Managers' retiring can be a big moment for a fund, particularly when a manager is as well-established as Keith Ashworth-Lord, who has led the SDL UK Buffettology fund since 2011.

Following recent announcements that the veteran will retire next year and Australian asset manager EC Pohl & Co is to acquire the Sanford DeLand investment firm, investors may be left wondering if the flagship strategy is still right for them.

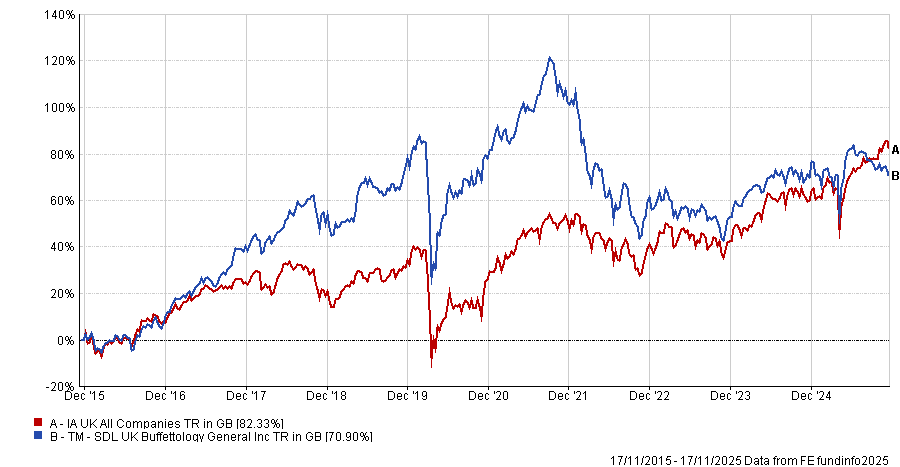

Between 2015 and the end of 2020, the fund delivered supranormal performance, rising 134.5% compared to an IA UK All Companies sector average of 35.2%. However, the funds' focus on smaller, quality-growth companies has been a headwind since 2021, resulting in the portfolio falling into the bottom quartile over one, three, five and 10 years.

Performance of the fund vs the sector and benchmark over 10yrs

Source: FE Analytics

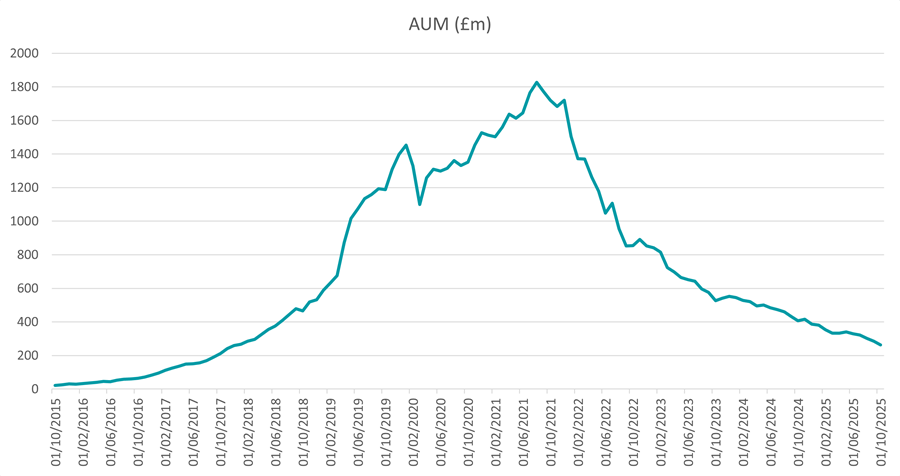

As a result, it has struggled to retain investor confidence, with assets under management falling from a peak of around £1.8bn in August 2021 to £247.3m today.

Assets under management of fund since 2015

Source: FinXL

Below, Trustnet asked experts whether Ashworth-Lords' retirement and the merger with EC Pohl is an opportunity to buy, hold or sell the fund, and if there are alternative options available.

Laith Khalaf, head of investment analysis at AJ Bell, said investors should remain patient, rather than rushing to the door.

While Ashworth-Lord stepping down is a change that investors will “need to chew over”, it is “still relatively early days” in the takeover and it is unclear how the strategy will be affected.

However, investors should expect some continuity with deputy managers Eric Burns, Chloe Smith and David Beggs set to remain on the team and Ashworth-Lord staying until next year to ensure a smooth handover, Khalaf said.

On top of this, the takeover has been approved by Mary Buffett and David Clark, who originally authored the Buffettology books, which indicates that the philosophy is unlikely to change, he said.

“The fund has struggled in recent times, but disciples of [Warren] Buffett who have been attracted to this fund will most likely be patient investors.”

Bestinvest managing director Jason Hollands said, while there is an argument to be made for holding onto the fund and seeing what happens, “there is a stronger case for exploring a switch”.

