Chancellor Rachel Reeves’ Budget last week may have targeted pensions by capping salary sacrifice at £2,000 a year, but experts warn another danger to pension pots is being overlooked.

Inflation, which has stayed above 2.5% since mid-2021, peaked at over 11% in 2022 and now currently sits at 3.6%, continues to erode the real value of retirement savings – a hidden risk that could cause pension pots to run dry years earlier than expected.

Most pension pot projections available to savers through their pension providers still rely on a 2.5% inflation assumption – a long-standing figure set by regulators to ensure consistency. The problem is that this does not reflect the impact of today’s reality.

Pension experts have therefore warned that relying on outdated assumptions can leave savers dangerously exposed.

Marianna Hunt, personal finance specialist at Fidelity International, said: “Inflation is one of the biggest long-term risks to retirement savings, yet it’s often underestimated.”

Although the difference between 2% and 4% inflation may not sound dramatic on the face of it, over a 30-year retirement the resulting gap can be “devastating”, she said.

Fidelity research suggests that inflation remaining at 3.6% could cause pension pots to run dry 11 years earlier than if it remained at the Bank of England’s 2% target, meaning people are more likely to outlive their savings.

History can also teach us a lot about the impact of inflation on saving.

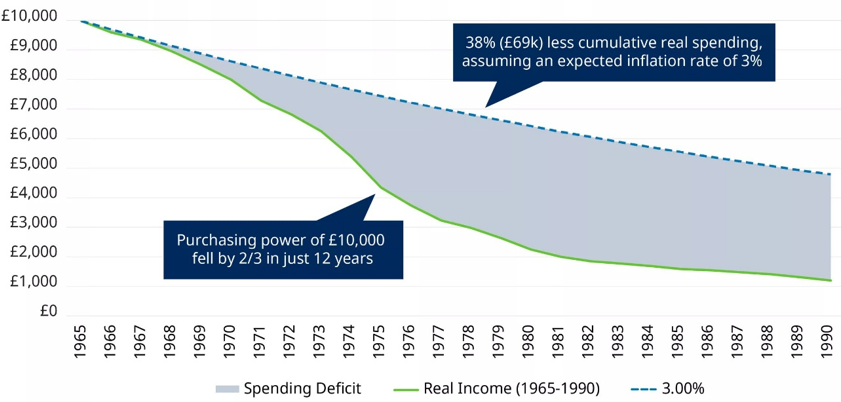

In the 1970s, the UK experienced a bout of inflation which caused a significant erosion of purchasing power.

Research last year by Schroders noted that investors who bought fixed interest products such as annuities during that time suffered, losing more than two-thirds of their purchasing power by the halfway point of their plan and up to 90% by the final year.

The impact of buying a fixed annuity in 1965

Source: Schroders. Projects based on annual UK RPI data from 1965 to 1990.

So when savers view the projections their pension provider has calculated for their pension pots at retirement age, these should be treated as benchmarks rather than guarantees.

Carina Chambers, pensions technical expert at Moneyfarm, said: “While these models are useful for planning, they should be viewed as directional rather than definitive.”

Lena Patel, independent financial advisor (IFA) and director of ISJ Financial Planning, also noted that it is “essential to sense-check [the projection and see] whether that figure reflects reality”.

“Over the past few years, inflation has been much higher, so we’ve been stress-testing plans using a range of inflation assumptions to see how different scenarios might affect clients’ future income,” she said.

“This helps people understand what their pension pot will actually buy them in real-world terms – beyond the headline number.”

Tiffany Tsang, head of DB, LGPS and investment at Pensions UK, said that the impact of inflation is just one factor savers need to take into account when working out their target pension pot size.

“Typical online retirement calculators, or even the more sophisticated ones IFAs use, also need to make assumptions about contribution rates, net returns, life expectancy, withdrawal rates, salary increases and tax rates,” she explained.

As all these assumptions can vary and change, savers need to review their retirement saving and planning regularly – at least once a year.

Chambers suggested that one way to mitigate the impact of inflation specifically is through indexation, by automatically increasing pension contributions in line with inflation.

“This helps preserve the real value of savings over time,” she said.

“Additionally, try to increase your pension contributions as your salary increases and look at diversifying portfolios to include inflation-resistant assets, such as real assets, which can provide a buffer against rising prices.”

However, with Reeves introducing a cap on salary sacrifice from 2029, increasing pension contributions through the workplace pension may not be the preferred option in the longer term for many as they look to avoid National Insurance.

Saving more and starting your saving journey earlier also remain powerful defences against inflation.

Hunt added that maintaining exposure to growth assets such as equities in your portfolio during retirement can also help to preserve purchasing power, “as historically shares have outpaced inflation over time”.

“For those who prefer more certainty, inflation-linked or escalating annuities can provide income that rises in line with prices,” she said.

The worst thing savers can do is be complacent.

“One of the biggest risks with sustained inflation is complacency, assuming that rising costs are temporary or that markets will automatically compensate,” Patel said.

She has open conversations with clients about what inflation means for them as an individual – for example, their day-to-day spending and longer-term lifestyle.

“Most people are acutely aware of rising prices at the supermarket or their energy bills but translating that awareness into action on their pension plans takes guidance and planning,” Patel said.

Ultimately, the best protection against inflation is maintaining flexibility in investments, income strategy and mindset, she noted.

“By regularly reviewing assumptions, adjusting drawdown levels and maintaining diversified portfolios with real assets exposure, [savers can] remain resilient, even in a high-inflation environment,” Patel said.