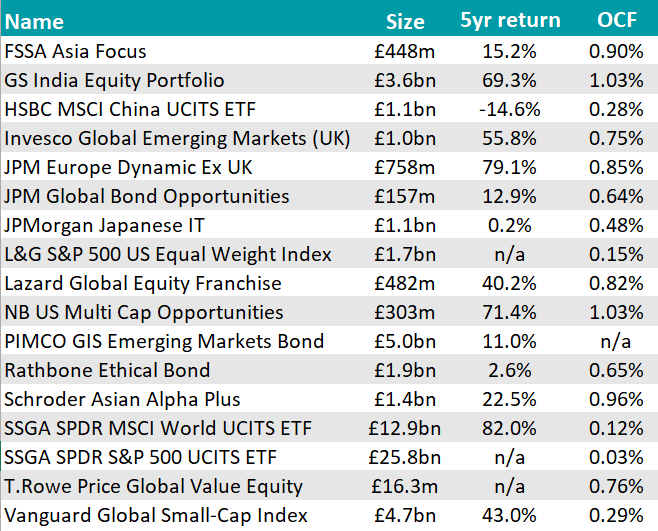

Last year was tumultuous for markets, but that didn’t mean that the opportunities were scarce. In fact, the nation’s best-known fund pickers, who compile and maintain the UK’s main platforms’ best-buy lists, found 17 new funds worthy of their – and investors’ – attention.

Below, we reveal what they are, as we kick off Trustnet’s yearly review of the UK’s top best-buy lists: Hargreaves Lansdown’s Wealth Shortlist, AJ Bell’s Favourites List, interactive investor’s Super 60, Fidelity’s Select 50 and Barclays’ Funds List.

The recommendations below do not mean investors should necessarily make changes to their portfolios. Best-buy lists are designed as a research starting point – investors should then make sure any decision matches their investment goals and attitude to risk.

Emerging markets and Asia

The area with the most changes was emerging markets and Asia, with five newly ranked funds. Invesco Global Emerging Markets was a new entry in December to Hargreaves Lansdown’s Wealth Shortlist. It is a £1bn strategy with a maximum FE fundinfo Crown Rating of five run by contrarian fund managers looking for value companies.

Hargreaves Lansdown investment analyst Tom James was particularly fond of Charles Bond, who has been running the fund since February 2020 and whom he described as “a knowledgeable yet humble investor, […] a quality we like as it shows continued development as an investor”.

He added: “Bond has learned his craft under the guidance of William Lam and Ian Hargreaves, who are co-heads of the team. They’re both experienced investors who have spent their whole careers investing in Asia, which forms a large part of the emerging markets universe.”

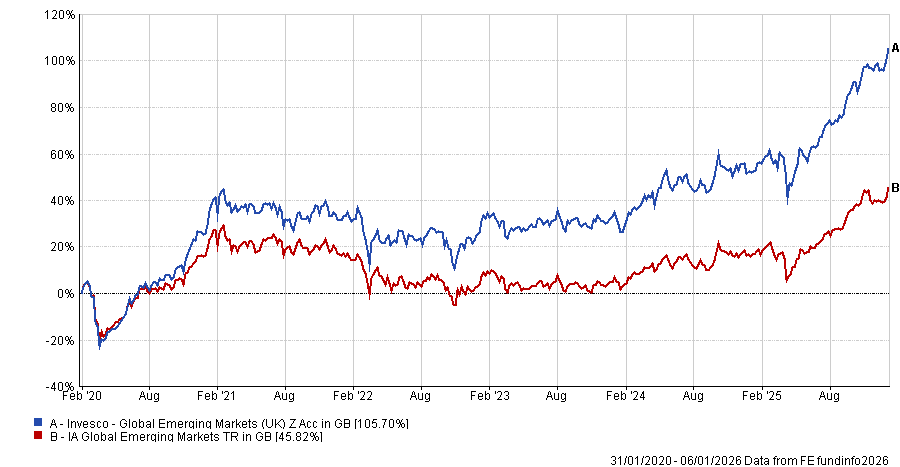

Performance of fund against sector under Bond’s tenure

Source: FE Analytics

We move on to Asia, where AJ Bell added two names: Schroder Asian Alpha Plus and FSSA Asia Focus (both of which are also recommended by Hargreaves).

The former is a £1.4bn portfolio run by Abbas Barkhordar and Richard Sennitt, which became a favourite because of its “strong team of research analysts and fund managers, who have delivered good returns within Asian equity markets over many years”.

