Global small-caps have endured a tough few years and fallen short of their large-cap peers but Kirsty Desson, lead manager of abrdn Global Smaller Companies, believes 2026 could mark a turning point.

Investors are often drawn to small-caps for their higher growth potential and ability to become future market leaders.

However, small-caps have struggled to deliver since 2022 amid a perfect storm of surging inflation, aggressive rate hikes, geopolitical tensions, energy volatility and a sluggish post-Covid recovery.

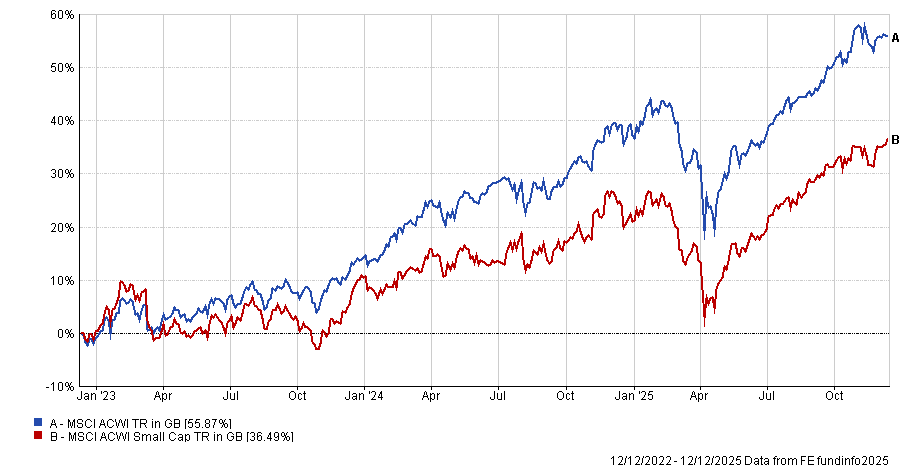

Comparing the total return of the MSCI ACWI index with the MSCI ACWI Small Cap index, the former has outperformed, gaining 55.9% over three years versus 36.5%.

Performance of MSCI ACWI vs MSCI ACWI Small Cap over 3yrs

Source: FE Analytics

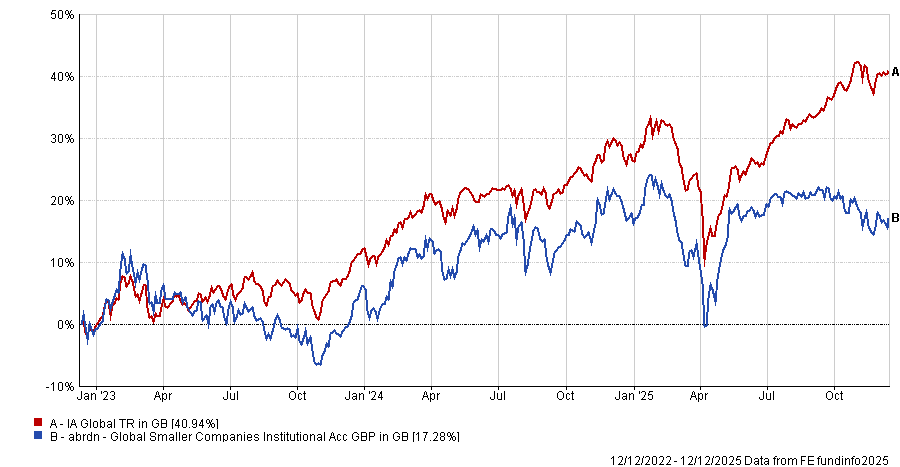

However, it has been an especially difficult period for small-cap funds such as abrdn Global Smaller Companies, which has also been punished for its focus on quality stocks.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

