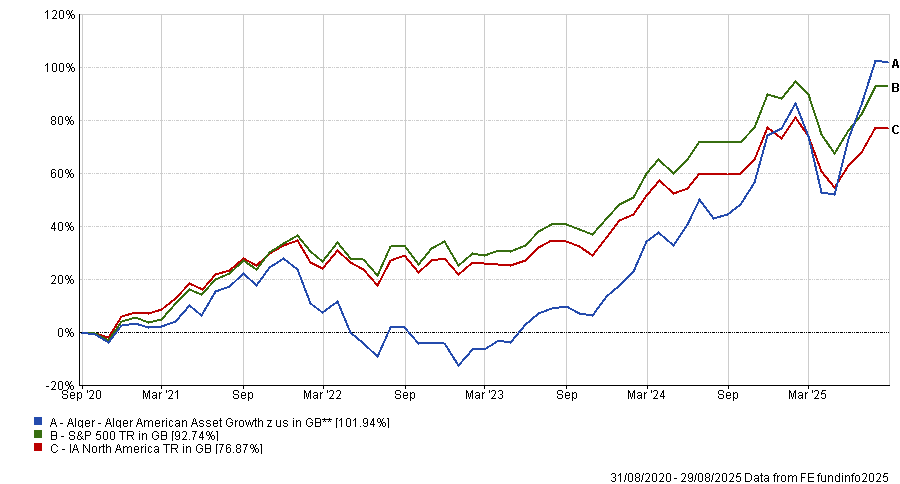

Cheap, low-cost passive funds are popular among those looking for exposure to the US, but for investors willing to pay up, there have been a handful active managers who been delivering bang for their buck.

While passives have shone in recent years as the US market has been dominated by large-caps (and in particular the Magnificent Seven of Apple, Nvidia, Tesla, Alphabet, Microsoft, Amazon and Meta), they have not been the only game in town.

Below, Trustnet examines the top-quartile North American funds over the past five years with an ongoing charges figure (OCF) of 1% or higher.

Source: FE Analytics. Returns in sterling to the end of August.

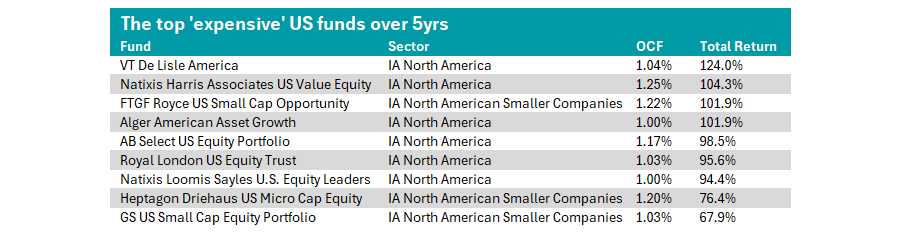

Top of the list is the VT De Lisle America fund, led by veteran stock picker Richard De Lisle, which has made its returns despite just 3.5% of the portfolio being invested in technology, some 30 percentage points lower than the S&P 500.

For example, “we don’t and won’t have any Nvidia,” De Lisle explained in the fund’s latest monthly factsheet.

Instead, the portfolio favours consumer stocks, such as Build-A-Bear Workshop or energy companies such as Cameco Corporation.

Despite a 1.04% OCF, it has delivered the fourth-best five-year return of 124% in the highly competitive IA North America peer group. All figures are returns after fees.

Performance of fund vs sector over 5yrs

Source: FE Analytics

This lack of direct exposure to tech has sometimes been a headwind, with the fund sliding into the third quartile in the past three years as these stocks have performed well. However, it has rallied year to date, which the manager attributed to holding companies that indirectly benefit from tech.

“We have tried to put ourselves in the way of anywhere big tech can think of spending. This is the essence of the performance difference: tech growth at nearly value multiples,” the manager said.

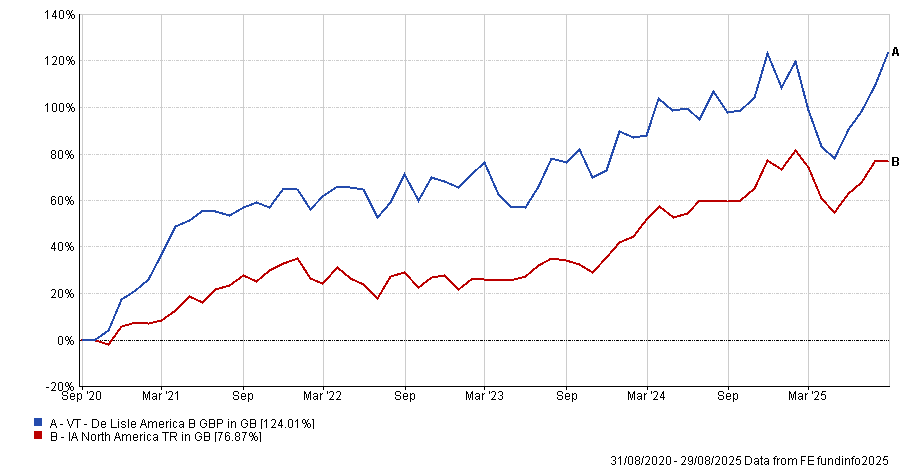

Next is the Natixis Harris Associates US Value Equity fund, which is the most expensive portfolio on the shortlist with a 1.25% charge.

