The artificial intelligence (AI) landscape is shifting fast, with some fund managers now claiming that China’s tech giants are on track to replicate the explosive growth seen by US firms – despite the Trump administration’s efforts to slow them down.

The warning bell for president Donald Trump came in January 2025, when DeepSeek – a low-cost Chinese AI chatbot – surged past ChatGPT in downloads, proving it was possible to train large language models quickly on less powerful chips and with fewer resources.

What followed was a fresh wave of trade tension between the two superpower countries, compounded by sweeping tariffs and chip bans.

Yet according to Nick Evans, co-manager of the Polar Capital Global Technology fund, Trump has failed to isolate China technologically.

“After the US election [in November 2024], we reduced our China exposure significantly because we thought Trump would cut off the supply of most chips and equipment from China and wield tariffs to prevent it from developing the best technology,” he said.

“But Trump’s [delays have meant that he] has missed that opportunity. DeepSeek was the first moment when investors realised that China was further along with AI than we all thought it was – the gap between China and the US was much narrower.”

In the case of DeepSeek, there was perhaps a collective sigh of relief from the White House, as its rapid growth was abruptly interrupted by a significant cyber-attack in late January which exposed sensitive user data and led to a loss of trust among users.

However, Tina Tian, manager of Fidelity China Innovation, said DeepSeek has opened the door to more opensource-focused Chinese companies “innovating to achieve self-sufficiency and ensure they are not reliant on Western suppliers for critical technologies like AI”.

“The AI landscape in China is following the US,” she explained. “The DeepSeek movement was just the start of the overall domestic AI landscape coming into play. Alibaba, for example, has increased its capital expenditure estimates for AI over the next few years and said it is going to spend as much as it did over the past decade combined.”

Alibaba’s shares immediately spiked 9% following the recent announcement that it will spend over $53bn on a global AI infrastructure plan, which includes investing in data centres across the Middle East, Europe, Southeast Asia and Latin America.

Stock price performance YTD

Source: Google Finance

As a Chinese entity, Alibaba is currently blocked by the Trump administration from buying Nvidia’s chips to power this planned innovation.

But there are homegrown chip-maker alternatives, such as Huawei, which recently announced plans to step up its production of advanced AI chips to 1.6 million in 2026 – up from one million this year.

Research by equity research and brokerage firm Bernstein projected China’s locally developed AI chips could take a 55% share of the Chinese market in 2027 – up from 17% in 2023.

“Although not quite as cutting edge [as Nvidia], China has an advantage in that it has an unlimited supply of energy and power and so can throw more chips at a problem,” Evans said.

Alibaba also recently secured a deal with Chinese e-commerce giant Unicom to deploy Alibaba’s AI accelerators from its semiconductor unit.

In addition, although Alibaba and Nvidia have been prevented from doing chip business, Alibaba recently announced it was integrating Nvidia’s physical AI tools into its cloud platform. This gives Nvidia direct access to developers in China, while Alibaba remains competitive with domestic rivals such as Huawei Cloud and Baidu AI Cloud.

“This all shows that the ability for the US to stop China has gone. Once you start to realise that, stocks like Tencent and Alibaba look increasingly well-placed in those markets,” said Evans.

As such, Polar Capital Global Technology has built its exposure to China back up, through companies such as Tencent, Alibaba and Xiaomi – China’s equivalent to Tesla.

“In aggregate, our China exposure has gone from sub-1.5% back up to around 7% because Trump’s ability to destroy the AI sector in China no longer exists,” he said.

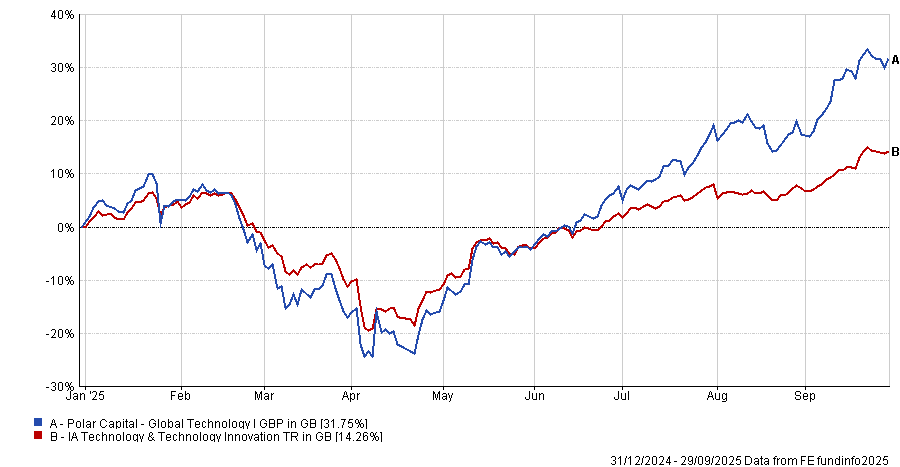

Performance of the fund vs sector YTD

Source: FE Analytics

As such, for fund managers like Tian and Evans, the AI race is no longer a US-only story, with China’s tech giants firmly in the running.

Nonetheless, the US remains the dominant market for AI and tech-related investment opportunities.

Evans said the fund invests in Nvidia and Amazon and also has “a tiny portion is Tesla”.

“Overall, we are materially underweight the Magnificent Seven,” he said, noting – as other fund managers have also recently claimed – that not all seven US firms will be winners in the race to dominate the AI landscape.