Consistently beating other funds is a challenge, especially for funds investing in US equities, where the market has funnelled money to a select few stocks over the past few years.

Yet some have managed to thrive in this environment. Here, we looked at the funds in the IA North America and IA North American Smaller Companies that have made a top-quartile return in their respective peer groups over one, three, five and 10 years – the most common timeframes used by investors. Just 12 were able to achieve the feat.

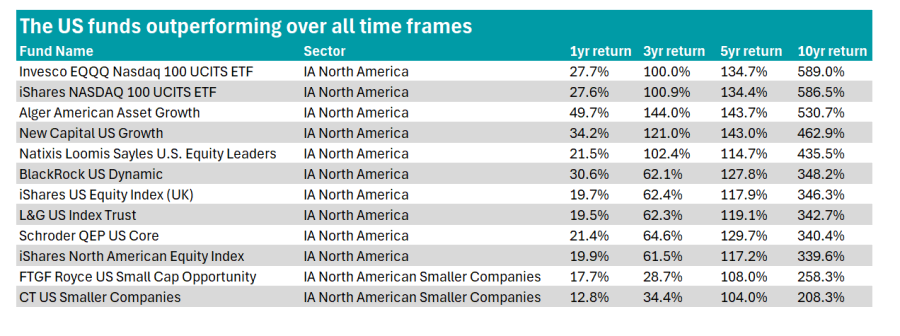

Source: FE Analytics. Data to end of October. The table is sorted by 10-year returns.

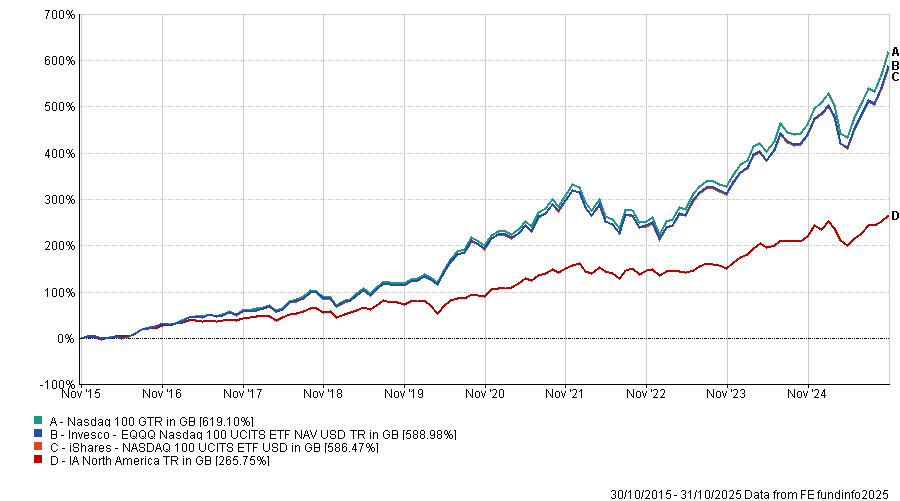

Starting with the IA North America sector, half of the funds to make the list above are index trackers. Top of the pile is the Invesco EQQQ Nasdaq 100 UCITS ETF, which made a 589% return over the past decade.

The ETF replicates the tech-heavy Nasdaq index, which is even more exposed to the top-performing ‘Magnificent Seven’ stocks than the wider S&P 500. Over the past 10 years, this cohort has surged between 573% (Meta) and 28,700% (Nvidia) according to FE Analytics data.

It was joined by the iShares Nasdaq 100 UCITS ETF, which has also delivered a top-quartile return over the past one, three, five and 10 years.

Performance of funds vs sector and benchmark over 10 years

Source: FE Analytics. Data to end of October. Total return in sterling.

Three other passive funds made the list: iShares US Equity Index, L&G US Index Trust, and iShares North American Equity Index.

However, trackers were not the only way to outperform over all time frames, with seven active funds posting top-quartile returns over one, three, five and 10 years in the IA North America sector.

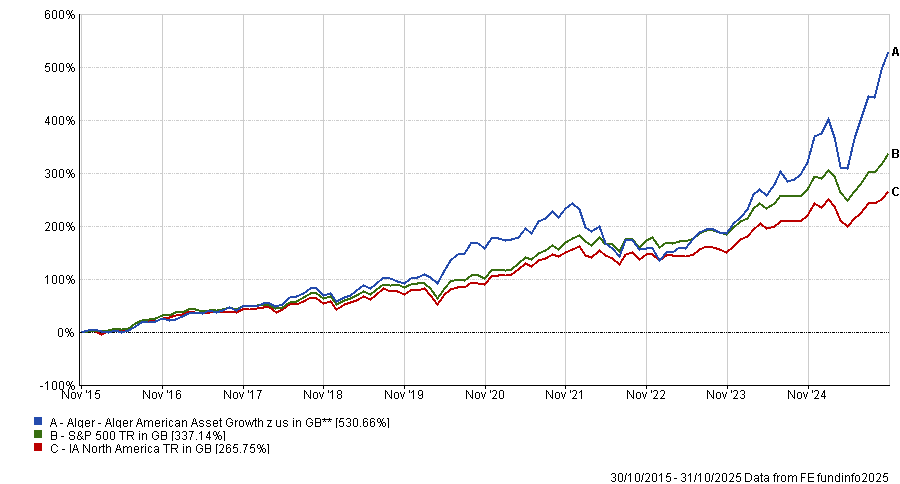

The Alger American Asset Growth fund, run by FE fundinfo Alpha Managers Patrick Kelly and Ankur Crawford, qualified. It targets companies experiencing positive dynamic changes (businesses that are growing market share and are at innovative stages of their life cycle).

