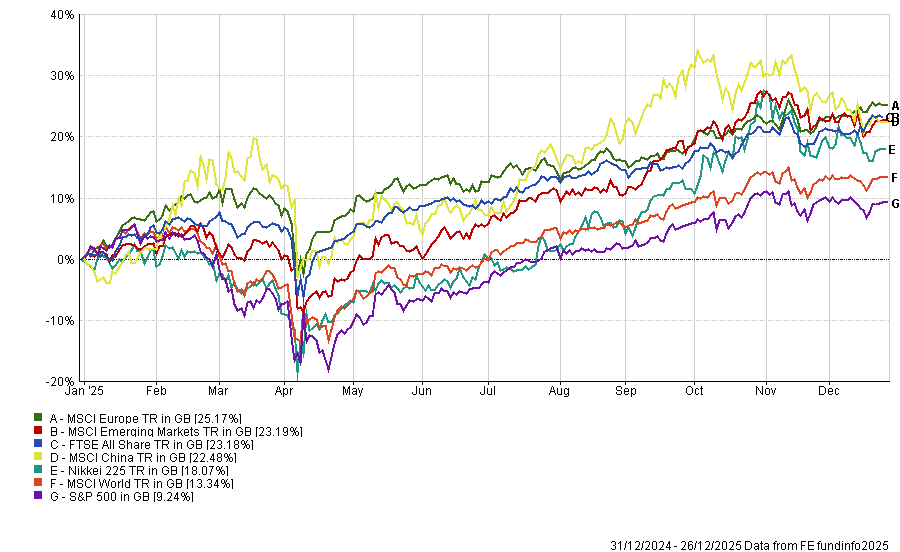

Markets experienced a tumultuous 2025, going from DeepSeek and Liberation Day-mania in the first six month to the renewed optimism over artificial intelligence (AI) of the second half of the year. Most markets ended in the black, as demonstrated by the chart below.

Performance of markets in 2025

Source: FE Analytics

Little of this could have been foreseen in advance, and while no one’s crystal ball is better than anyone else’s, well-known managers that have been doing their job well for longer might be worth listening to. Below, we asked a number of them which investments they think will do well in 2026, and why.

The debate over AI

The debate over AI is polarising, with some managers still optimistic and others increasingly wary.

For James Cook, FE fundinfo Alpha Manager on the JPM Global Growth and Income Trust, the companies “translating AI investment into tangible financial results are emerging as clear winners”.

While it is important to be selective, semiconductor producers and those adopting AI at scale, such as TSMC, are poised to be the biggest beneficiaries, regardless of which AI company “comes out ahead as the world’s leading foundry”.

Nick Train, manager of the Finsbury Growth and Income Trust, said the rise of AI would continue to benefit UK stocks.

The strategic value of assets such as Experian will become clearer as the “arms race between competing AI agents” will cause businesses to pay more for companies with large, proprietary data sets.

On top of this, technology-driven productivity tends to drive down inflation and AI “looks set to be the biggest productivity driver yet”.

As a result, Train expects US and UK interest rates to be “notably lower” over the next couple of years. This would indirectly benefit companies such as Diageo, which have struggled due to a lack of consumer confidence.

Among the more cautious was James Thomson, manager of the Rathbone Global Opportunities fund, who has reduced his allocation to AI this year in favour of other areas.

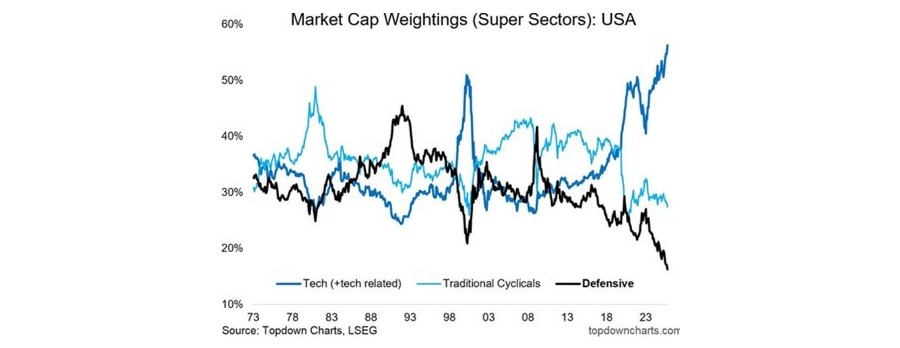

While the AI story has performed very strongly, concentration in markets has become “eyewatering”, he said. Indeed, despite defensives and cyclicals trading strongly in recent years, “both have shrunk before a tech-trained one-trick pony”.

Market cap weightings in the US

Source: Rathbones, Topdown Charts, LSEG. Data as of 3rd December

To satisfy this growing demand for tech, there has been “a tidal wave” of leveraged exchange-traded funds (ETFs), which represent almost 25% of total new fund launches last year.

“There’s a lot of highly speculative bets being made by tourist investors with fear of missing out. That sort of behaviour can cause volatility to spike when the mood turns,” Thomson said.

Raheel Altaf, Alpha Manager of the Artemis SmartGARP Global Equity fund, also took of a more cautious stance and said AI is the area that “investors should be most wary of” in 2026, as valuations and concentration risk “remain a serious concern.”

Opportunities beyond AI

Some experts saw attractive opportunities in areas beyond AI, with Altaf believing that the rotation from growth to value could still have further to go.

The gap between the cheapest and most expensive companies on the market “remains quite large versus history” due to the dominance of passive funds, which are positioned away from value stocks and make them “unusually cheap”.

Altaf saw compelling opportunities in financials, commodities and cyclicals.

Mike Fox, head of equities at Royal London Asset Management, is also bullish on financial stocks, which have performed very well in recent years.

The FTSE World Financials index is up 76.9% over the past three years, but it could have further to run, according to the manager. Part of this is because economic growth is “likely to surprise on the upside” next year, which should benefit the sector.

“This has been a feature for several years now, as investors have hedged the wrong risk (recession), whereas they should have been hedging for higher-than-expected growth. This is one of the reasons financials have done so well,” he said.

On top of this, banks are becoming much less regulated and much more efficient, which should be supportive even if interest rates fall.

Which markets will outperform?

For Rathbone’s Thomson, the US remained the “barometer” of global investor sentiment. While the market may be expensive, this does not mean it is overvalued, the veteran manager said.

US companies are innovative, adaptable and have mission-critical growth, benefitting from higher research and development spending than many competitors, he said.

“[This] is why the US has $6trn companies and Europe has none”.

Investors shouldn’t underestimate the structural growth opportunity in emerging markets, according to Artemis’ Altaf.

The manager is “cautiously optimistic” that China could have another strong year, as domestic “national champions” look well-positioned to drive growth over the long-term. Additionally, policy measures are supportive, with fiscal and monetary easing creating a “strong picture” for another rally.

Across the market, corporate balance sheets have “resilience which we’ve not witnessed for years”. In regions such as Latin America and Brazil, this has been supported by robust demand for commodities and low valuations.

“When you look at emerging markets, it's not just about China or India. There is a broad range of themes that are really driving the upsurge,” Altaf concluded.