The Bank of England will cut rates fewer than two times over the next 12 months, according to Chris Higham, manager of the Aviva Strategic Bond fund. On average, he expects rates to fall by around 39.7 basis points – broadly between one and two 25 basis-point cuts.

His rationale is that inflation looks set to roll over, giving the central bank some breathing room.

“Inflation has been the big story for the past three years. We are at the end of the inflation hump now and as we move into next year we expect it to gently come down,” he said.

This is a worldwide trend, but specifically for the domestic market, he said, with reducing inflation likely to be a big tailwind for UK government bonds.

With a number of public finance questions still open until the Budget later this autumn, gilts aren’t a crowded trade at the moment, but this isn’t a concern for Higham.

“There's quite a lot [of uncertainty] in the price of government bond yields and lots of reasons for that. Trying to square the circle of public finances is difficult, but the sustainability of government balance sheets is not a new thing – that's been something that we've been grappling forever. France hasn't run a government budget surplus in my lifetime,” he said.

“Ultimately, yields are at the highest they have been in my career, and we do see them as attractive. As an investor, you are being compensated.”

Higham contrasted the UK with the US, where the cycle has already shifted. There, the manager is pricing cuts by the Federal Reserve for another 100 basis points over the next year.

Even with policy easing, however, he remained cautious about valuations. “With slowing economic growth, mainly led by the US, we think credit spreads are fairly tight, at historically expensive levels.”

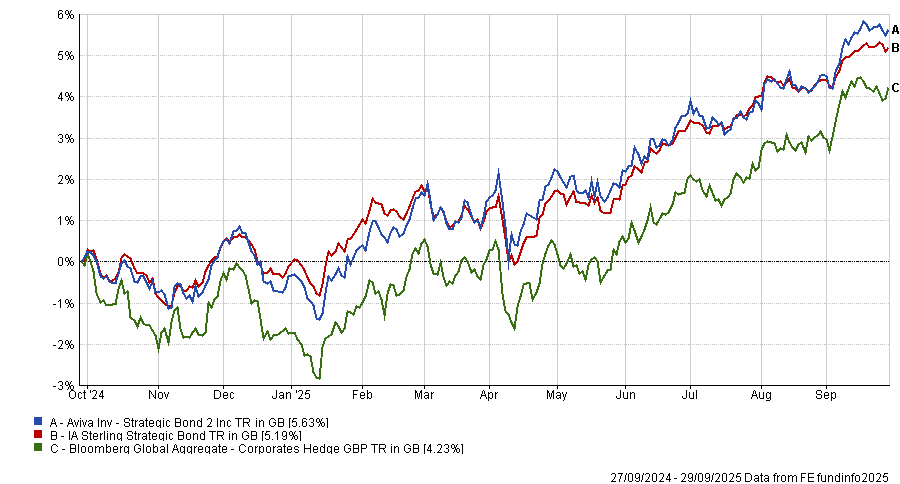

Performance of fund against index and sector over 1yr

Source: FE Analytics

In the past year, the Aviva Strategic Bond fund has achieved a second-quartile return against its IA Sterling Strategic Bond peers – up from the third quartile where it sits over the past three, five and 10 years.

To achieve this performance, the portfolio has gone “slightly long” duration, resulting from a long position in the UK versus short positions in Japan and Europe.

On the credit side, the fund is “positioned for decompression” – expecting higher-quality bonds to outperform riskier debt as spreads widen. This reflects his caution on valuations and the limited compensation investors are receiving for taking extra credit risk.

“Investors look at the yield on offer with an investment-grade bonds and think 5% is very attractive. But the spread component of that (70 basis points) is the tightest it's been in 20 years,” he explained.

“The vast majority of the risk that you're buying in investment-grade bonds is interest-rate risk – duration risk. The credit-spread component of that yield is the lowest it's been in my career.”

Higham is therefore leaning towards the safer end of the market. “Within that, we prefer higher quality, so investment grade over high yield, and within that we prefer Europe over the US because of growth differentials narrowing.”

The adjustments have already been felt in allocations. “We've reduced credit marginally over the past year, so our high yield allocation is slightly smaller than at the start of the year,” he explained.

Sector positioning is also selective. Higham has reduced the fund’s financials exposure, although he remains overweight. “Banks are in good shape and we like the sector, but it's performed very well, so we've reduced through the year,” he said.

One area he is less keen on is automakers, as the sector “faces significant headwinds, including tariffs”. Instead, he prefers non-cyclical areas like telecom and media

A smaller but notable addition has come in emerging markets, which have come on his radar as the dollar has depreciated.

“We're not calling an end to US exceptionalism, but we think it's likely to deteriorate. We expect the dollar to depreciate, so we have some positions in emerging market local currency, with Mexico our largest, where we own local-currency Mexican bonds. It's quite a small part of the portfolio, just 2%, but it's gone up from zero,” said Higham.