The traditional portfolio with a 60/40 split between stocks and bonds is doing a disservice to investors, leaving them with a lighter wallet and significantly more risk, according to BlackRock’s latest Autumn Investment Directions report.

The asset manager argued that investors need to “rethink portfolio construction principles” to account for a new investing regime, which began in 2020, where the correlation between stocks and bonds is shifting in ways not seen for decades.

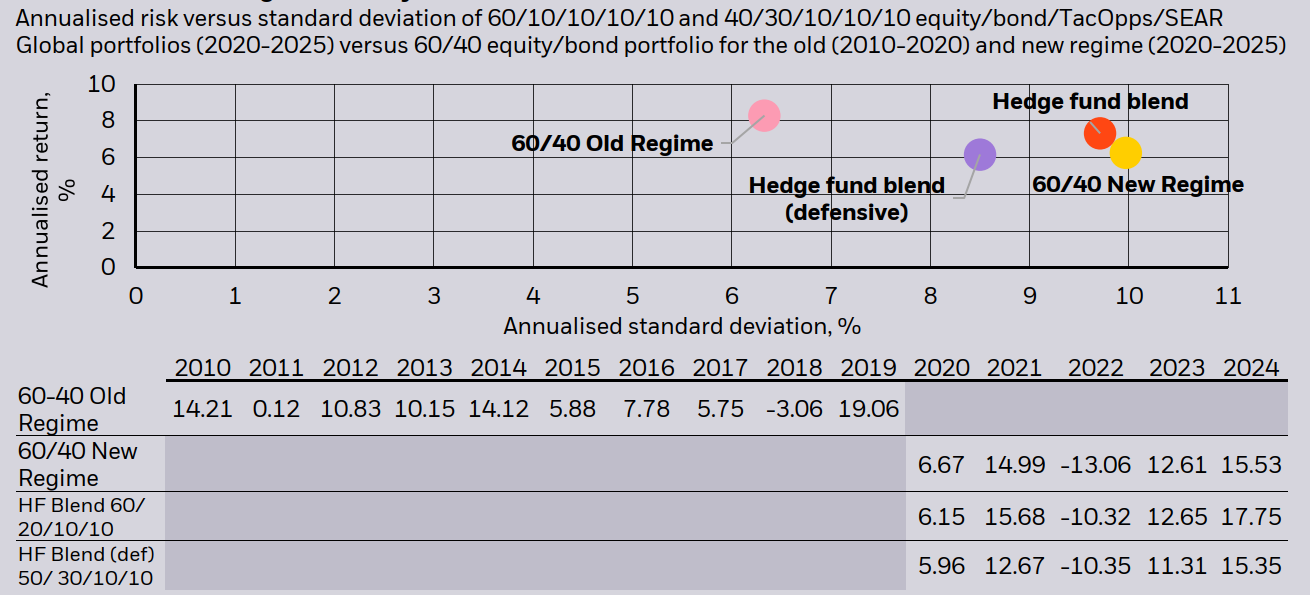

During the “old investing regime” from 2010 to 2020, when inflation was subdued and central banks consistently supported markets with low rates and quantitative easing, a 60/40 portfolio delivered an annualised 8% return.

Crucially, it did so with an annualised standard deviation just above 6%, meaning investors enjoyed high returns for relatively little volatility.

In today’s “new regime”, which BlackRock dates from the Covid-19 shock and the resurgence of inflation, the same portfolio has delivered only 6% annualised returns.

That might not sound like a huge drop, but investors have had to endure significantly higher volatility: a standard deviation of 10%, an increase of roughly 35% in risk for a lower reward.

Source: BlackRock

This regime change has upended the long-standing assumption that bonds act as a natural hedge against equities.

“Fixed income’s role in multi-asset portfolios has changed as stock-bond correlations have become less dependable: once a reliable hedge in the standard 60/40, duration’s ability to offset equity drawdowns has deteriorated – while equity and fixed-income volatility has risen. This puts multi-asset portfolios like the 60/40 under strain,” the report read.

