India has become the world’s “anti-AI market”, according to Gaurav Narain, manager of the India Capital Growth trust, who argued the country’s recent underperformance could mask one of the most powerful domestic growth turnarounds among emerging markets.

“There are multiple themes in India,” he said. “The only one it’s not playing is artificial intelligence [AI]. We have a thriving services economy but no real AI play. Some people say India has underperformed because of that, but others call it the best anti-AI market.”

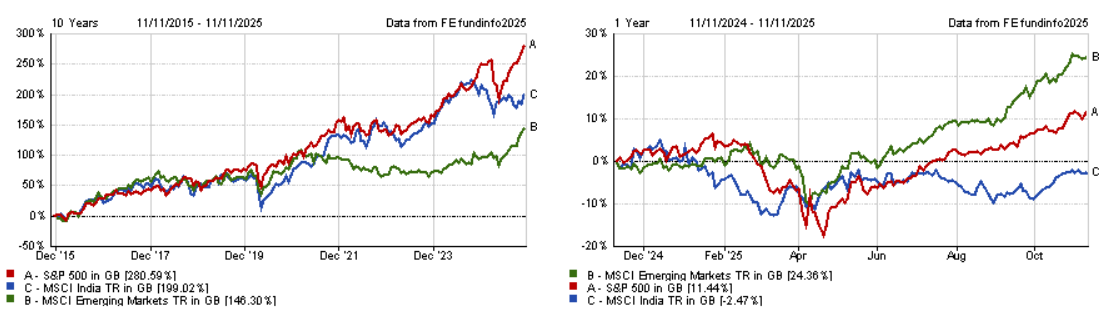

Narain said India’s story has shifted dramatically over the past year. After a period when it matched US markets, as the charts below show, Indian equities have been flat more recently while emerging peers surged, leaving India behind by as much as 25 to 50 percentage points. “This is unprecedented,” he said. “The last time it happened was 50 years ago.”

Performance of indices over 10 and 1 yr Source: FE Analytics

Source: FE Analytics

The reason for this weaker recent performance, he explained, is due to a post-Covid growth slowdown. Real GDP, which had been expanding near 9% a year, slipped to around 6.5% – still the fastest among large economies but a disappointment for investors used to stronger momentum.

“From an India perspective, when you are anticipating 7% plus growth, 6.5% felt much like a recession,” he said. Corporate earnings growth followed the same path, dropping from above 20% to single digits.

Several factors coincided. Elections absorbed government bandwidth for months, delaying public investment. The central bank, concerned about overheating, tightened liquidity and capped unsecured lending, bringing credit growth from 16% down to 10%. Then external pressures hit, as US tariff policy under Donald Trump delayed private-sector capex plans.

Yet since mid-year, authorities have moved aggressively to revive growth. “In the post-election Budget in February, they slashed income tax rates across the board and ramped up capex on infrastructure – this first half is already up about 40%,” he said.

“The central bank unbound all the liquidity-tightening measures and cut interest rates by 100 basis points, almost twice what people expected.”

The most striking shift came last month with ‘GST 2’, a major overhaul of India’s indirect tax regime. “From a four-tax structure, we moved to two,” he said. “Items previously taxed at 28% mostly moved to 18%, and those at 18% or 12% came down to 5%. That’s done wonders for sentiment and brought prices down across the board.”

The timing coincided with the festival season, giving a visible boost to consumption. “During Diwali, automobile sales hit all-time records, up 20% over the previous year,” Narain said. “Retail sales were up between 25% and 40%. Even with tax cuts on 400 items, indirect tax collections still grew about 5%, reflecting the volume uptick.”

These steps have set the stage for a rebound. “The economy’s inflexion has happened,” he said. “The earnings growth downgrade cycle is behind us and we’re back on the upgrade cycle.”

He expects double-digit GDP and earnings growth ahead, supported by recent upgrades from global rating agencies and forecast increases from the IMF and World Bank.

Another key shift is who owns the market. “India has become a purely domestic-driven economy,” Narain said. Foreign investors have been net sellers, withdrawing roughly $30bn over the past year, while local inflows have remained resilient.

“In the past five years, domestic funds have seen inflows of about $205bn, while foreigners have pulled out about $8bn. Yet markets have stayed flat,” he said. “Foreign ownership is now at a decade low – just about 16%.”

Strong local participation has transformed market dynamics. “Thanks to technology and digitisation, retail investors are flooding into equities, having historically preferred physical assets and gold,” Narain said.

The boom has fuelled a vibrant IPO market: “A third of all global IPOs are happening in India,” he noted. “Last year $20bn was raised, and this year should be much higher, with 90 IPOs already – nine or 10 of them over a billion dollars each.”

The breadth of listings is another source of optimism. “Global firms like Hyundai and LG Electronics are listing 100% of their Indian businesses because they find the market so attractive,” Narain said. “It’s a very vibrant market, offering many opportunities, especially in the mid-cap space.”

He admitted volatility remains high, with individual holdings swinging between sharp losses and outsized gains. “Half our stocks have fallen between 0% and 30%, but we’ve had big winners too,” he said. “What’s really driving stocks this year is earnings growth. Companies able to deliver or surprise positively are doing exceptionally well.”

Among those, Narain highlighted CarTrade, an online automobile marketplace and one of the trust’s top performers. “It’s the number one portal in India, with a 95% share,” he said. “It doesn’t advertise. Growth is organic. Its margins have gone from 16% to 30% since we bought it.”

After a year of stagnation, Narain believes the combination of policy easing, structural reform and domestic liquidity is setting India apart. “It’s a volatile but very exciting market,” he said. “We’re identifying companies that can keep delivering earnings growth. I’m fairly confident this will be a good year for India.”

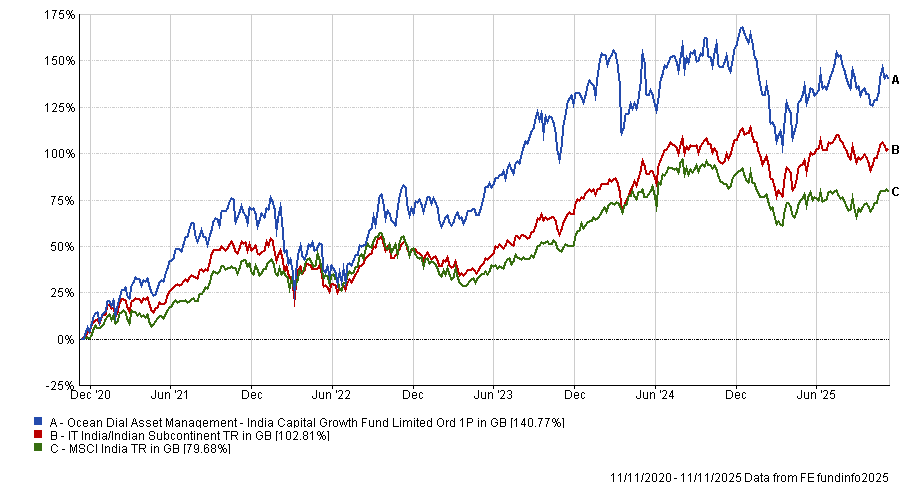

At £149.2m of assets under management, India Capital Growth is the smallest trust in the four-strong IT India/Indian Subcontinent sector and trades on the largest discount of 11.4%.

Performance of fund against index and sector over 5yrs Source: FE Analytics

Source: FE Analytics

Yet it has beaten the sector average over the long term and was the top trust over the past 10 and five years, although it has slipped to third and fourth position over the past three years and 12 months respectively.