While it does hold a member of the Magnificent Seven (Alphabet), its value style has led it to avoid many of these major tech names, with just 3% allocated to information technology.

Instead, the fund has a 25 percentage point overweight to financials compared with the S&P 500, with banks and financial services businesses, such as Citigroup and Charles Schwab, featured in its top 10.

This approach has paid off over the past five years, with the portfolio up 104.3%, beating the S&P 500. However, the low allocation towards growth stocks has been a headwind recently, with the portfolio in the third quartile over the past one and three years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Its stablemate, the Natixis Loomis Sayles US Equity Leaders fund, also made the list, pairing a 1% OCF with a 94.4% return in the past five years.

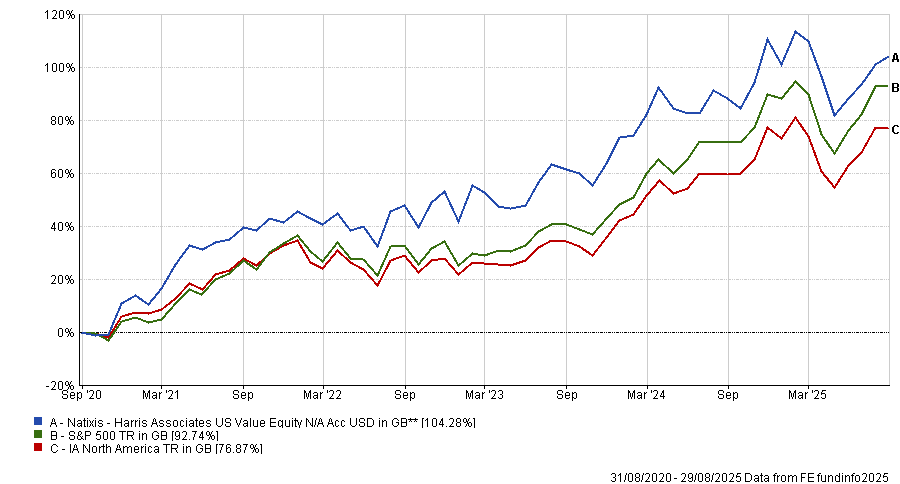

Alger American Asset Growth also qualified. Run by FE fundinfo Alpha Managers Patrick Kelly and Ankur Crawford, this is a growth strategy focused on some of the most innovative companies in the US.

“If you’re not innovating in the US, you’re going to struggle to compete,” Kelly told Trustnet earlier this year.

This has led them to favour artificial intelligence (AI) stocks such as members of the Magnificent Seven. However, Kelly explained they have also found unexpected opportunities in areas such as utilities with Talen Energy, which are not traditional growth markets.

This has contributed to a 101.9% return over the past five years, a slight outperformance compared to the S&P 500, despite a relatively high OCF of 1%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

For investors looking further down the market capitalisation spectrum, three smaller company mandates delivered top returns despite high costs.

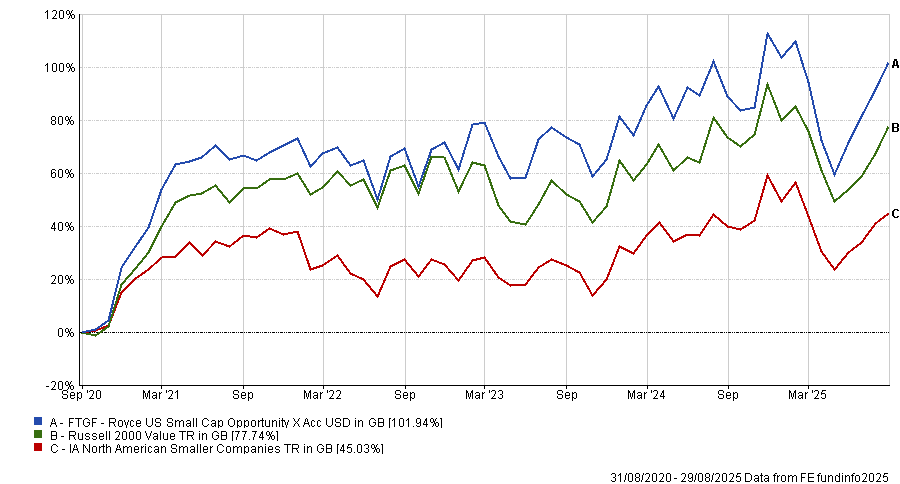

Firstly is the FTGF Royce US Small Cap Opportunity fund, where its 1.22% OCF has not dampened returns, with the portfolio up 101.9% over five years.

Managed by Brendan Hartman, Jim Harvey and Jim Stoeffel, it invests primarily in small and microcap companies, which the managers feel are undervalued.

Its wider performance has also been strong, with top-quartile results in the IA North American Smaller Companies sector over the past one, three and 10 years, as well as the five years studied.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The portfolio has also outperformed the S&P 500 by around seven percentage points, despite smaller companies lagging their large-cap peers over the past half decade.

The two other smaller company strategies on the short list are the Heptagon Driehaus US Micro-cap Equity fund and the GS US Small Cap Equity Portfolio.

This article is part of an ongoing series examining the expensive funds that have delivered top-quartile performance in their sectors over the past five years. Previously, we have looked at the global market.