Shifts in US monetary policy could reshape the outlook for key sectors, according to Jack Caffrey, co-manager of the JPM America Equity fund.

Investors should remain alert to changes at the Federal Reserve, as “people are policy” and new appointments may influence how it tackles inflation and growth.

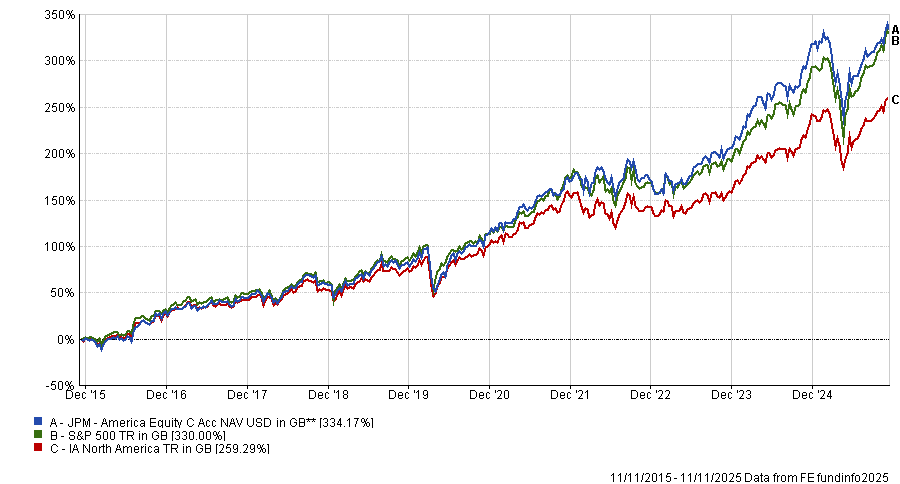

In this interview, co-manager Jack Caffrey explains how blending investment styles, maintaining a forward-looking view and leveraging deep research have helped the fund deliver top-quartile returns against the IA North America sector over five and 10 years, gaining 334.2% over the decade.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

Please describe the process of the fund.

The JPM America Equity fund brings together two different portfolio managers with different basic underlying styles – growth and value. I focus on the value sleeve while Felise Agranoff leads the growth sleeve.

By bringing these style-driven processes together, we believe we can deliver a differentiated return path within a core equity approach and better anticipate whether the market might evolve, recognising that there is inherent cyclicality in terms of style capitalisation.

How do you avoid concentration risk when you are benchmarked against the S&P 500?

The fund’s active share against the S&P 500 Total Return index has historically been somewhere between the mid-to-high 60% range – today it is around 58%. So while some of the largest positions in our fund can look very similar by nature to the concentration that we now see in the S&P 500, the reality is that we are expressing strongly different views within the portfolio.

That is because we are really leveraging our analysts and employing a deeply fundamental process that allows us to take strikingly different views.

Despite being more tilted to growth at 55% versus 45% to value, we are underweight technology and overweight financials, as we feel regulatory changes will benefit the latter. This is partially based on a view that the Federal Reserve is moving back towards an easing cycle, which should improve financials’ earnings power.

We also have an overweight in the energy sector, which has been painful in the shorter term but over the intermediate term it has been additive to the portfolio. The inflation-driven move towards higher energy prices has benefited the value side.

What are your thoughts on the macro picture in the US?

We must remain cognisant of the macro. Inflation remains higher than on a typical basis and the employment situation seems to have weakened at the margin over the past four or five months – we are also still missing some data that might confirm or deny concerns.

We recognise that the membership of the Federal Reserve board will be changing several months from now and, ultimately, people are policy. The [Trump] administration is very vocal about what it would like to see coming out of the Fed and that, as a result, it is likely we will see some personnel changes to favour certain views.

The US economy has operated on an A-shaped exposure for the past 30 years. In particular, things that have touched artificial intelligence (AI) have done exceptionally well, while things touching the broader economy have been forced to digest an extended drawdown of inventories on the overall system.

To the extent that businesses have been less willing to try to build inventory until they have gotten some clarity as to what tariffs and tax frameworks may look like, this leaves parts of the industrial economy looking fairly cheap.

Tariffs are high but not as bad as they could have been. It does mean that, at the moment, companies can’t give you specifics when you ask them where they think their business will be in three to five years’ time. But they can give you the goal posts for what they are aiming for.