They favour the high-growth tech names, with six of the Magnificent Seven in their top 10, a move that has resulted in the third-best return of the IA North America sector over 10 years, and top five performances over one, three and five years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics. Data to end of October. Total return in sterling.

In seven of the past 10 years, Kelly and Crawford have achieved a top-quartile return in the peer group, although it underperformed in 2016, 2021 and 2022.

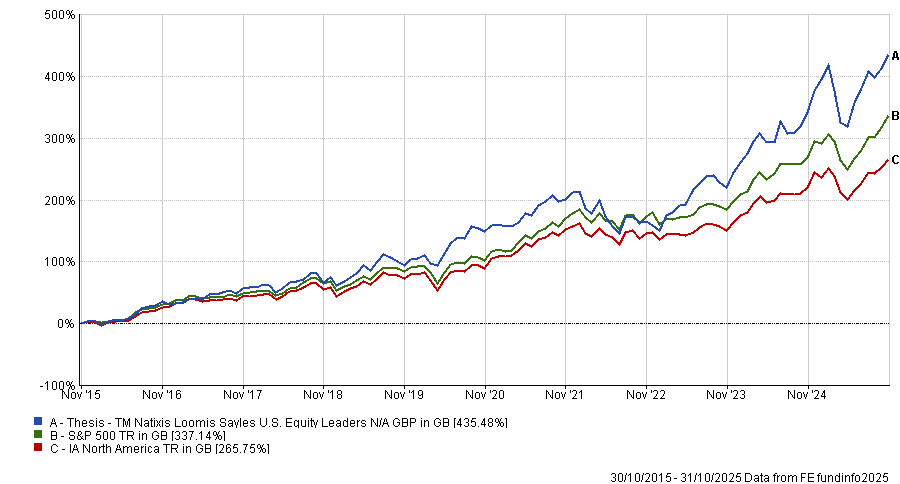

Larger active funds, such as the Natixis Loomis Sayles US Equity Leaders fund, also qualified. Led by Alpha Manager Aziz Hamzaogullari, the fund is a highly concentrated portfolio of US equities, with just 36 holdings and 56% of the total assets invested in its top 10.

It also emphasises the US mega-cap tech stocks, with six of the Magnificent Seven appearing in its top 10 allocations, but has never owned Apple, the manager said earlier this year.

Analysts at Titan Square Mile said the manager had a “clear philosophy, underpinned by a robust and consistently applied process”.

Although the high-conviction approach can lead to a bias towards certain sectors, the manager takes a “sensible approach” to limit exposure to any one factor to 20%.

Performance of fund vs the sector and the benchmark

Source: FE Analytics. Data to end of October. Total return in sterling.

The portfolio has outperformed in six years over the past decade, one fewer than the Alger fund above.

Other active equity funds that delivered best-in-class returns over all standard time frames include New Capital US Growth, Schroder QEP US Core and BlackRock US Dynamic.

With the ‘Magnificent Seven’ dominating the large-cap end of the universe, in the IA North American Smaller Companies sector returns have been more spread around.

Here, two funds outperformed the majority of their peers over one, three, five and 10 years, producing consistent top-quartile returns.

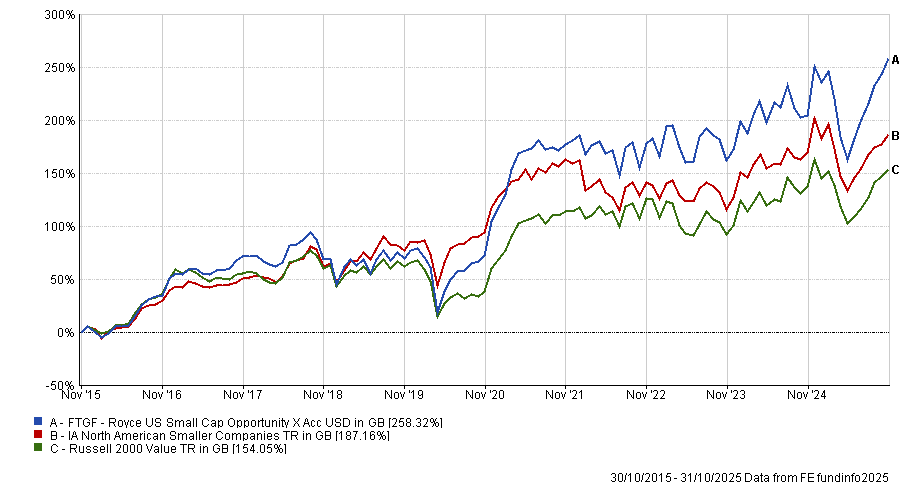

The FTGF Royce US Small Cap Opportunity fund, run by Brendan Hartman, Jim Harvey and Jim Stoeffel, was the stronger overall performer, up 258.3%.

It invests in 215 small and micro-cap companies, with the highest conviction position standing at 1.03% of the total portfolio. While it has proven volatile, as in 2018 when it was the worst-performing fund in the sector, it had particularly strong periods in 2016 and 2017, as well as in 2021 and 2022.

Performance of fund vs sector and benchmark over 10 years

Source: FE Analytics. Data to end of October. Total return in sterling.

CT US Smaller Companies, managed by Jason Hans, Oleg Nusinzon and Raghavendran Sivaraman, also made the list, although the trio only took over the fund in 2024.

Previously in this series, we have looked at Europe and Global funds.