Since 2020, periods of equity market stress have often coincided with bond sell-offs, leaving investors with few places to hide.

BlackRock’s researchers stressed that the current environment is not a temporary aberration but a structural shift. Inflationary pressures, supply-chain realignment, fiscal expansion and the transition to net-zero carbon emissions all contribute to a backdrop in which macroeconomic shocks drive both equity and bond markets in the same direction. The firm’s solution is to find diversification elsewhere.

“Unreliable stock-bond correlations underpin the case for a broader array of diversifiers”, read the report. Among the options highlighted were hedge funds and absolute-return strategies, which seek to exploit inefficiencies and deliver returns uncorrelated to equities or bonds.

BlackRock modelled alternative allocations to illustrate the impact. Adjusting the traditional 60/40 to 60% equity, 20% bonds, 10% BlackRock Tactical Opportunities and 10% BSF BlackRock Systematic Global Equity Absolute Return, for example, produced higher returns with lower volatility, according to its analysis.

In the report’s chart above, this improved outcome was shown by the orange dot, positioned above and to the left of the ‘new regime’ 60/40.

To achieve an even more meaningful change, BlackRock presented a 50/30/10/10 allocation, where equities were cut back in favour of a larger bond exposure alongside the two alternative sleeves.

This portfolio, represented by the purple dot, significantly reduced overall volatility while still delivering returns comparable to the ‘new regime’ 60/40.

The report did not stop at hedge funds, as today’s new investment landscape requires even more adjustments.

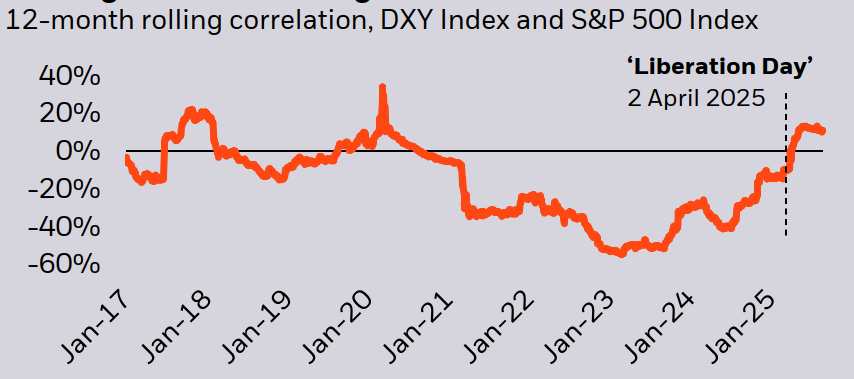

In the old regime, exposure to the US dollar served as a diversifier against equity volatility, tending to push higher when the equity market fell. In 2025, that correlation flipped, with the currency falling alongside equities, as shown in the chart below.

12-month rolling correlation of dollar and stock markets (DXY and S&P 500 indices)

Source: BlackRock.

Against this backdrop, there is less value in unhedged equity exposure, the report claimed, arguing for “more granular share class selection, such as using currency-hedged share classes”.

Bitcoin was cited as another possible allocation: while highly volatile, its return drivers are distinct from those of traditional assets, giving it a correlation to other investments below 0.5%, the study claimed.

“For investors concerned about US fiscal risks and the dollar, a modestly-sized allocation to bitcoin may be a logical part of a broader diversification strategy,” the report read.

Finally, static exposure to factors, such as growth, inflation or style, “has become a drag on returns”, so Blackrock argued allocating to active managers with a go-anywhere mandate, who have the best chance at “exploiting different market inefficiencies for broadly uncorrelated alpha streams”.

As higher-alpha strategies often carry greater short-term volatility and tracking error, which could deter portfolio constructors, the study suggested blending them with other more benchmark-aware solutions.