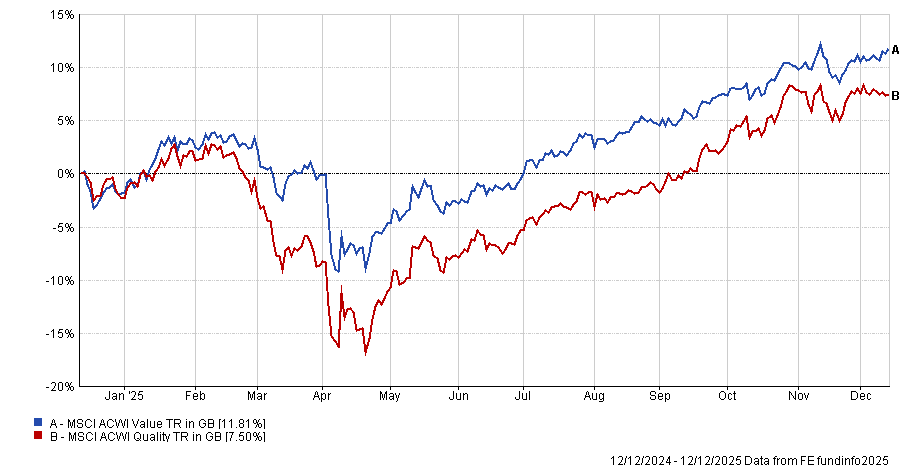

Quality stocks are typically characterised by offering a high return on equity, stable earnings growth and low debt levels. These stocks have suffered over the past year as value stocks – which are often more highly indebted and volatile than high-quality peers – have soared, driven by retail investors and big expectations for artificial intelligence (AI), Desson said.

“It’s always painful to underperform but we understand the biggest reason – our exposure to quality stocks,” she noted. “Being overweight profitability has actually hurt us.”

Performance of MSCI ACWI Quality index vs MSCI ACWI Value index over 1yr

Source: FE Analytics

She said there are signs that conditions may be reversing, with energy prices stabilising, central banks re-setting monetary policy and more interest rate cuts expected next year.

“Going into 2026, there is scope for very decent performance given that both the asset class and quality names have underperformed this year,” Desson said.

“On a relative basis, both the asset class and quality stocks therefore look very attractive, based on their growth and return profiles.”

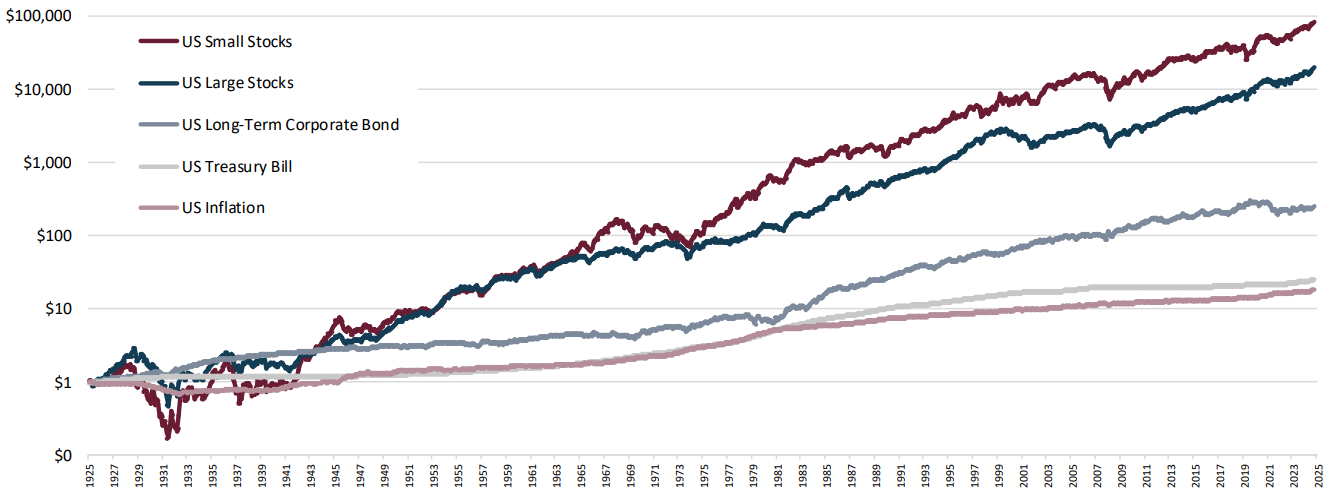

This backdrop, combined with historical trends, underpins Desson’s conviction that the tide is turning, as small-caps have repeatedly outperformed large-caps over the long-term, particularly during recovery phases.

Small-caps outperforming large-caps – December 1925 to September 2025

Source: Aristotle Capital Boston, Ibbotson. Small stocks represented by the Ibbotson Small Company Stock index and large stocks by Ibbotson Large Company Stock index. Data as of 30 September 2025.

“If you look back over time, small-caps have outperformed large-caps more often than not because of the higher growth facet to small-caps,” Desson explained.

“In recent years, [this has been interrupted by] a bigger growth story among the FAANG stocks – now the Magnificent Seven.”

Liberation Day in April encouraged investors to revisit global small-caps as a way to diversify portfolios. As an example, Desson noted that MSCI ACWI Small Cap is more geographically diverse than MSCI ACWI.

“The weighting to the US of the global small-cap universe [in the benchmark] is just over 50%, whereas it is almost two-thirds of the large-cap index,” she said.

