Fund managers have taken their overweight towards global equities to a seven-month high, a closely watched report shows, even though a record number believe the asset class is overvalued.

The latest edition of the Bank of America Global Fund Manager Survey polled 165 asset allocators running a total of $426bn between 5 and 11 Sep and found that sentiment is currently at its highest since February this year.

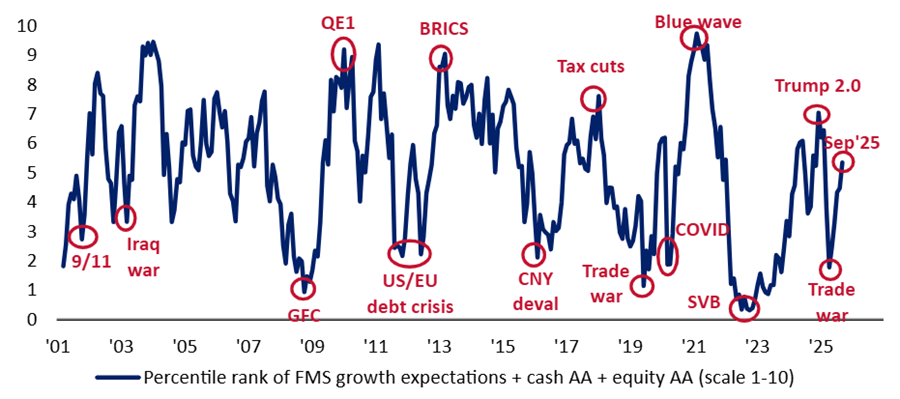

The survey’s broadest fund manager sentiment indicator – which examines professional investors’ cash levels, equity allocations and global growth expectations – rose from 4.5 in August to 5.4 in September.

Percentile rank of growth expectations, cash level and equity allocation

Source: Bank of America Global Fund Manager Survey – Sep 2025

As part of this, the net percentage of fund managers who are overweight equities has jumped to 28% this month. This is a 14 percentage point increase on last month.

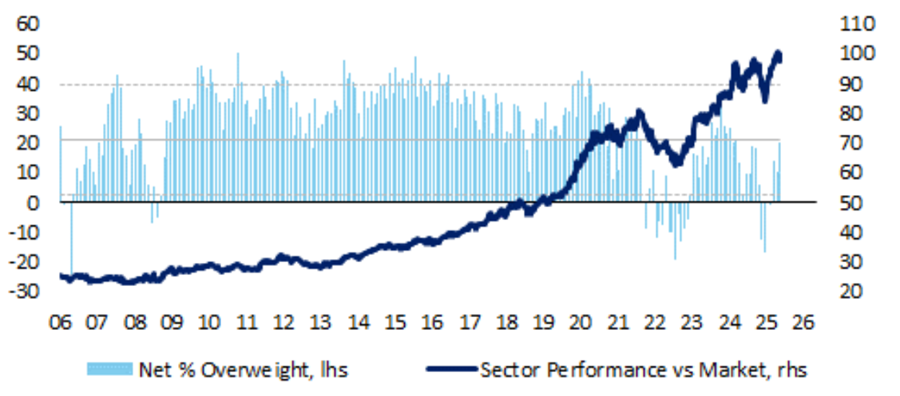

In addition, investors have a net 20% overweight to tech stocks. This is a 10 percentage point increase on August and takes the tech allocation to its highest level since July 2024.

Net % of fund managers overweight tech stocks

Source: Bank of America Global Fund Manager Survey – Sep 2025

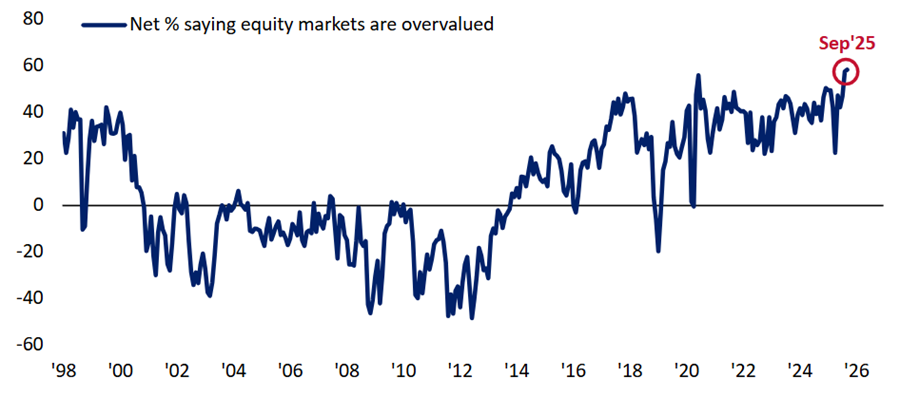

However, this comes at a time when fund managers are concerned about valuations in global stock markets, which have been driven higher in large part by tech stocks.

The report said: “A record 58% of [Fund Manager Survey] investors view global equity markets as overvalued, up slightly from 57% in August.

“Meanwhile just 10% of investors say bond markets are overvalued.”

Net % fund managers saying global equity markets are overvalued

Source: Bank of America Global Fund Manager Survey – Sep 2025

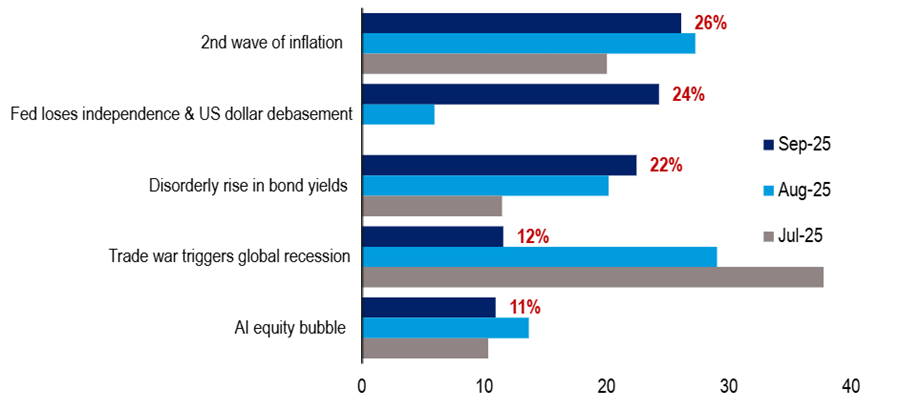

But overvaluation did not make it in the top market tail risks that fund managers are worried about this month.

The survey found 26% of respondents see a second wave of inflation as the most significant tail risk. A further 24% point to a loss of central bank independence and potential US dollar debasement as their primary concern.

Fears over trade-related risks appear to be diminishing. Only 12% of investors now view a trade war triggering a global recession as the biggest tail risk. This marks a sharp decline from August, when it ranked as the top concern for 29% of respondents.

Fund managers’ biggest tail risks

Source: Bank of America Global Fund Manager Survey – Sep 2025