Chancellor Rachel Reeves is reportedly considering introducing a £2,000 cap on salary sacrifice pension contributions as part of her autumn Budget at the end of this month, in a move that could raise up to £2bn a year for the Treasury.

However, doing so could result in a £22,000 dent in savings by retirement, research by AJ Bell suggests.

Salary sacrifice enables employees to exchange part of their salary for employer pension contributions in a bid to reduce their income tax and National Insurance (NI) liabilities. This allows employees to build their savings or contribute more to childcare costs and student loans and is also beneficial for the employer, as it reduces their NI contributions for employees.

Although capping salary sacrifice isn’t an explicit tax increase – meaning Reeves could still cling to Labour’s manifesto pledge – the result would be less in employees’ pockets and pension pots.

Charlene Young, senior pensions and savings expert at AJ Bell, said: “Our analysis shows that someone aged 35 earning £50,000 a year could face a hole in their pension of £22,060 by age 65 under these plans.”

This figure assumes the individual already has a pension fund of £30,000 and saves an overall contribution of 5% personally, with another 3% coming from their employer.

However, the black hole rises to over £37,000 – or even nearly £50,000 – if they are a higher earner on £75,000 or £100,000 respectively.

AJ Bell outlined the example of an employee who earns £55,000 a year and wants to make higher personal contributions to their workplace pension of 10% a year, with their employer offering salary sacrifice as an option.

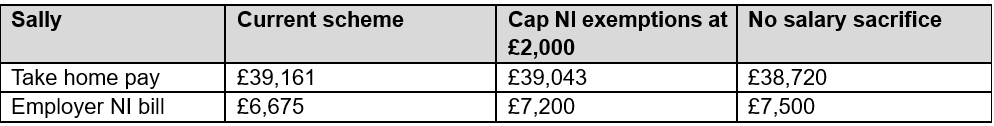

As shown in the table below, a £2,000 salary sacrifice cap would mean an extra £525 annual NI bill for her employer and a £118 cut in take-home pay.

If salary sacrifice was then removed as an option, the extra costs would be £441 and £825 respectively.

Source: AJ Bell

It would also be bad news for employers. “The savings on offer [through salary sacrifice] are bigger for employers – as employer NI of 15% would have been payable on the amount of pay that is sacrificed,” said Young.

“Some employers like to reward employees by sharing all or some of this saving and use it to boost pension contributions even further. But asking businesses to absorb yet another cost might be one step too far, particularly at a time when the number of people out of work is already at its highest rate since the pandemic.”

HMRC-commissioned research earlier this year outlined different scenarios for reforming pensions salary sacrifice. Employers reacted negatively to all of them, arguing that removing reliefs would wipe away the financial benefits of salary sacrifice and also result in lower pension savings at a time where retiring in poverty is increasingly a concern.

Rachel Vahey, head of public policy at AJ Bell, said: “Any potential changes to pensions salary sacrifice should not only take account of the immediate impact but also consider what it means for the future of pension savings and Brits’ retirement income.

“Given the significance of this issue, it makes sense to leave such a major decision until the Pensions Commission has concluded its work.”