The FTSE 100 could build on its strongest annual performance since the financial crisis and push higher into 2026, as rising corporate profits and substantial cash returns to shareholders continue to support UK equities.

This is the view of Russ Mould, investment director at AJ Bell, who thinks the UK market has confounded persistent pessimism and may still have room to run.

“Despite torrents of caustic commentary about the paucity of new floats, and far greater number of departures, the UK stock market is on the verge of recording its best annual capital and total return since 2009,” he said.

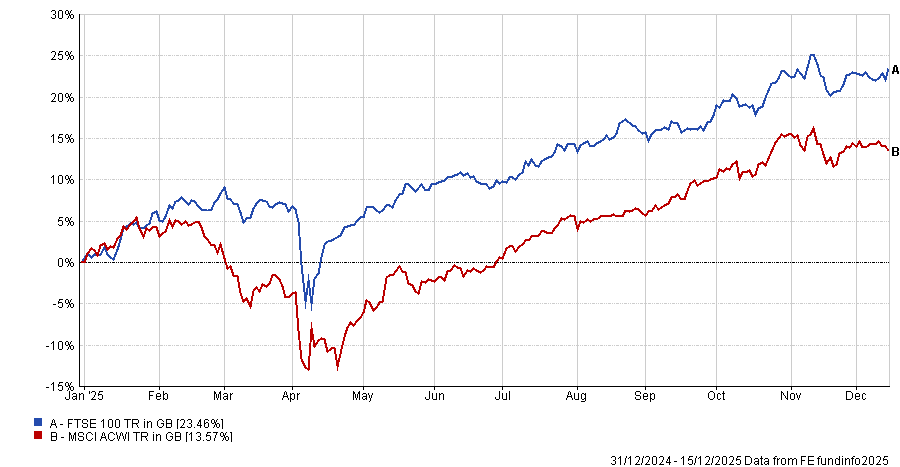

Over 2025 so, the FTSE 100 has made a 23.5% total return, beating the MSCI AC World by around 10 percentage points. It is also ahead of the sterling returns of the benchmark US, Japanese and emerging markets indices.

Performance of FTSE 100 vs MSCI AC World in 2025

Source: FE Analytics

The argument for the index to continue on a similar path in 2026 rests on a combination of earnings growth, dividends, share buybacks and selective takeover activity, rather than a re-rating driven by enthusiasm alone. In Mould’s view, the foundations of the rally matter more than the headlines about listings and capital flight that have dominated debate around London’s markets.

A key pillar is profit growth. Consensus forecasts suggest FTSE 100 companies are on course to deliver aggregate pre-tax profits of just under £229bn in 2025, which would be a record. Analysts then expect a further 14% increase in 2026, taking profits to around £260bn.

“All other things being equal, the omens are currently quite good,” Mould said, pointing to earnings upgrades that contrast with the pattern of repeated downgrades seen in recent years.

Those improving forecasts matter because they underpin the UK market’s ability to deliver income. After several years of limited progress, analysts expect dividend growth of about 6% in 2026. Total FTSE 100 dividends are forecast to reach £85.6bn, edging past the previous peak set in 2018. While that equates to a forward yield of around 3.4%, which is less generous than in the recent past, it still provides a meaningful component of total returns.

Dividends are only part of the picture, as UK companies have increasingly favoured share buybacks as a way of returning capital – a trend that shows little sign of fading.

Ordinary and special dividends of roughly £81bn are expected in 2025, alongside about £56.5bn of buybacks, taking the combined ‘cash yield’ on the FTSE 100 to around 5.5% of its market capitalisation.

“Add together those two and the cash yield on the index does beat inflation, the Bank of England base rate and the 10-year gilt,” Mould said.

Performance comparisons also challenge the idea that global markets are still dominated by the US alone. While select emerging markets have led many league tables in 2025, the UK has more than held its own among major developed markets.

In local currency terms, the FTSE 100 has outperformed the S&P 500 over the period, and sterling’s strength against the dollar would widen that gap further for UK-based investors. Mould described this as a shift away from the long-running “‘America first, the rest nowhere’ narrative”.

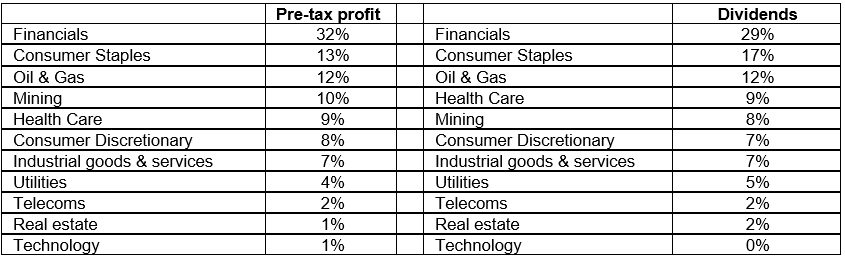

Percentage by sector for total FTSE 100 – 2026 consensus forecasts

Source: AJ Bell, Marketscreener, consensus analysts’ forecasts

Merger and acquisition activity has provided an additional, if uneven, tailwind. Buyers have agreed deals worth about £29bn for UK-listed companies so far this year, down from £49bn in 2024. The slowdown partly reflects higher valuations, which leave less obvious value for acquirers. Even so, Mould argued that any pick-up in activity during 2026 could still “top up the pot for investors”, particularly if lower interest rates reduce the cost of capital.

Valuations are one of the main risks to the outlook. After a strong year, the FTSE 100 is no longer as cheap as it was. The index trades on roughly 13.5 times consensus earnings forecasts for 2026, a level that sits close to historic averages.

“Not expensive by historic averages, but not ragingly cheap either,” Mould said. However, he added that continued earnings upgrades could make that multiple look less demanding than it appears.

Analysts expect more than half of the FTSE 100’s pre-tax profits in 2026 to be generated by just three areas: financials, oil and gas, and mining. Banks, insurers and asset managers alone are forecast to contribute around a third of total profits. Mould said rising estimates for banks and miners in particular were encouraging, while sticky inflation could continue to support commodity-related earnings.

That concentration cuts both ways. A backdrop of steady global growth would be supportive, helping cyclical sectors deliver the cash flows needed to sustain dividends and buybacks. An unexpected slowdown or recession would pose a greater threat, as shareholder returns, especially buybacks, tend to be pro-cyclical. “An unexpected slowdown or recession would probably put into jeopardy dividend growth and share buybacks too,” Mould warned.