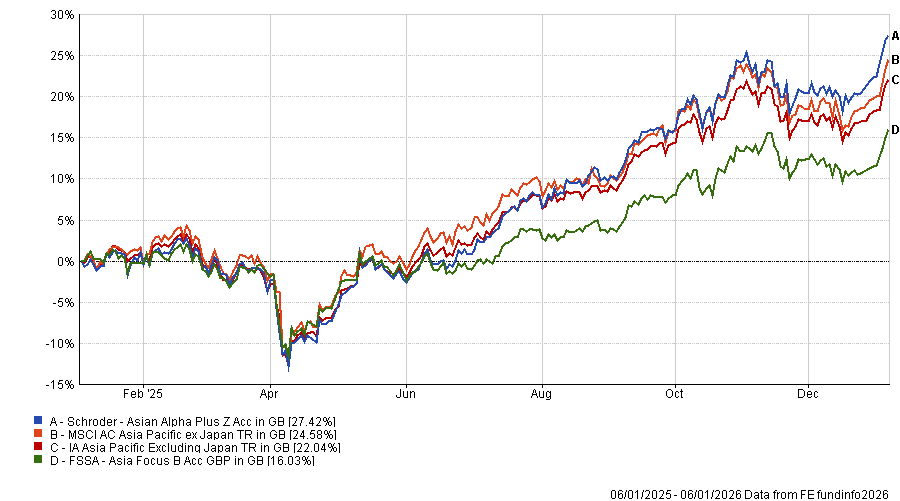

Performance of funds against index and sector over 1yr

Source: FE Analytics

The much smaller (£448m) FSSA strategy gained its spot due to “the calibre of the team’s focus on quality businesses, underpinned by the expertise of lead manager Martin Lau”, who is flanked by Rizi Mohanty – both of whom are FE fundinfo Alpha Managers.

Interactive investor (ii) made two emerging market additions to its Super 60 list. The first one was the introduction of GS India Equity, which was added at the beginning of the year, put under review in May following the announcement that lead manager Hiren Dasani would leave the firm, and retained as of 30 July as Aman Batra was confirmed as the new lead manager.

“We have confidence in his market and analytical knowledge and feel he has the potential to successfully implement this fund's well-codified and time-tested investment approach,” ii analysts said.

“This approach is not expected to change and has always had a bottom-up focus with significant input from the experienced and dedicated analyst team, which remains in place.”

The passive HSBC MSCI China exchange-traded fund (ETF) also made the list.

Global

At the global level, passive strategies featured prominently among interactive investor’s additions. The Vanguard Global Small-Cap index fund joined the Super 60 list as a low-cost way to access nearly 4,000 small-cap companies across developed markets.

While the index has a heavy US weighting, analysts said it offered a reasonably representative exposure to global small-cap equities across 23 countries.

Interactive investor also added the SPDR MSCI World ETF, which tracks the mainstream MSCI World index of large and mid-cap stocks. With more than 70% allocated to the US, the ETF was selected for its competitive fees and its role as a broad, core holding covering around 85% of the free-float-adjusted market capitalisation in developed markets.

Hargreaves Lansdown, meanwhile, added two actively managed global equity funds to its Wealth Shortlist, both with a value tilt. Lazard Global Equity Franchise was included in January 2025, with analyst Aidan Moyle highlighting the experience and longevity of its four-strong management team, who have run the fund together since launch in 2015.

While the fund has lagged the MSCI World index during periods when growth and US technology stocks have dominated, HL analysts said it has delivered solid long-term results relative to peers and offered diversification from more growth-heavy global portfolios.

They also added T. Rowe Price Global Value Equity. The decision centred on lead manager Sebastien Mallet, who has run the strategy since 2012 and has more than two decades of experience in global value investing.

Analysts noted the fund’s strong long-term record relative to its sector and other value strategies, even if, like Lazard’s fund, it has lagged the MSCI World index during periods when growth investing has been in favour.