What has been one of your best calls over the past 12 months?

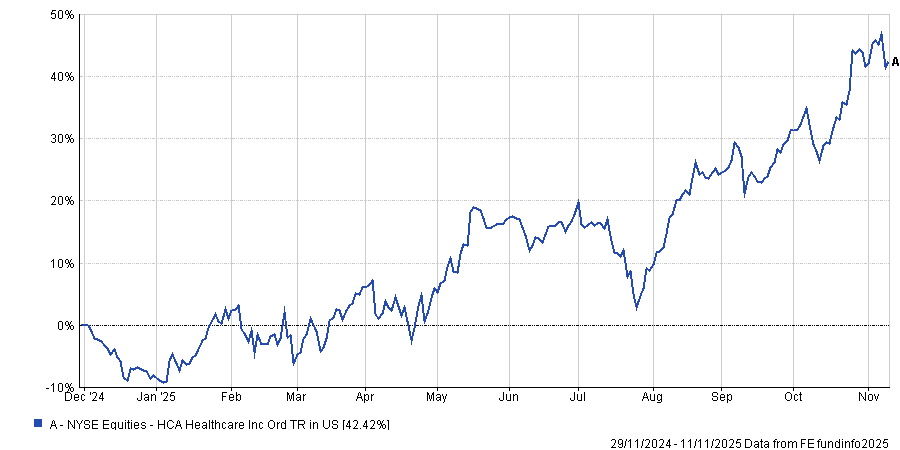

We added a new name to the healthcare sector, HCA Healthcare (HCA), in December 2024 and have been adding to the position this year.

The company provides healthcare services through a network of hospitals and healthcare facilities across the United States, with substantial market share in urban markets.

It has demonstrated reliable earnings and margin improvement through volume growth and cost controls, while also benefiting from stable demand for healthcare services and supplemental Medicaid payments.

Stock price performance since December 2024 (in dollar terms)

Source: FE Analytics

As of 30 September, HCA represents 2.4% of the fund’s holdings.

What has been one of your worst calls over the past 12 months?

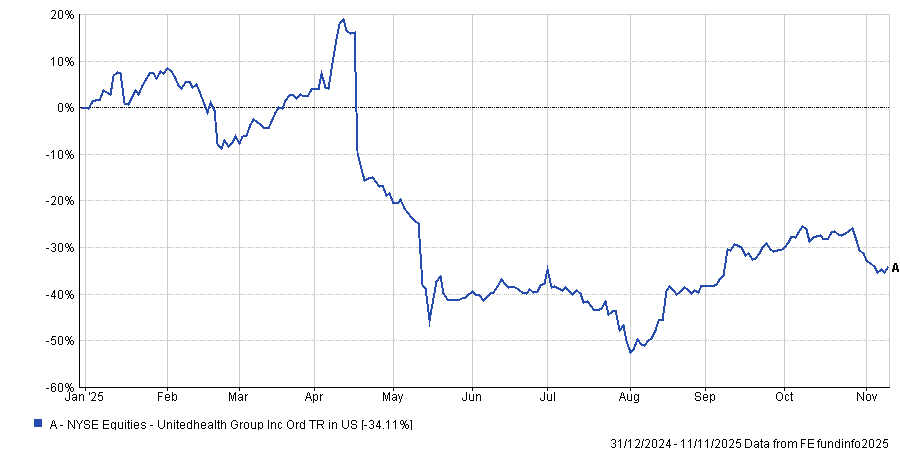

UnitedHealth Group (UNH) was a long-term holding this portfolio, and we viewed it as a leading managed care company with a history of premium valuation and superior performance relative to peers.

In 2024, it continued to outperform competitors in the Managed Care space. However, in 2025, it became apparent that efforts to accelerate growth led to mispricing and significantly higher-than-budgeted healthcare costs.

Although the company reinstated a former chief executive who is committed to restoring operational discipline, the timing and effectiveness of this turnaround remain uncertain, which has reduced our conviction in UNH. Furthermore, the premium valuation that UNH historically enjoyed may no longer be justified given these uncertainties.

Following many meetings with the management team, we had concerns around the potential for improved execution over the medium to long term and exited our position in May 2025.

Stock price performance YTD (in dollar terms)

Source: FE Analytics

What do you do outside of fund management?

I enjoy reading about history and psychology and I am involved in managing sailing racing.