Just two of the most expensive funds on the UK market have delivered top-quartile returns to investors over the past five years, according to recent Trustnet research.

As part of an ongoing series, we examined strategies with an ongoing charges figures (OCF) of 1% or higher but had delivered supranormal performance compared to their sector average.

In the three main UK equity sectors (IA UK All Companies, IA UK Smaller Companies and IA UK Equity Income sectors), Barclays UK Equity Income and Premier Miton Tellworth UK Smaller Companies were the only strategies to match these criteria. No fund from the IA UK All Companies sector made the list.

Source: FE Analytics. Data to the end of August.

Topping the shortlist is the Barclays UK Equity Income fund, a multi-manager fund led by Stephan Peters.

Alex Savvides' Jupiter team is responsible for 60% of the total portfolio, while Thomas Moore’s Aberdeen team manages the remaining 40%.

Both run their respective sleeves of the portfolio based on their unique approaches, with Jupiter’s branch using a contrarian value approach that positions them in “unfavourable” areas of the market, according to Barclays analysts.

Meanwhile, Moore’s team focuses on the lower end of the market-cap spectrum, targeting companies that are improving or changing how they operate.

“By investing in two very different managers together, the aim is to deliver more consistent performance, as when one underperforms, we hope that the other has the potential to deliver,” analysts at Barclays explained.

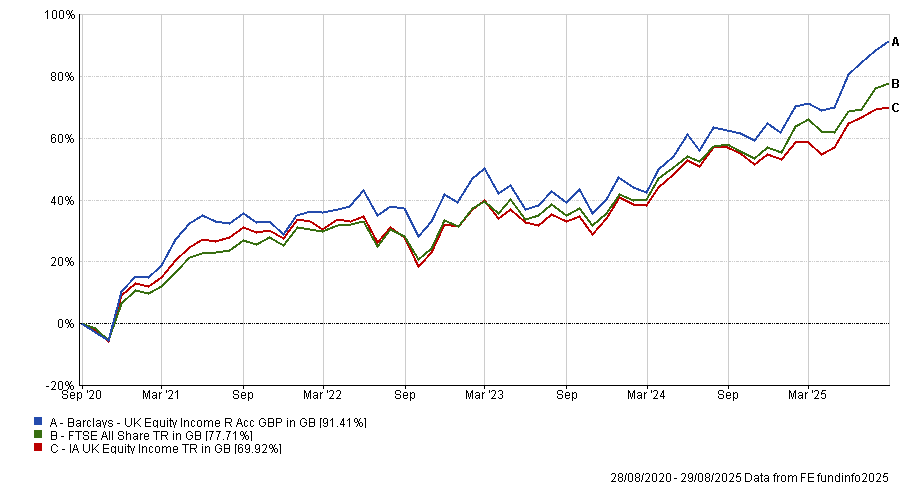

This approach has paid off in recent years, with the fund up 91.4%, trouncing the average peer in the IA UK Equity Income sector, despite its 1.1% OCF.

Performance of fund vs sector and FTSE All Share

Source: FE Analytics. Data to the end of August.

Premier Miton Tellworth UK Smaller Companies is slightly more expensive, with a 1.2% OCF, but it has also justified its costs.

Led by FE fundinfo Alpha Managers John Warren and Paul Marriage, it targets companies offering “differentiated products” as well as strong profit margins and management teams.

While the strategy has less than £100m in assets under management, it is not unheralded by experts and has received an ‘A’ rating from analysts at Titan Square Mile.

While the strategy had several appealing qualities, one of the most important for the analysts is the managers. “This is a fund managed by a pragmatic and knowledgeable team, who have proven their abilities as investors across several market cycles,” analysts said.

With the benefit of their balanced approach and market experience, the strategy is a “true representation of investing in UK smaller companies” compared to some of its peers, which often strays into the higher end of the market-cap spectrum, they continued.