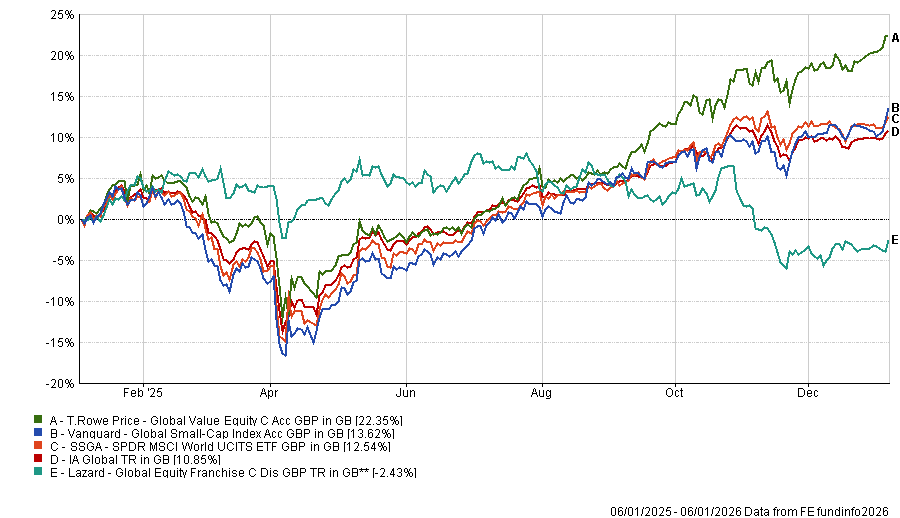

Performance of funds against sector over 1yr

Source: FE Analytics

Developed markets

In developed markets, analysts leaned on low-cost index exposure alongside a small number of actively managed strategies with long-standing teams.

In the US, the only active fund added was Neuberger Berman US Multi-Cap Opportunities, a concentrated, actively managed strategy run by Richard Nackenson since launch in 2006.

Added to ii’s Super 60, analysts highlighted the fund’s long-tenured manager and well-established process, noting that its flexible, multi-cap remit and blend style had produced good results over the longer term, albeit with the potential for more pronounced periods of volatility.

Among index trackers, ii analysts backed the SPDR S&P 500 ETF, noting that the decision reflected the ETF’s competitive fees and the fact the S&P 500 remains a “soundly constructed and representative” way of accessing large-cap US equities.

To reflect the growing concerns in the over-concentration of US indices in a handful of large-caps, Fidelity preferred to add an equally-weighted index tracker instead, which distributes its allocation equally between its holdings. Fidelity’s choice was Legal & General S&P 500 US Equal Weight index.

Turning to Europe, interactive investor added JPM Europe Dynamic (ex-UK). The fund is led by Jon Ingram, who has held that role since 2007 and runs the fund by combining a quantitative model with qualitative oversight.

While the process can result in a bias towards smaller companies at times, ii analysts said the depth of resources behind the strategy and the experience of the team were key positives, even if returns can lag when value and momentum fall out of favour.

Japan was another area of activity for interactive investor, which added the JPMorgan Japanese Investment Trust. The closed-ended fund has been managed by Nicholas Weindling since 2007 and runs a concentrated, high-conviction portfolio of 50-60 holdings.

Analysts pointed to Weindling’s consistency and the stability of the wider Japanese equity team, while acknowledging that the trust’s focused approach can lead to lumpy performance over shorter periods.

Fixed income

There were fewer changes in the world of bonds, but analysts still made selective additions across both global and emerging market bonds.

Interactive investor added Pimco Emerging Markets Bond to its Super 60 list as an adventurous global option. The fund focuses primarily on hard-currency sovereign debt, with limited exposure to corporates and local-currency bonds.

Yacov Arnopolin has led the strategy since 2019, working closely with Pimco’s head of emerging market debt, Pramol Dhawan, and a large specialist team. Analysts highlighted the depth of resources behind the fund and the combination of a well-regarded process with an experienced, risk-aware management structure.

AJ Bell also made a fixed-income addition, adding Rathbone Ethical Bond Income to its Favourites list due to the strength of its management team and its track record of delivering attractive risk-adjusted returns within the sector.

Hargreaves Lansdown’s only bond fund addition of the year was JPMorgan Global Bond Opportunities, which joined the Wealth Shortlist in July. The fund is led by Bob Michele and Iain Stealey, who determine overall positioning across global bond markets, supported by four additional managers with responsibility for individual segments.

Analyst Hal Cook said the result was an “extremely diversified” portfolio, typically holding more than 1,000 bonds across over 50 countries. Rather than aiming to outperform aggressively, the fund is designed to provide broad exposure to global fixed income markets, making it suitable as a core holding or a diversifier alongside equity-heavy portfolios.

Source: Trustnet