Corporate bond markets are looking increasingly stretched and investors are not being compensated for taking additional risk by lending to a corporate, as they can get almost the same by lending to the UK government.

This backdrop has left the MI Hawksmoor Vanbrugh fund with a lower allocation to fixed income (28.5% versus last year’s 32.1%) and corporate bonds (3.3% versus last year’s 5.4%), and a larger focus on alternative sources of steady income – mostly infrastructure and renewable energy trusts.

Ben Conway, co-manager of the fund, argued that infrastructure assets can be analysed through a fixed-income lens because of the way they generate their revenues through long-dated contracts that are coupon-like in their returns.

“One reason why our overall fixed income is quite low and has been low for some time is because of the outstanding value we see in infrastructure and renewable energy investments,” he said.

The appeal comes from the yield on offer compared with traditional bonds, but also the “significant pick-up” available from these “very steady” contractual revenue streams.

As Conway put it: “The extra kicker is that these contracts also have some indexation: depending on the type of project, you can get between 2% and 4% annual increases in revenue streams. So it’s better than bond with a fixed coupon, because it grows.”

He pointed to HICL Infrastructure and International Public Partnerships as particularly attractive.

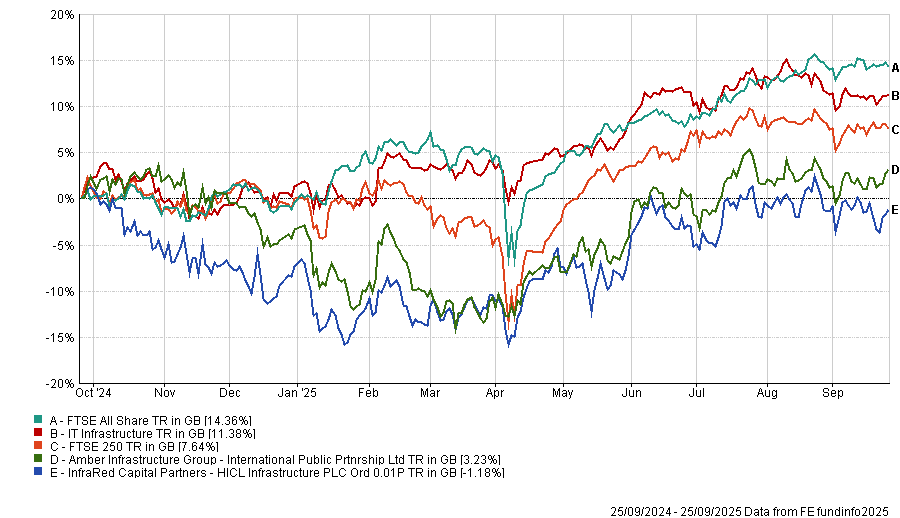

Performance of trusts against indices and sector over 1yr

Source: FE Analytics

HICL is a £2.3bn market-cap company with a yield on the share price of 7%. This can “safely be assumed to grow at least a couple of percent”.

“Our base case on share price is it will grow at 2% or 3%, so 8% or 9% total return. Compare that to what’s available in corporate bonds and you can quickly see why it’s interesting,” the manager said.

International Public Partnerships is also about £2bn in size with a 7% starting yield.

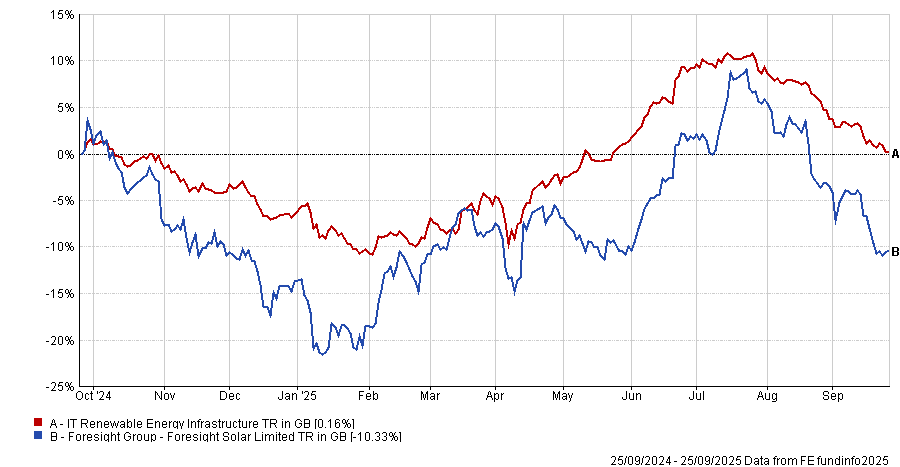

For investors prepared to accept more risk, renewable energy trusts offer even higher starting yields. Foresight Solar, for example, has a starting yield of 11%.

