Despite a buoyant US stock market, a weakening dollar has chipped away at UK investors’ returns from unhedged US equity exposure.

According to JP Morgan Asset Management, since 2010 US dollar appreciation has added an additional 1.9% per annum for investors to their sterling returns from US stocks and bonds.

However, the dollar has been steadily declining since US president Donald Trump won his second term in the White House – a trend that only accelerated after ‘Liberation Day’ in April, which added to wider economic uncertainty.

But why does this matter to UK investors? When owning assets priced in a foreign currency, if the value of that other currency falls versus sterling, the value of the investment in sterling also falls.

As such, with a typical global developed world tracker holding around 70% in US equities compared to less than 5% in UK equities, UK-based investors are not making as much money from US equities as they have done in recent years.

Rebekah McMillan, associate portfolio manager at Neuberger Berman, said: “UK retail investors with unhedged US equity exposure are taking on both equity and currency risk. Even if your US stocks go up, a weaker dollar can reduce or even wipe out your gains when converted back to sterling.”

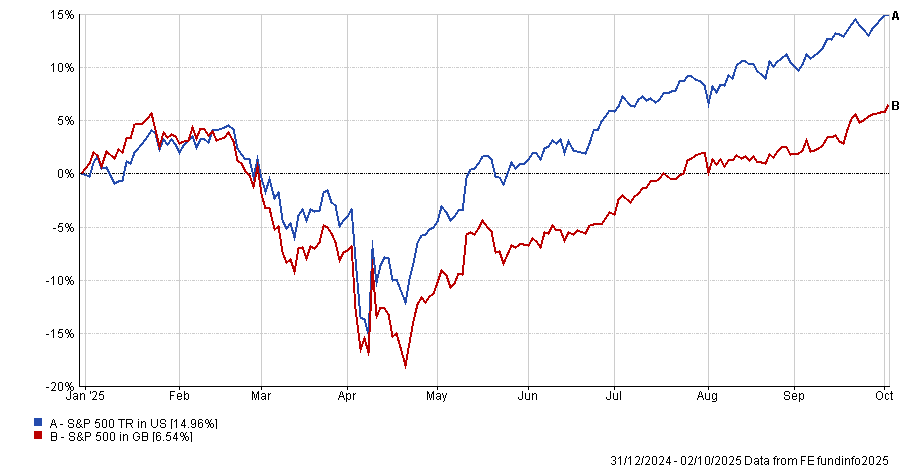

As shown in the graph below, although the S&P 500 (in dollar terms) has had a strong year-to-date, gaining just shy of 15%, UK investors have made around eight percentage points less in sterling terms.

Performance of S&P 500 in dollars vs sterling YTD

Source: FE Analytics

Given this trend, McMillan said she expects market participants to increase their hedge ratios on US assets over time.

She noted that a key tenet to equity portfolio construction post-global financial crisis has been that unhedged exposures to dollar assets have been risk-diversifying for investors from countries with pro-cyclical currencies.

“This has been one of the few ‘free lunches’ in finance as the risk-off hedge has actually not cost anything since hedging back to local currency would be carry negative.”

However, dollar depreciation could represent a “catalyst” for continued downward pressure on the dollar “as macroeconomic and technical factors collide”, she argued.

It is also important to note that hedging to address currency movements is typically a move to address short-term volatility, as the costs of doing this could weigh on an investor’s returns over the long run.

Alternatively, Invesco multi-asset fund manager David Aujla “takes the sting” out of his exposure to the US through equal-weighted exchange-traded funds.

“We also have less in US equities than the MSCI World across our multi-asset funds and models at about 50% or less compared to 65%,” he added.

If not the US, where can UK investors look for opportunities?

US investors hunting for diversification are increasingly turning to the UK, viewing it as a relative safe haven due to lower tariffs than most countries and access to attractively priced global companies.

According to Schroders, they have funnelled more than $15bn into UK equities year-to-date.

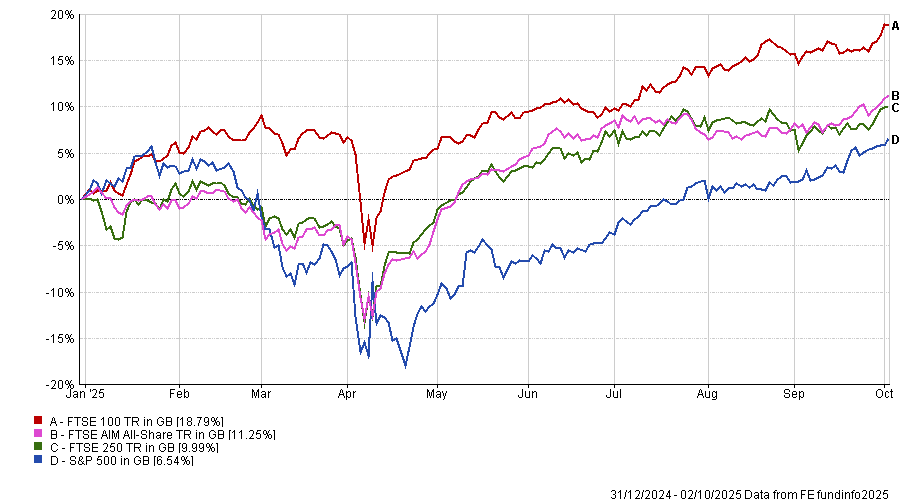

Domestic investors would have made more money this year by investing in the FTSE 100, FTSE 250 or FTSE AIM All-Share.

Index performance YTD (in pounds sterling)

Source: FE Analytics

As such, Ken Wotton, manager of Strategic Equity Capital at Gresham House, said that the US market’s dominance and the UK’s relative underperformance over the past few years “creates opportunity” for UK investors to invest locally.

“There is a lot to be said for UK investors sticking with domestic equities because – while we are quite good at being self-deprecating and thinking about the negatives – from a global perspective the UK is more attractive on a relative basis,” he said.

Specifically, he referred to the typical valuation of a UK-listed company (which is cheap) and a US-listed company (which is stretched).

“You have to be careful not to conflate a good company with a good investment because they are not the same thing,” Wotton said.

“Ultimately, the valuation of the company matters in terms of the returns you are going to get. So Nvidia is a fantastic company, but it is an expensive one. Meanwhile, there are lots of good quality companies in the UK that are growing – particularly when you get to the small- and mid-cap end of the market – and trading at very low valuation multiples.”

In particular, Wotton said there are attractive opportunities in UK financials (although he does not invest in banks), consumer goods and business services.

He noted that the latter is a “large catch-all sector with some interesting consultancy businesses and capitalised industrial businesses which have been de-rated due to concerns about cyclicality”.