Less than half of UK-based fund groups (41%) attracted net retail sales in the third quarter, down from two-thirds of asset managers between April and June, according to ISS Market Intelligence's latest Pridham Report.

Although net sales were down (the total money added after subtracting outflows from the inflows), the gross picture (total inflows only) was more mixed, with bond fund inflows up 8% while equity funds suffered net withdrawals of 9%.

Passive funds were the cause of the large drop in equity flows, the report found, although they remained positive on a net basis, implying investors who already owned these strategies were more willing to hold, while investors were put off adding to existing positions or initiating new ones.

Benjamin Reed-Hurwitz, head of research development for EMEA & North America at ISS Market Intelligence, said: “Investor confidence remains fragile, with headlines dominated by US political tensions, concerns over overbought and over-concentrated US equity markets, uninspiring economic growth in the UK and mounting speculation about tax rises in the autumn Budget breeding a climate of caution and hesitancy.

“The enduring nature of investor fragility, arguably seen since markets rebounded in 2023, is due to the fact that it is not one cloud, but many, blocking investors’ long-term view. It seems that when one source of uncertainty fades, another emerges.”

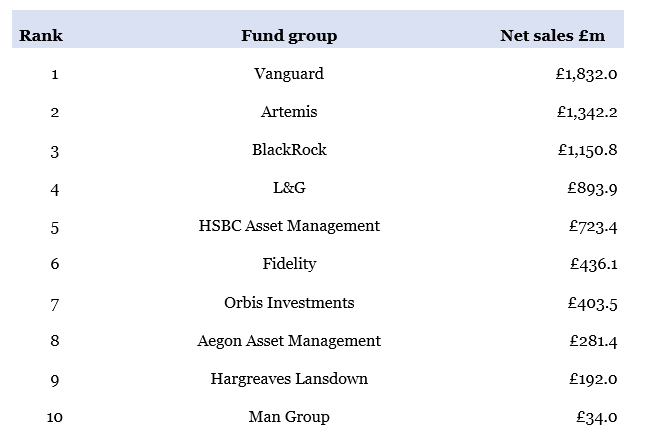

Looking at net sales, Vanguard was the most popular choice among investors as its wide passive range drew attention. The group’s US and global strategies proved popular, with the FTSE Global All Cap Index fund leading the way on net inflows. BlackRock sat in third, with strong support for its passive US equity range.

Source: Pridham Report

L&G and HSBC Asset Management also made the top 10 thanks in large part to their emerging market ranges. The former was boosted by net sales of its emerging market bond and equity funds, while the latter’s emerging market and mixed asset ranges were popular.

Reed-Hurwitz said: “Investors and asset allocators are increasingly looking for diversification and value beyond US large-caps. While this search has become far and wide, emerging market funds were one such area to benefit. A real opportunity exists for those willing to offer something that can add genuine diversification.”

While passive was popular – all of the funds above have a mix of active and passive strategies – it was active-only Artemis that took second spot behind Vanguard, with record inflows into its active equity and mixed asset funds in the third quarter.

Meanwhile, Reed-Hurwitz pointed to Aegon Asset Management as a beneficiary of changing mindsets in the bond space. Here, short-dated, government and money market funds were the most popular, with the firm achieving record bond fund sales in the quarter.

He said: “The tilt towards fixed income in the third quarter underlines just how cautious investors have become. What’s more revealing is that much of that fixed income demand was concentrated in short-duration bond funds, which reflects deep uncertainty about long-term interest rates.”

While multi-asset fund sales were flat for the third quarter, the report highlighted Orbis Investments as a notable winner. The firm achieved record net flows, with the group finishing seventh in the rankings, largely owing to the Orbis Global Balanced fund, which was its best performer during the quarter.