Now is not the time to take on massive risk, but nor is it right to be overly cautious, according to Bryn Jones, lead manager of Rathbone Strategic Bond, who is making changes to his portfolio to bring down allocations due to certain short-term concerns, while keeping his allocations above doomsday levels.

When deciding on his allocations, he uses a quote from renowned US investor Warren Buffett: ‘To be greedy when everyone else is fearful and be fearful when everyone else is greedy’.

This is ingrained in the design of the fund, which was launched in 2011 to offer investors more diversification away from high yield, while simultaneously ensuring strong returns and low volatility.

As such, there has been a recent shift in the portfolio’s positioning, with the manager gradually unwinding risk over the summer “as credit spreads continue to contract overall” – for example, by taking the fund’s high yield position from overweight to neutral.

“If an iceberg hit us tomorrow, we still have some credit risk in the portfolio,” he said. “We are not so completely fearful that we are just stuck in cash and asset-backed securities and government bonds. It has been more of a transition in that direction.”

Despite the increasingly defensive tilt, Jones remains optimistic about the long-term prospects for fixed income.

“Bonds mature and the bond market needs to reinvest,” he said. “Although we have heard a lot of negativity, the demand for bonds isn’t going away. If anything, they look pretty attractive right now.”

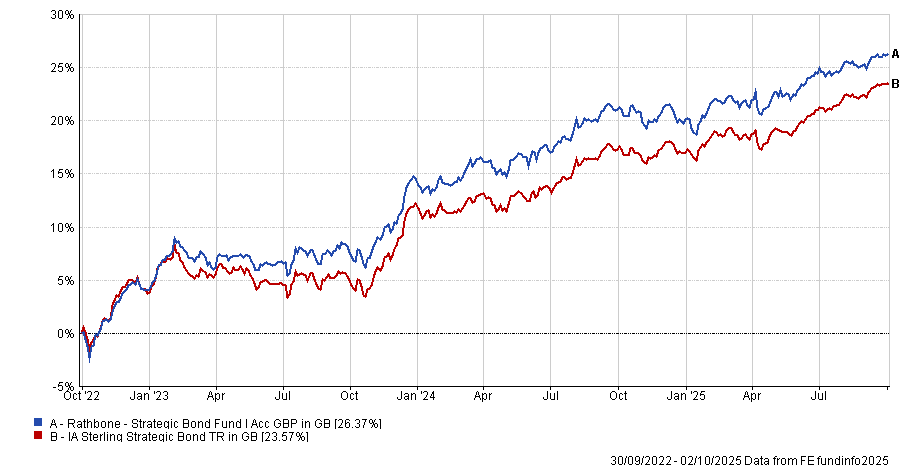

The fund, which was launched in 2011, returned 26.2% over three years – ahead of the IA Sterling Strategic Bond sector average of 23.4%. Over a decade, it also beat the sector average, gaining 37.2% versus 37%.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

Below, he tells Trustnet why he prefers investment grade credit to high yield, why the UK looks “quite attractive” and why investors need to be careful when listening to “sensationalist” rhetoric.

How do you balance performance with volatility?

We want to create a low-volatility fund that is within the second quartile of the sector for volatility and has a correlation with the MSCI World index of less than 0.4.

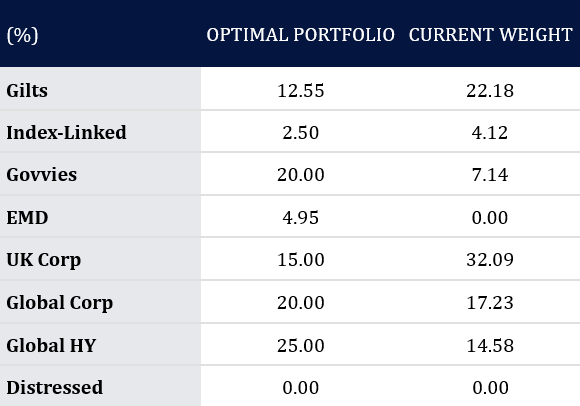

To do this, we worked out the base ranges for how much we could pull different levers without significantly ramping volatility and put together an annual optimal portfolio.

Ultimately, we put in a hard and fast 10% rule either side of the base portfolio. I cannot go higher than 25% high yield, for example.

As time goes on, the frontier changes. We annually re-run the data to see how the optimal portfolio has changed and adjust our portfolio weightings accordingly.

Current split of assets across the fund

Source: Rathbones. Fund data as at 31/08/25. Optimal portfolio as at 31/07/2025.

We have positioned the fund slightly differently from the optimal based on the economic outlook and valuation metrics – for instance, we like investment-grade credit over high yield as the latter is starting to look more expensive.

We also prefer UK investment-grade over European or US investment-grade, as the all-in yield is more attractive, with underlying gilt yields being higher.

Spreads still look tight and overvalued in emerging markets, especially as, historically, it has been at the higher beta end.

We have a slightly higher weighting for index-linked at present, but shorter duration, as we like front-end real yields.

What are your thoughts on the UK bond market?

This is perhaps controversial, but I think the gilt market looks quite attractive. The potential downside to the UK economy next year seems underpriced and everyone seems to be overstating inflation concerns too.

While the trade deficit is still high and government borrowing is too high, we have an independent central bank that has already shown its colours by not issuing as much long long-duration assets.

Meanwhile, the UK government has reduced its long gilt issuance and we saw recently it has started to reduce quantitative tightening, steering more towards short-duration quantitative tightening. Simple supply and demand economics means if I can buy a 20-year gilt on a 5.4% yield, that is pretty attractive right now.

This idea that the UK will have to go to the IMF [for a bailout] is garbage. The Bank of England can come in and do quantitative easing again way before that and it is still doing qualitative tightening, so let’s be careful listening to some of the sensationalist narratives and instead look through the noise.

What have been some of your best calls for the bond fund?

Most of our good credit selection has come from our exposure to legacy insurers.

One of our best performers has been Rothesay Life, an insurer successful at pension risk transfer with large levels of solvency. It has a portfolio weighting of 1.1% and has made 17.9%, giving an overall portfolio contribution of 0.2%.

Gilt purchases and US TIPS have also added decent performance.

Due to the sell-off in the gilt market, our weaker investment from a contribution perspective has come from longer-duration gilts, although we feel we are now positioned for lower yields in a weaker economy next year with limited long-dated supply.

Some of our best calls have also been in credit. Some of our Nordic credit positions are extremely rare.

What was the worst period for the fund?

The worst period for the fund was in 2022 when we were overweight credit risk.

The spreads were widening and we had big inflation fears. Then, of course, there was the impact of Russia invading Ukraine. Arguably, we got the duration call right by being underweight duration but we had a little bit too much credit risk.

I would also point out that 2022 saw the fastest rise in interest rates since two years after US independence. There were very few fixed-income funds that were insulated during this time.

We nonetheless did actually outperform our composite benchmark over this period, with a portfolio return of -10.96% versus the composite of -20.08%.

The biggest ongoing risk comes from valuation. Valuations are tight and so spread widening will be my biggest concern for the portfolio from here. We try to manage this by utilising government bonds and our hedges.

What do you do outside of fund management?

What don’t I do? I am someone who cannot sit still. I used to run ultra marathons quite a bit – but have taken a break recently – and 24-hour races. I have also been a big fan of the NFL since the 1980s. I have not been to the Super Bowl yet, as it’s too expensive, but maybe one day.