Nearly a quarter of UK investors would consider allocating more than 10% of their portfolio to cryptocurrencies, but a quick look at how Bitcoin affects a balanced portfolio highlights how this would be a risky venture.

From 8 October, the Financial Conduct Authority will allow retail investors in the UK to access crypto exchange-traded products (ETPs) for the first time, in a move that is seen as taking the asset class further towards the mainstream.

WisdomTree polled 1,000 UK adults with £5,000 in savings or investments and found two in five would be more likely to invest if access came through a bank, platform or adviser. And 23% said they would consider putting more than 10% of their portfolio into crypto, which WisdomTree took as “a sign that enthusiasm may be running ahead of understanding”.

Investors need to keep in mind that a shift in regulation does not alter the nature of the asset class.

Crypto remains volatile, sentiment-driven and difficult to value. It might serve a role in diversified portfolios, but that role has limits. The idea that it deserves 10% or more of an investor’s capital is, at best, misguided.

Other results from the survey underline the tension. Some 72% of respondents said they are not knowledgeable about crypto. Nearly a third admitted they wouldn’t know how to react if prices fell sharply.

Despite this, some are already embedding crypto in long-term plans: 26% of those engaged with the asset class said they are using it as part of a retirement strategy and 21% are saving toward a home.

It hardly needs pointing out that these are high-stakes objectives that typically rely on capital preservation and predictability: qualities crypto does not consistently offer.

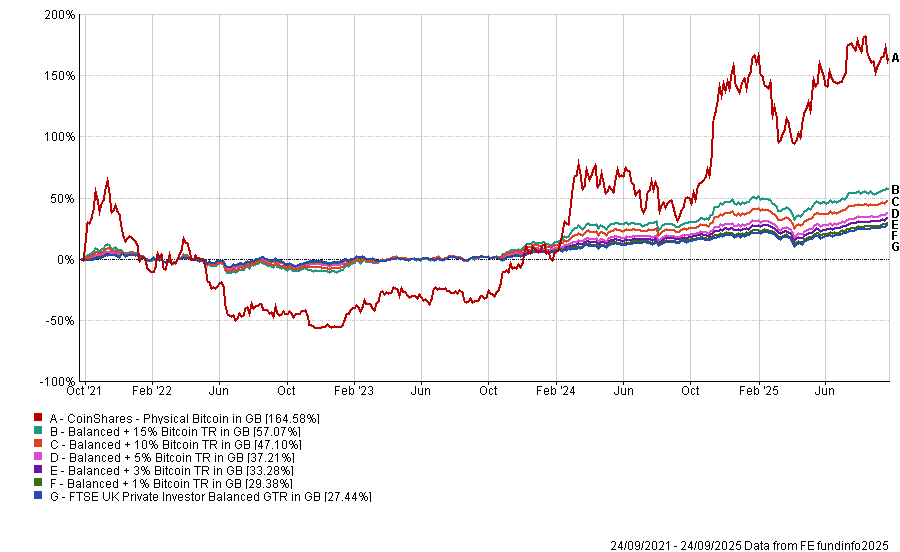

So what happens when investors add crypto to a balanced portfolio? We ran the numbers in FE Analytics and the data from the past four years is instructive.

Performance of balanced portfolio with Bitcoin over 4yrs

Source: FE Analytics

From 24 September 2021 to 24 September 2025, a traditional balanced portfolio represented by the FTSE UK Private Investor Balanced index returned 27.44% (in sterling terms) with annualised volatility of 7.8% and a 9.7% maximum drawdown.

Adding a 1-5% allocation to the CoinShares Physical Bitcoin ETP, which launched in 2021, to the balanced portfolio improved returns materially. The portfolio with 5% exposure delivered 38.2% over the same period, with only a modest increase in volatility. The 3% blend outperformed while keeping risk within a broadly acceptable range.

Beyond that, the relationship deteriorates. A 10% allocation to bitcoin raised the total return to 47.5% but pushed volatility to 10.1% and deepened the maximum drawdown to 16.3%. At 15% exposure, the portfolio returned 57.1% but with a drawdown exceeding 20% and maximum loss nearly tripling relative to the balanced portfolio.

Higher allocations to cryptocurrencies may potentially generate more upside, but only if the investor can withstand prolonged periods of drawdown without exiting prematurely.

Over this same four-year period, CoinShares Physical Bitcoin returned 164.6%, but with a maximum drawdown of over 70% and annualised volatility above 50%. These numbers don’t seem compatible with core portfolio holdings.

WisdomTree’s internal modelling supports the inclusion of crypto in diversified portfolios, but with measured allocations. The group suggests around 1% of a portfolio could be in cryptocurrencies.

“Education is essential to helping investors use crypto sensibly and manage the ups and downs,” said Dovile Silenskyte, director of digital assets research at WisdomTree.

“By understanding how crypto works in a portfolio and how to react when prices fall, people can avoid taking on too much risk and make decisions that support their long-term goals. Simple approaches like investing regularly and building balanced portfolios can make a real difference over time.”

This framing reflects a realistic view of crypto’s portfolio role: possibly additive when small, potentially destabilising when large.

The arrival of UK-listed ETPs does not change the underlying volatility profile. Investors may feel safer owning crypto through regulated vehicles but that safety is procedural, not financial.

While the shift might mitigate some platform and execution risks, it does not mitigate drawdown risk or the behavioural risk of exiting at the wrong time.

Taken together, the data points in one direction. Crypto has the potential to contribute positively to long-term performance when thoughtfully integrated in small amounts.

But it is poorly suited as a core holding and even less so as a double-digit portfolio component. The fact that almost a quarter of investors are prepared to take on that level of exposure suggests that the industry still faces a significant educational gap, one that product availability alone will not close.

For those who think crypto is a good addition to their portfolio, a 1–3% allocation captures much of the diversification benefit without unduly altering the risk profile. It leaves room for rebalance, room for error and, most importantly, room for the rest of the portfolio to continue doing its job.

The FCA’s decision will reshape how crypto is accessed in the UK. But access is not the same as suitability. A high bar remains for any asset to earn a substantial place in long-term portfolios, especially one as volatile and sentiment-sensitive as crypto.

Investors may be ready to buy more. That doesn’t mean they should.