The strategy faces a challenging backdrop, with UK funds experiencing outflows in recent years, Hollands said. Data from the investment association shows UK funds have shed money every year since 2016.

This poses a challenge for a fund that is already “tiny” and that has been struggling in recent years due to a high allocation to less popular parts of the market. Paired with the departure of a veteran manager such as Ashworth-Lord, “the chances are that there are outflows rather than inflows on the horizon for this fund”.

Interactive investor (ii) analysts also did not recommend the strategy due to its recent underperformance and identified some alternatives for exposure to UK equities.

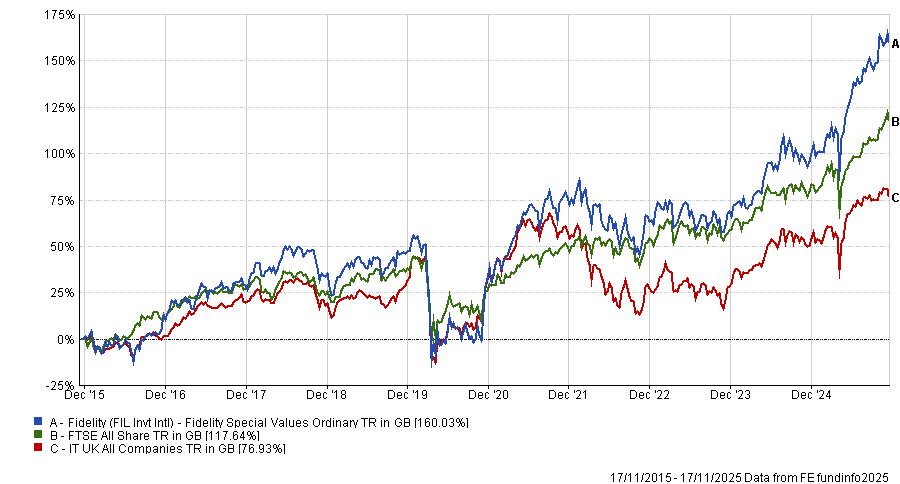

Instead, senior investment analyst Alex Watts suggested Fidelity Special Values. Run by FE fundinfo Alpha Manager Alex Wright and co-manager Jonathan Winton, the trust is an all-cap strategy targeting undervalued UK companies.

As a result, the fund has a greater emphasis on mid-caps and small-caps, with a 22.5% overweight to the FTSE 250 and 7.5% overweight to the FTSE Small-Cap compared to the FTSE All Share.

This is a part of the market Wright and Winton have “great expertise in”, allowing them to deliver “impressive performance” over the long term. Over the past one, three, five and 10 years, the trust has outperformed the UK market, as demonstrated by the chart below.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Additionally, the 2.3% yield is “not insubstantial” and helps smooth investors' returns over the long term, Watts said.

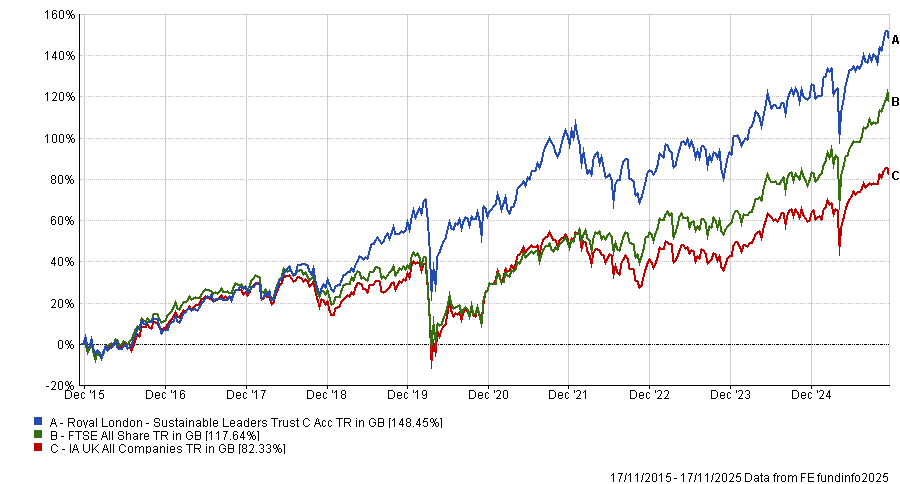

For an alternative to SDL UK Buffettology’s growth exposure, Royal London Sustainable Leaders Trust is also a good choice, the ii analyst said.

Run by Alpha Manager Mike Fox since 2003, the fund invests in companies that try to deliver a net benefit to society or demonstrate leadership in environmental, social and governance (ESG) practices.

“Fox primarily seeks to identify long-term growth opportunities that are underappreciated by the market,” Watts said.

This approach has resulted in a strong 10-year performance, with a 148.5% return versus the FTSE All Share’s 117.6% over the same period.

However, investors should be aware that the “outperformance of UK value has been a headwind to relative returns of recent given the fund’s natural bias towards growth”.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics