Pension consulting firm XPS Group and pub owner Young & Co’s Brewery are two ‘dividend diamonds’ that income-needy investors might want to consider, according to Octopus Investments.

The firm highlighted the stocks as having “compelling long-term growth dynamics” while also “rewarding investors with an attractive and growing dividend stream”.

Mid-cap XPS Group, listed in 2017, has managed to grow both organically and through the seven acquisitions it has made since initial public offer (IPO), culminating in a “highly-credible” 14% five-year revenue compound annual growth rate (CAGR).

“The business helps members of defined benefit (DB) and defined contribution (DC) pension schemes to receive better outcomes and security in retirement,” analysts noted.

“The business benefits from circa 90% repeat recurring revenues and has been rewarding investors with an attractive and growing dividend yield of 4% currently.”

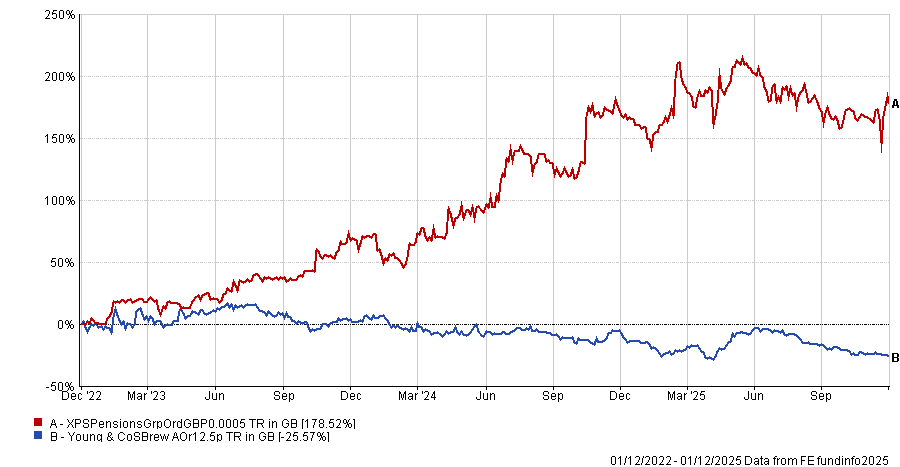

Performance of stocks over 3yrs

Source: FE Analytics

Shares have been on an upward trajectory over the past three years, up 178.5%. The same cannot be said for the firm’s other pick, however, as shares in AIM stock Young & Co’s Brewery are down 25.5%.

The company can trace its roots back to 1831 and, with almost 280 pubs and 1,000 hotel rooms under its management, it has assets worth an estimated £1bn.

“The group comprises of predominantly freehold assets, delivering best-in-class operating margins,” Octopus Investments analysts said.

“It has a proud history of revenue, profit and dividend growth which, despite being interrupted during Covid, was reinstated shortly afterwards and has continued to progress. The business is expected to deliver shareholders a yield in excess of 3% for the current year.”

Going beyond these two names, smaller companies in general are often overlooked by investors, but in its bi-annual Dividend Barometer, Octopus found UK smaller-cap stocks outperformed their larger peers.

The FTSE Small Cap Excluding Investment Trusts index was up 15% on a total-return basis over the six months between March and October, while the FTSE AIM Index rose 16.6%. This compared to a 12% rise in the FTSE 100.

“Whilst this outperformance could be a result of a more domestically-driven revenue base, the Barometer argues it could also be due to the once-in-a-cycle low valuations at which many UK smaller companies have been trading,” the report read.

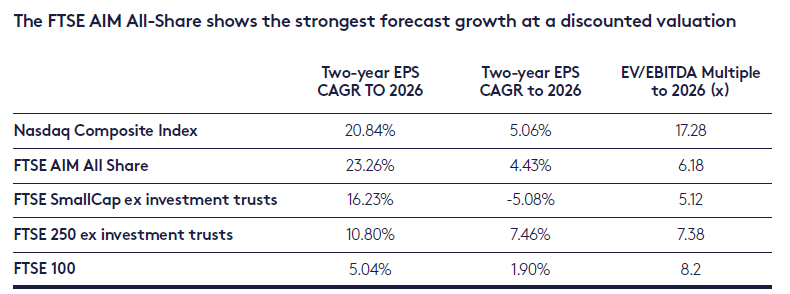

Low valuations are at odds with improving earnings, with the FTSE AIM index expected to deliver compound annual earnings growth of 23.3% for the two years to December 2026, higher than the US-based Nasdaq.

Source: Octopus Investments

Chris McVey, deputy head of quoted companies at Octopus Investments, said: “The past six months have seen steady performance for many smaller-cap stocks, but this hasn’t changed their long-term undervaluation compared with their larger-cap and global peers.”

This is underscored by the uptick in mergers and acquisitions (M&A), he said. From the start of 2024, some 80 bids have been made for UK-listed companies at an average 40% premium to the share price.

Fewer stocks means that the overall cash paid out by listed companies is expected to fall in 2025. As such, investors may wish to look further down the market capitalisation spectrum.

Indeed, both the FTSE SmallCap (ex investment trusts) and the FTSE 250 offer higher starting dividend yields than the FTSE 100, with the report noting that larger companies have had to rebuild dividend cover after the Covid pandemic.

Additionally, payouts from AIM stocks have risen by almost 30% over the past 10 years, compared with around 9% for those in the FTSE 100.

These dividends are also more diverse. While the top 10 dividends payers in the large-cap index account for more than half of the total paid out, this figure drops to 38% and 34% for the top 10 in the FTSE AIM and FTSE Small Cap (ex ITs) indices. The least concentrated index is the FTSE 250, where the top 10 account for 28% of dividends.

According to the report, this means that income from smaller-cap stocks rests on more individual companies – making it less exposed to any individual dividend cut or cancellation when companies run into difficulties.

“It’s with this in mind that we believe it’s an anomaly that these companies are continuing to fly under the radar for traditional income investors,” McVey said.

“Investors should take advantage of this now as UK smaller-cap stocks can offer them a compelling opportunity in terms of both absolute and relative value, as well as income, benefitting from attractive and growing dividend streams.”