“The diversification of global small-caps is key. The macro picture is very unpredictable going into 2026 and so having the broadest possible universe intuitively makes sense to us.”

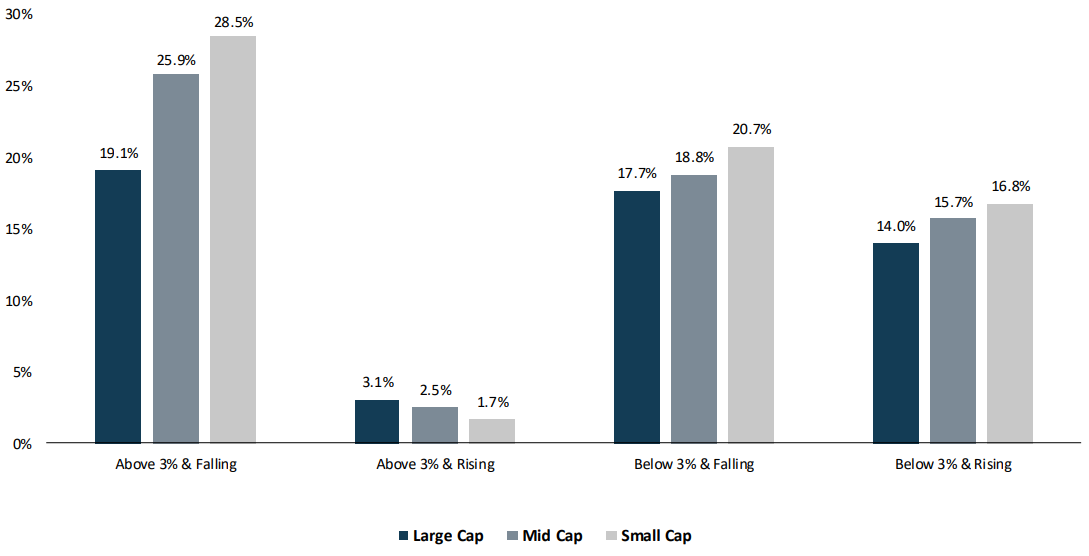

Small-caps also perform well in many different scenarios, particularly in regards to interest rates. As shown in the graph below, they have historically outperformed larger companies in all scenarios other than when rates are above 3% and rising – as has been the case in recent times.

Historical performance of small-caps in differing inflationary environments: 1935 – 2025

Source: Aristotle Capital Boston, Center for Research in Security Prices (CRSP), The University of Chicago Booth School of Business, Jefferies. Data as of 30 September 2025.

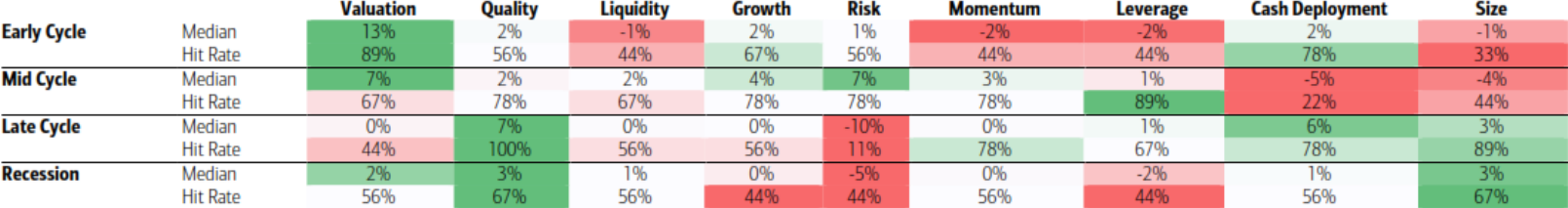

Similarly, although quality stocks have been through a “difficult patch”, Desson said quality stocks typically go on to deliver their best returns after periods of underperformance. Again, there is some historical evidence to back this up.

The table below maps the percentage of time in which an investment style outperformed the equal-weighted Russell 2000 index.

It shows that high-quality stocks outperform in challenging environments. They beat both the index and low-quality peers in every late-cycle regime and most recessions since 1990.

Small cap factor group performance during phases of the economic cycle: January 1990 to September 2025

Source: Aristotle Capital Boston, FactSet, Bank of America. Based on the Russell 2000 index. Data as of 30 September 2025.

For Desson, these trends reinforce the abrdn Global Smaller Companies fund’s long-term philosophy of focusing on quality, growth and momentum.

“We are ultimately looking for names that could be tomorrow’s large-cap companies,” she said.

“As such, they need to have a sustainable growth trajectory with strong corporate management putting all the right building blocks in place.”