Performance of trust against sector over 1yr

Source: FE Analytics

These opportunities help explain why the MI Hawksmoor Vanbrugh fund has kept fixed income allocations at subdued levels. Yet Conway still sees selective value in parts of the bond market, particularly through specialist managers and alternative structures.

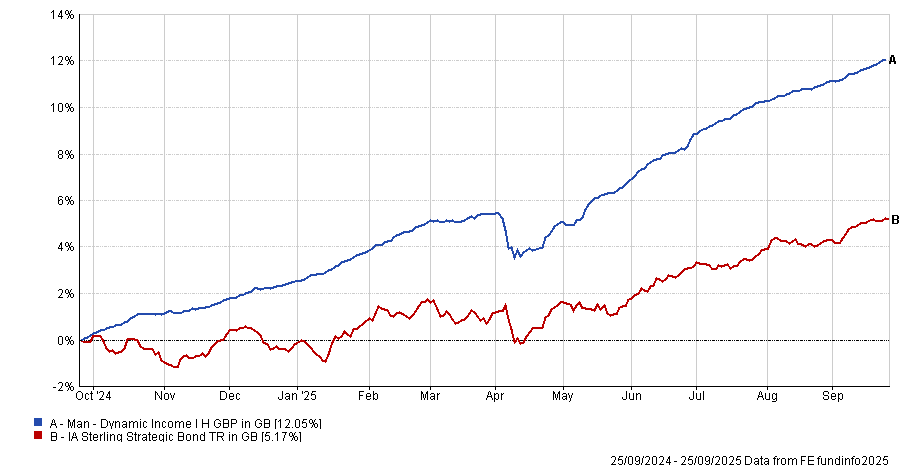

“Within corporate bonds and high yield, very talented active managers can build portfolios that are by no means as expensive as the aggregate spreads would have you believe,” he said. “We do allocate to corporate bonds despite spreads being very tight, but we really embrace counted access to managers.”

Here, he highlighted Man Group’s Jonathan Golan (who recently explained to Trustnet that his philosophy is to “have our cake and eat it too”) and Michael Scott, who manage Man Dynamic Income and Man High Yield Opportunities, respectively.

Performance of trust against sector over 1yr

Source: FE Analytics

Conways said in corporate bonds, there is “real value” in allocating to an active manager.

“The shift from active to passive is a particular shame in fixed income, because it’s vital to have a strong ecosystem of active managers in corporate bonds,” he said.

The only area where Hawksmoor uses passive funds are in treasury inflation-protected securities (TIPS), gilts and, potentially, treasuries, which however are not part of the Vanbrugh allocation.

“It is only the very liquid part of fixed income that’s suited to passives,” he said.

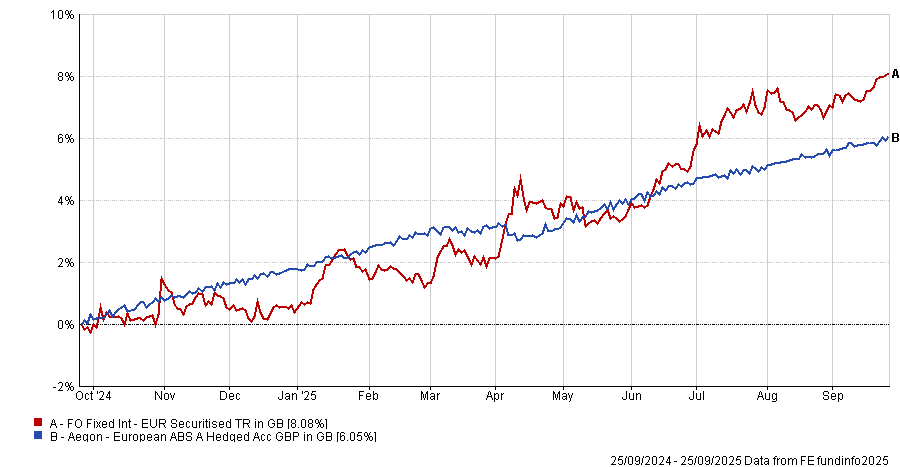

Elsewhere, asset-backed securities (ABS) remain a meaningful position in the Vanbrugh fund (10.7%), accessed through the Aegon European ABS fund.

“In ABS, we identify a really nice pick-up in yield to maturity for very high-quality credit risk. For equivalent credit risk in corporate bonds, we’re seeing a much bigger pick-up in yield by accessing asset-backed securities,” Conway said.

Performance of trust against sector over 1yr

Source: FE Analytics

Conway’s approach reflects a reluctance to chase narrow spreads in mainstream credit and a willingness to shift capital into areas offering better risk-adjusted returns. “We are very valuation-based investors. These are the opportunities where we think there is genuine cheapness.”

In conversation with Trustnet last week, the manager discussed the philosophy behind Vanbrugh, his best and worst calls and where he sees opportunity in equities.