Value investing has struggled to stay in favour in recent years, as investors piled into growth stocks in increasingly concentrated equity markets benefiting from the artificial intelligence roll-out.

However, Sean Peche, manager of the $2.2bn Ranmore Global Equity fund, argues that it is impossible to fully forecast what lies ahead and that investors overpaying for growth or quality stocks will suffer significant losses when expectations are not met.

While many value strategies run the risk of lagging during periods of exuberance, Peche said there is strength and safety in capital preservation.

“The future is unforecastable, so don’t pay too much for it,” he said. “Quality doesn’t work all the time and neither does growth. The difference is that when value doesn’t work, you generally don’t lose much money.”

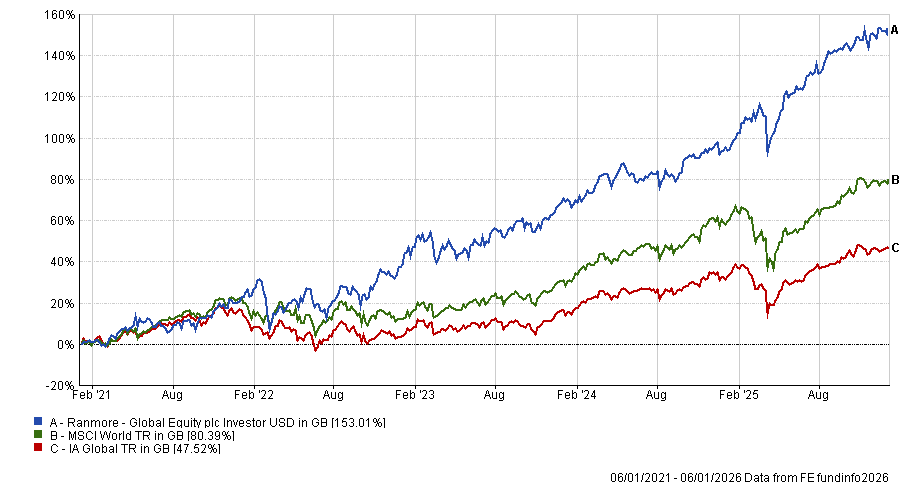

The fund has delivered strong returns over one, three and five years, gaining 29.8%, 75.9% and 153% respectively.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

Central to Peche’s approach to investing is the “clean sheet” mindset. “If a cat walked across the computer keyboard and sold all your stocks, which ones would you buy back? This helps you avoid endowment bias, where we value the things we own more than if we didn’t own them.”

For Peche, resisting that instinct and avoiding the comfort of consensus is essential.

“If you run with the herd and it changes direction, then you are going to get trampled,” he said.

Against this backdrop, Peche spoke to Trustnet about how Ranmore’s value-driven, unconstrained approach has shaped portfolio decisions.

What are your reflections on the performance of the fund over 2025?

In 2025, we had almost 40 companies which individually contributed more than half a percent to performance in dollar terms, with our total gains in dollars up 34.7% [over the year to December 2025].

We have only had three positions that have detracted more than half a percent to performance.

We have been buying cheap European stocks and banks, in particular, have done very well for us. Financials overall have been our biggest recent contributor to performance. Consumer discretionary has also done well.

We have also found that, where there is a crisis, there is opportunity.

So, following Liberation Day in April, a lot of companies were also given away at a low price and we were able to take advantage of that. For example, we bought Foot Locker in early May – 10 days later, it was bid for at a 100% premium to the price we paid.

Why is the fund low conviction?

Like The Beatles, we don’t want to be totally reliant on one hit.

There is a lot of risk involved in high conviction – a lot of investors had high conviction that Novo Nordisk was going to be the winning stock in the obesity treatment race, yet having a big position would have cost you a lot of money.

We like to take smaller positions and we like to sell when a stock reaches what we think is fair value. If we buy a $100 stock for $50, we aim to get back to $100 as quickly as possible so we can sell that $100 stock for two other things valued at $50.

However, when a stock rallies hard and gets close to what we deem to be fair value, we will still take our profits. If a stock is close to it, I don’t want to wait another three years for the potential of an extra bit of return.

What were your best calls of last year?

Our biggest winner of 2025 was Alibaba – but that was only 3.8% of our total winners.

We started buying Alibaba in December 2023 at HK$72 as the stock was down on a price-to-earnings ratio of 8x – it was being completely ignored at the time, as consensus thinking was that China was uninvestable.

We knew Alibaba was out of favour because investors feared the government was cracking the whip and getting too involved in companies.

This kind of situation gives us opportunity. We felt the government was going to ease up on the pressure, so felt it was worth buying a company like Alibaba which has lots of free cash and was trading at 8x earnings and ultimately has benefited from a lot of Chinese stimulus.

As such, we took our profits at HK$110 in July 2024 and then there was a pullback in the market and we were buying the stocks back at around HK$82 and then we sold it again at HK$136.

Then you have European banks like ABN Amro, which were practically being given away because consensus thinking was that banks are horrible businesses with Silicon Valley Bank going bust [in March 2023]. But Silicon Valley Bank and a conservatively run Dutch bank are very different propositions.

We started buying ABN Amro in 2020 at around €8 and sold at €13. [After Silicon Valley Bank went bankrupt] we started buying more aggressively at around €13 to €14 in May 2023.

In December 2024, we were still buying at €14 and then suddenly consensus thinking was that European banks weren’t so bad. We ultimately exited our position at €23.

We did arguably sell too early but that is typically the problem with value investors – we buy too early and sell too early.

And your worst calls for the fund?

While we have had nine positions that have contributed more than 1% to the portfolio, two have detracted more than 1% and B&M is one of those two.

It has been a very good business historically as it delivers value to consumers, is low cost and has been a rapidly growing business. However, when a business is rapidly growing there are high future expectations attached.

We bought B&M at just over £4 in September 2024 – it is now around £1.63. We have collected a little bit in dividends along the way, but it has de-rated from some 10x earnings to 7x expected earnings during our ownership period due to a couple of hiccups such as a management change and an accounting scare.

To put this into perspective, there were times in 2021 when people thought the company was worth 17x earnings.

What do you do outside of fund management?

We have a charity called Help More, through which we support around 15 smaller charities, both in terms of contributions to stay in business and helping them expand their support base. I’ve also got dogs and I like snow and water sports.