Initial public offerings (IPOs) lagged in 2025, a “patchy year” both in terms of performance and volume, according to Dan Coatsworth, head of markets at AJ Bell. “[This] goes against the grain for what was a superb year for UK stocks more generally,” he noted.

More relaxed listing rules were meant to attract a greater number of companies to the UK. Certainly, slightly more companies listed in London compared to 2024 – up to 20 from 16 – but only a handful delivered strong returns.

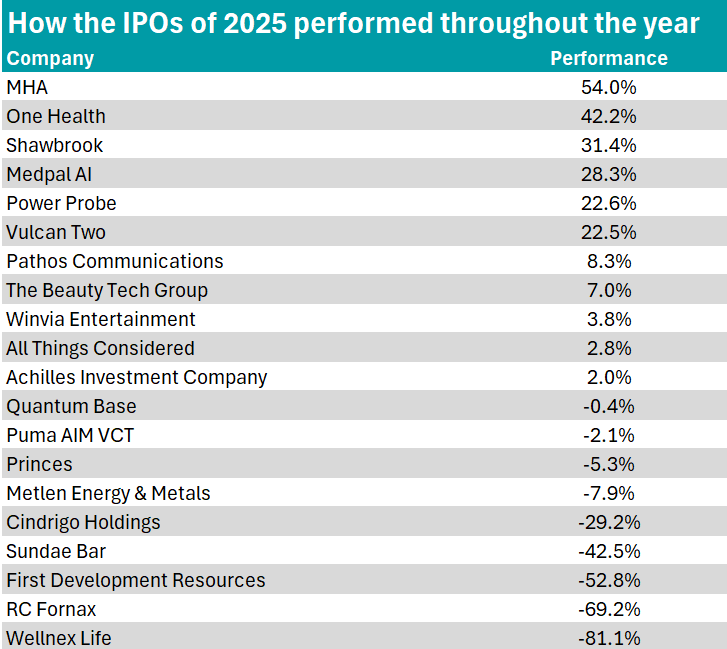

“Investors who bought every one of the 20 UK IPOs this year would have lost money on average” to the beat of a 3.3% loss when comparing the IPO offer price with the year-end market closing level. This is down from a 35.7% positive return on average in 2024.

“In contrast, those who bought a FTSE 100 tracker fund at the start of January [2025] and sat back and did nothing for the rest of the year would have cleaned up with a 25.8% return including dividends,” Coatsworth noted.

As shown below, the top-performing UK IPO in 2025 was tax and advisory services group MHA with a 54% share price return, whereas the worst performer – wellness products provider Wellnex Life – fell by 81.1%.

Source: AJ Bell

MHA announced its public listing on London’s Alternative Investment Market (AIM) market in April 2025 – two weeks after Liberation Day in the US – after the firm raised £98m as part of its offering. Shares were up by 2.5% at £1.25 on its first morning of trading.

Its market capitalisation on admission to the AIM market was £271m. This has since grown to £435.8m.

The net proceeds from the IPO were earmarked for investment in growth-enabling artificial intelligence (AI), repaying partner loan notes and supporting bolt-on acquisitions.

In August 2025, MHA chief executive Rakesh Shaunak said the company is eyeing potential deals to expand its UK presence. It acquired Baker Tilly South-East Europe that same month, giving the company presence in Europe and expanding its audit, tax, advisory, legal and corporate services offering.

Second in the table is One Health, which returned 42.2% in 2025. It is a provider of surgical procedures funded by the NHS. It switched from its listing on the Aquis Stock Exchange to London’s AIM market in March, raising over £7m in the process.

It priced its AIM admission at £1.80 per share, giving the company an opening market capitalisation of £24.7m. Its market cap has increased to £33.6m.

The fresh equity was invested in One Health’s first owned surgical hub, which the company expects to raise between £6m and £9m in revenue per year.

British lender Shawbrook rounds out the top three best-performing IPOs of 2025, returning 31.5%. It was the biggest UK company IPO on the London Stock Exchange in two years, marking the company’s return to the public market after it was taken private by BC Partners and Pollen Street in 2017.

Research firm Tipranked noted that analysts offering 12-month price targets for Shawbrook in the past three months are bullish, with three out of four recommending ‘buy’ and the other recommending ‘hold’. The average price target is £5.38.

The company planned to use part of its IPO proceeds to fund acquisitions, building on the 24 deals it has made since 2011. It is also targeting mid-to-high teens annual profit growth over the medium term.

Shawbrook dividends are expected to reach 20.1p in 2027, equivalent to a 4.1% yield.

However, not every IPO in 2025 bore fruit.

Wellnex Life had a strong start to the year before it went public in March 2025, reporting an 89% year-over-year increase in revenue in the first two months of the year, with brand sales increasing by 46% and IP licencing revenue up by 600%.

Such results indicated a positive outlook for the company’s future growth.

By listing on London’s AIM market, the company hoped to gain access to a broader investor base and greater liquidity to enable more strategic positioning within the European market.

However, despite its pre-IPO surge, the company struggled in the months that followed and is down over 80%.

Meanwhile, specialist engineering consultancy RC Fornax lost 69.2% over the course of 2025.

It was founded by two ex-RAF engineers who spotted deficiencies in the existing outsourced contract defence market and now supports national security projects.

The company listed on London’s AIM market in February 2025 following successful fundraising in which it raised £6.2m.

Finally, First Development Resources, an exploration company focused on materials such as copper, gold, uranium, lithium and rare earth elements, is also at the bottom of the table.

It debuted on London’s AIM market, raising £2.3m, with plans for a flagship project to be undertaken in Wallal, Western Australia.

The project yielded disappointing results, with the company announcing it was abandoning the drill hole, weighing on investor sentiment and leading to a sharp share price decline.

Shares in First Development Resources subsequently slumped by 50% to £0.04. As of the end of 2025, the company lost 52.8%.