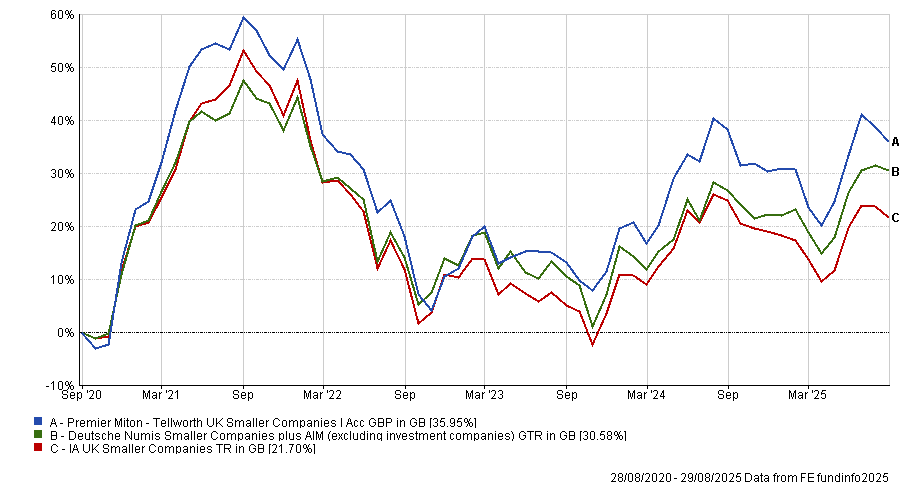

Indeed, the fund has delivered a 36% return over the past five years, outpacing the IA UK Smaller Companies sector average by 15 percentage points.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Data to the end of August.

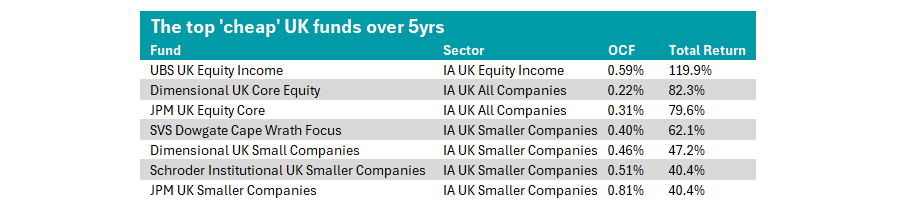

The low-cost funds that delivered supranormal returns

Investors who wanted a cheaper option that still achieved top-quartile performance were spoilt for choice in the UK market.

Over the past five years, 34 UK funds have paired top quartile OCFs (meaning they are among the cheapest 25% in the peer group) with supranormal returns in their respective sectors. Around 79% of the list is passive funds such as the Invesco UK Enhanced Index, which beat almost 200 peers in the IA UK All Companies peer group.

However, for those investors who wanted a low-cost active fund, there are still several options which stood out.

Source: FE Analytics. Total return to the end of August. All passive funds have been removed from the list.

Top of the list is the UBS UK Equity Income fund, managed by Chloe Hickey-Jones, Jessica Kaur and Steven Magill. It has paired a 0.59% OCF with the third-best total return of 119.9% in the IA UK Equity Income sector.

It is rated by analysts at Rayner Spencer Mills Research (RSMR), who said: “The team are purposefully considered when initiating and exiting positions. Trading is undertaken gradually with the team conscious of share price momentum being additive when accumulating or decumulating a position.”

On top of this, the managers have a “hands-on approach to researching companies” and a disciplined process, staying committed to their search for “materially undervalued opportunities” in the UK market.

Meanwhile, in the IA UK All Companies sector, two actively managed funds made the shortlist: the Dimensional UK Core Equity fund and the JPM UK Equity Core fund.

Finally, for those investors who wanted to look further down the market cap spectrum, SVS Dowgate Cape Wrath Focus, Dimensional UK Small Companies, Schroder Institutional UK Smaller Companies, and JPM UK Smaller Companies have balanced cheap costs with top-quartile returns.

Previously in this series, we have looked at the global and US markets.