UK stocks, precious metals and money market funds were the most bought investments on the interactive investor (ii) platform in December, the firm revealed today, as retail investors ended the year favouring more defensive assets.

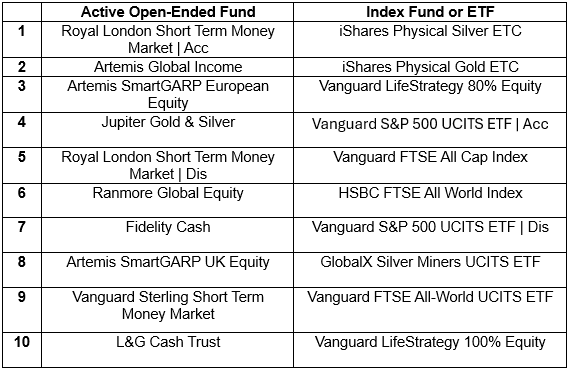

The data showed Diageo topped the list of most-bought shares, iShares Physical Silver ETC led passive fund purchases and Royal London Short Term Money Market retained its position as the most popular active fund.

The patterns point to a mix of repositioning within equities, continued caution on interest rates and strong demand for alternatives after a volatile but broadly positive year for markets.

UK equities regain prominence

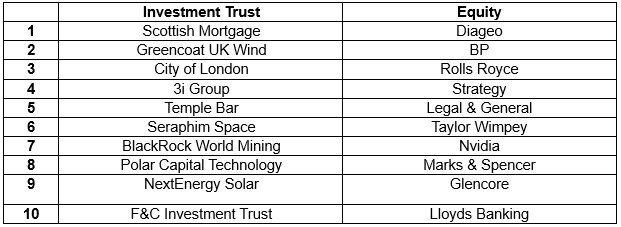

The most notable shift in December was the renewed popularity of UK-listed shares. Diageo entered the most-bought equities list for the first time and moved straight to the top spot, while BP re-entered in second place.

Other FTSE 100 names such as Rolls-Royce, Legal & General and Lloyds Banking also featured, alongside housebuilder Taylor Wimpey and retailer Marks & Spencer.

Stocks and trusts most bought on ii in December 2025

Source: interactive investor

Victoria Scholar, head of investment at interactive investor, said income-focused UK stocks continued to attract buyers, noting that “UK dividend payers like Legal & General and Taylor Wimpey continued to be popular stocks” while there was some interest in the big winners of 2025, such as Rolls Royce and Lloyds, which “both enjoyed very strong share price gains last year”.

Diageo’s prominence followed the appointment of Sir Dave Lewis as chief executive, while Marks & Spencer returned to the list after several months’ absence. Scholar said the drinks group’s leadership change and M&S’s recent share price weakness had drawn interest from investors looking for recovery potential following a difficult period for both companies.

At the same time, demand for US technology shares moderated. Nvidia remained in the top 10 but slipped from first place in November to seventh in December, while Meta and Tesla dropped off the list altogether. Scholar said investors were becoming “more discerning” about US tech exposure, citing concerns around valuations and concentration risks.

Precious metals dominate passive fund buying

Among passive strategies, precious metals were the clear standout. The iShares Physical Silver ETC rose from seventh place in November to become the most-bought index-linked product in December, while iShares Physical Gold ETC ranked second. Interest also extended to mining equities, with GlobalX Silver Miners UCITS ETF entering the top 10 for the first time.

Most bought funds on ii in December 2025

Source: interactive investor

Alex Watts, senior investment analyst at interactive investor, said the demand reflected strong performance across the sector during 2025. He noted that “the upward pressure on precious metal prices did not abate in December, but continued as gold and silver (and other precious metals) hit new all-time highs”.

He added that silver prices accelerated sharply in the final quarter of the year, prompting investor demand for both direct metal exposure and funds investing in mining companies.

Alongside silver-focused products, BlackRock World Mining and Jupiter Gold & Silver also appeared among the most-bought active and closed-ended funds.

Money market funds remain a core holding

Despite falling yields, sterling money market funds continued to dominate the active fund rankings. Four such funds featured in December’s top 10, down slightly from five in November, with Royal London Short Term Money Market retaining first place in both its accumulation and distribution share classes. Fidelity Cash, Vanguard Sterling Short Term Money Market and L&G Cash Trust also attracted significant inflows.

Watts said their ongoing popularity is in spite of the Bank of England cutting rates for a fourth time in 2025, reducing the base rate from 4% to 3.75%.

“Short-term yields in the UK continued to decline,” he said, but investor demand for money market funds remained resilient, reflecting their role as a low-volatility option amid uncertainty over inflation and fiscal policy.

Investment trusts: Global growth and resources

In the investment trust universe, Scottish Mortgage returned to the top spot of the most-bought list in December, displacing 3i Group, which fell to fourth place. Greencoat UK Wind and City of London retained places near the top, while new entrants included Seraphim Space – the best trust this December – and BlackRock World Mining.

The mix of trusts bought by investors echoed themes seen elsewhere in the data, combining global growth exposure with income and alternatives. Watts said interest in global equity strategies had widened beyond the US as relative performance shifted during the year, prompting investors to reassess regional and style exposure.

“Given a shift in performance dynamic amid global regions, it’s no surprise in December to see continued interest in active funds investing in UK and Europe, and global equity funds where the US holds lesser prominence in portfolios,” he said.

“Furthermore, as the gap between returns of global growth and value narrowed in 2025, and concerns spread regarding concentration in global indices across a handful of growth stocks, we see continued interest in value-biased approaches to global equities.”

These included Artemis Global Income and Ranmore Global Equity.