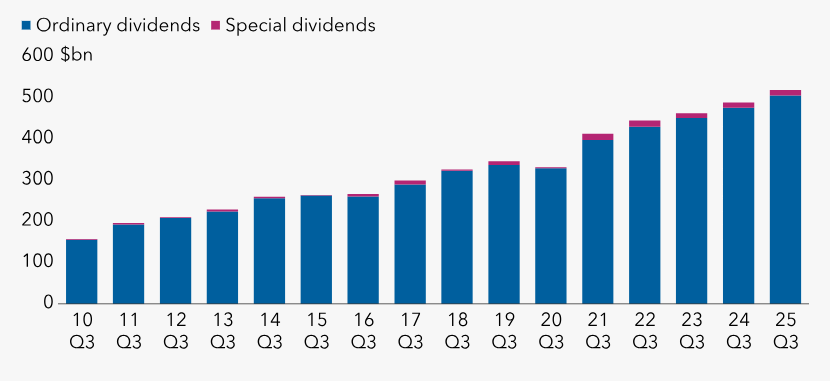

Global dividends rose to an all-time high of $518.7bn in the third quarter of 2025, up 6.2% from the same period last year, according to Capital Group’s latest Dividend Watch report.

Across the globe, 88% of companies either increased dividends or held them steady in the third quarter, with median dividend growth standing at 5.7%.

Christophe Braun, equity investment director at Capital Group, said: “The third quarter continued the strong growth in global dividends, extending an unbroken four-year sequence of quarterly highs.”

Quarterly global dividend payouts

Source: Capital Group’s Dividend Watch

The financial sector drove nearly half of the quarterly growth, with core dividend increases of 11%. This was twice as fast as the remaining sectors combined (5.5%).

Within financials, insurers posted the fastest rise at 18.6%, followed by general financials at 16.1% and banks at 8%. Between January and September, those three groups added $44bn in dividend payments globally.

Software and transport were also highlighted by Capital Group for strong dividend growth during the quarter while mining and chemicals were weak spots.

In the US, payouts reached a record $179.3bn. Although core growth slowed to 5.7%, dividends remained resilient; over the past 15 years, there have been only two quarterly declines, both during the Covid-19 pandemic.

Europe’s core dividend growth stood at 6.1% year-to-date. Poland and Spain accounted for half the region’s third-quarter gains by growing more than 10%, while France and the Netherlands underperformed.

UK companies paid £20.2bn in Q3, up 1.4% on a topline basis due to favourable currency movements. On a core basis, dividends fell 0.9%, the second-weakest performance among major markets (after Australia).

Cuts in commodity and telecom firms outweighed gains in industrials and domestic financials. Roughly 90% of British companies either held or increased their payouts during the quarter.

In Asia, Japan reported 13% core dividend growth, though its seasonal distribution patterns meant a smaller impact on global totals. Hong Kong payouts rose 15.4% in its peak season, with no cuts reported. China saw no core growth and around one-third of firms reduced distributions.

Emerging markets posted 11.2% core growth, led by India, Saudi Arabia, South Africa and Mexico. In contrast, Australia saw a 7.4% decline due to cuts from mining and energy companies, placing it at the bottom of major markets in 2025 so far.

Capital Group expects Japan to play a larger role in the fourth quarter, with continued support from European banks and Pacific markets. However, dividend cuts are possible in India and Brazil.

Braun said: “For investors, diversifying globally can unlock real benefits. It can ensure access to enduring sources of dividend growth such as the US, where consistency and resilience are underpinned by the diversity of its stock market and robust profit momentum, to global sector trends like the current strength among financials, or to regions experiencing periods of significant growth like Europe.

“Firms that consistently pay and grow their dividends typically show solid earnings, healthy cash flow and disciplined management. Dividends can be an anchor in times of uncertainty and by tracking dividend trends, investors gain deeper insights into a company’s performance and its resilience.”