US equities, UK equities and global bonds are sectors where investors' returns are most dependent on the index’s performance, according to Trustnet research.

In recent years, investors have been rewarded for tracking the index through passive funds, as many active managers have failed to keep up with their respective markets.

Active funds have shed almost £121bn in outflows over the past four years and some of this money has found its way into passive solutions, according to Laith Khalaf, head of investment analysis at AJ Bell.

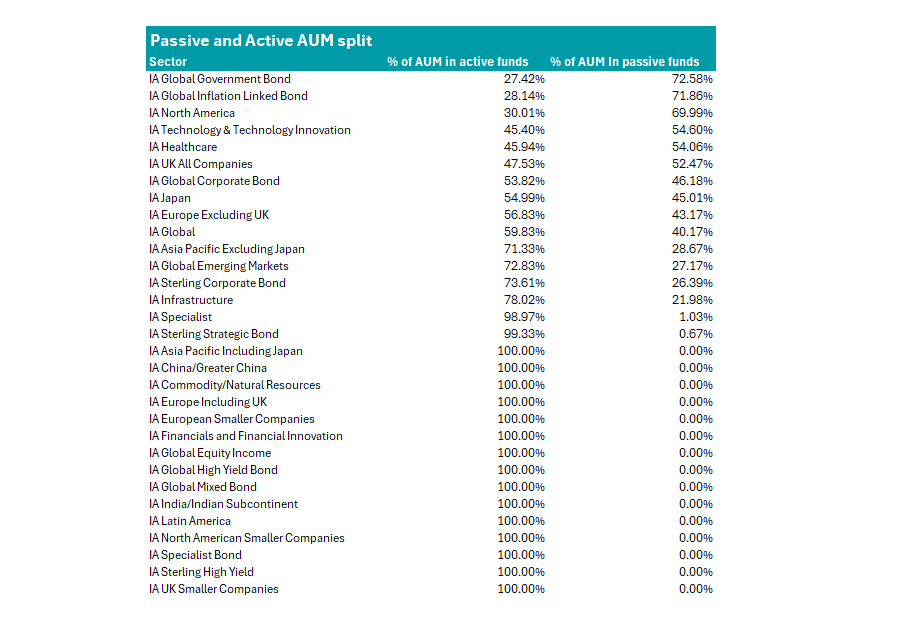

In the chart below, we examined the percentage of assets under management (AUM) invested in passive or active funds across equity and bond sectors to determine where investors are most tied to the fortunes of their respective markets.

Source: FE Analytics. Data is based on London-domiciled funds.

Sectors dominated by passives

Khalaf said the dominance of passive funds is a consequence of the “dismal results” of active managers.

“Many active funds have underperformed over long periods, helping to drive more investors into the arms of the passive machine,” he said.

In the IA North America sector, 70% of the assets are held in passive funds and investors have largely been rewarded for allocating to the region passively.

Indeed, just 13% of US active managers have outperformed the average passive over the past decade, rising to 17% over the past five years, according to AJ Bell’s recent Manager vs Machine report.

This is largely due to the Magnificent Seven, which dominate the top 10 of the S&P 500 but are hard for active managers to overweight, Khalaf said.

Cheaper low-cost passives with their higher allocations to these stocks have sped “onwards and upwards, knocking huge swathes of active managers out of the race”.

The dominance of passives within the IA UK All Companies sector (52.5% of AUM) follows a similar trend, according to Khalaf.

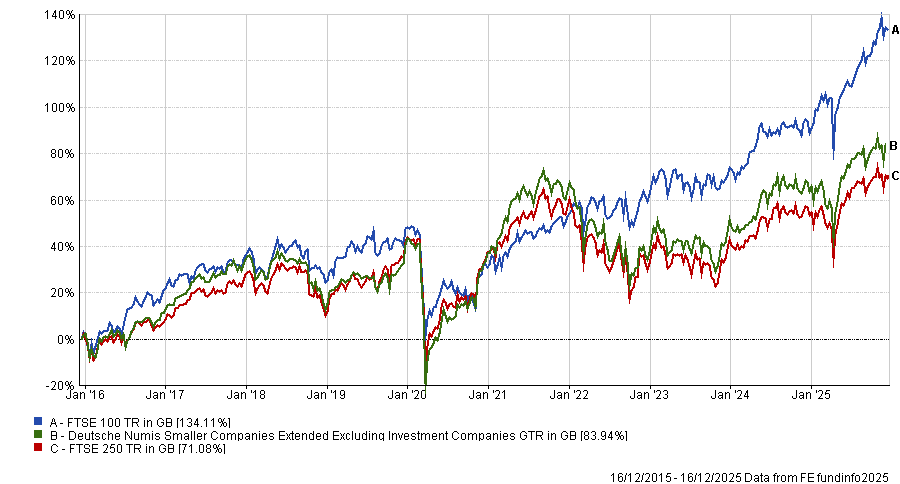

The FTSE 100 has been the place to be in the UK market, outperforming the Deutsche Numis smaller companies and the FTSE 250 by almost 50 percentage points over the past decade.

Performance of indices over past 10yrs

Source: FE Analytics

As such, just 17% of active funds have outperformed passive alternatives in the UK over the past decade.

“It’s been challenging for active fund managers to outperform because of their underweight position in the biggest stocks in the index,” said Khalaf, who noted that most active funds tend to overweight mid- and small-caps.

However, while these allocations towards the top stocks have worked out for UK and US investors allocating passively, it also places investors at risk if the market stumbles.

For example, in the US the Magnificent Seven experienced a tough start to 2025 as Chinese AI chatbot DeepSeek brought concerns that rivals could appear from other parts of the world, while US president Donald Trump’s wave of tariffs threatened their ability to export to other countries, according to Khalaf.

As a result, during the first half of the year, 44% of US active funds outperformed their common passive counterpart.

Similarly, for UK investors, while the FTSE 100 has outperformed over the past 10 years, it has experienced periods of underperformance. Between 2011 and 2021, the FTSE 100 was the worst-performing part of the UK market, according to data from AJ Bell.

During this period, actives ate the lunch of their passive counterparts, with 85% outperforming.

The four other sectors where passives dominated assets under management are: IA Global Government Bond, IA Global Inflation Linked bond, IA Technology and Technology Innovation sectors and the IA Healthcare sector.

Sectors dominated by actives

In the 25 remaining sectors, more assets were invested in active funds and so investors are less tied to the fortunes of their respective markets.

Investors went active in most bond sectors, ranging from IA Global Corporate Bond (53.8% of AUM in actives) to IA Sterling High Yield.

Following the market in fixed income can often mean taking on more risk as bond indexes are weighted to the most indebted companies, meaning investors allocating passively can end up holding companies at risk of default, managers said earlier this year.

Several equity sectors also favoured active management, despite the underperformance of active managers in recent years.

For example, the IA Global sector still favours active funds (59% of the total AUM) despite the dominance of Magnificent Seven stocks within the global index. While this has mostly been a headwind on performance, it did pay off in the first half of 2025, when the leading stocks experienced a downturn.

Similarly, in the IA Global Emerging markets sector, managers have kept pace with passives. Over the past decade, 48% of active funds have outperformed the average passive, according to data from AJ Bell.

For experts such as Hargreaves Lansdown, it is one of the most attractive areas for investors in 2026, which could provide more impetus for active managers to outperform.