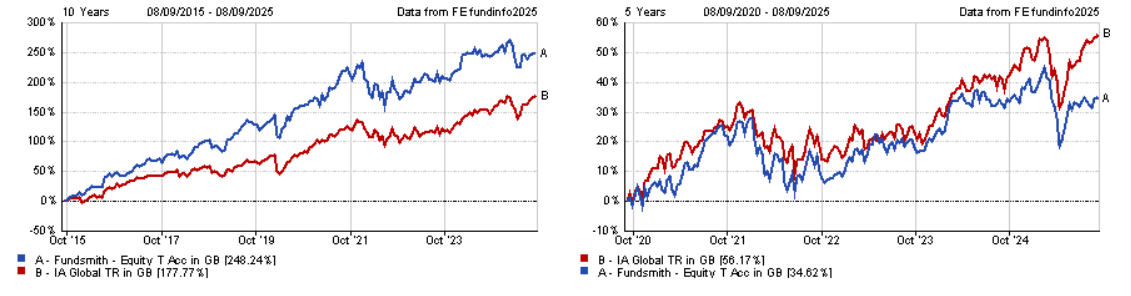

These tend to be long-duration equity strategies such as the quality-focused, buy-and-do-nothing style of Fundsmith Equity, which have struggled recently, as the chart below shows.

Performance of fund against sector over 10 and 5yrs

Source: FE Analytics

Managers who developed a great track record over the 2010s did so in “certainly a bad decade for active fund management”, said Evan Cook, as the dynamics of the market along with the real-world dynamics behind them “suited the passive approach perfectly”.

“Today we shouldn’t necessarily dismiss them, for if those conditions return, they may again rise to the top.” However, he continued, investors “should attach more weight to recent performance – while not assuming that the game has changed for good.”

So what is working now?

The best-performing funds since 2022 have been those with shorter time horizons that trade more frequently, Evan Cook noted.

“Shorter-duration strategies in which the manager is looking to profit from six-month moves, not six-year moves, have started to rule the roost,” he said. “This applies whether the funds are value or growth, so we suspect that this may be the thing that’s changed compared to the preceding period.”

For Rees, the stand-out has been those who have remained disciplined in providing diversification.

“The job of an investment manager is to demonstrate greater discipline, better insight, useful diversification and risk management. Those who have been disciplined with risk management and delivered more resilient returns are winning out,” he said.

One thing investors can look for is a track record that pre-dates the financial crisis, with Rees noting that “experience is really valuable at this time because it ensures you have grounding and an understanding”.

Similarly, Metcalfe’s approach is to look for managers with “the longest possible track record”, so that they can show they can cope with the unexpected.

To thrive in this volatile regime, therefore, investors may need to look not just at ‘veterans’ but ‘super veterans’, those rare managers whose experience spans cycles, whose discipline tempers risk and whose adaptability has been tested across crises.

In our next article, we will reveal which equity managers can truly claim that title, according to experts.